By John Richardson

CHINA’S apparent demand for polyethylene, polypropylene (PP), styrene monomer (SM) and paraxylene fell during the first two months of this year versus November-December 2020.

I have yet to crunch the data on the rest of the major products, but I suspect the trend will be the same.

(This comparison is the only valid one because during January-February 2020, China was in the middle of the pandemic. This resulted in net imports and local production collapsing – what makes up apparent demand. All statistical year-on-year comparisons up until May will be highly misleading. China’s economy rebounded from May onwards).

In every year between 2009 and 2019, January-February petrochemicals demand improved over the end of the previous year because of the build-up of stocks before the Lunar Year Holidays.

This build-up was so finished goods could be manufactured for the holidays – one of China’s biggest consumption seasons.

The Chinese government also normally boosts the availability of new lending during January and February, leading to a pick-up in economic activity

This year was no exception. January 2021 lending hit a record high, and the decline in February lending was less than expected.

Why was apparent demand lower in January-February 2021? It important to note that the declines were usually the result of sharp falls in net imports.

One explanation is better netbacks in Europe, Latin America and Turkey. This could attracted petrochemicals cargoes to these three other regions which would have normally gone to China.

The diversion of cargoes could be the result of exceptional tight supply in Europe, Latin America and Turkey during the 11-17 January Lunar New Year Holiday period.

As overseas pricing surged on the tight supply – and on higher oil prices, Chinese pricing was flat because its markets were shut down during the holidays.

But why have China netbacks remained much, much lower than in other regions since the end of the holidays? Something else is happening.

I believe there are two reasons for the falls in petrochemicals demand, which I have been flagging up as risks since January this year. Now we have some data to back up my warnings.

The two reasons are as follows:

- China’s growth in exports of manufactured goods has likely slowed-down in January-February this year versus the final two months of 2021. No data has been released to this effect. But as China’s extraordinarily strong overall economic growth in 2020 was the result of booming exports, sharp declines in petrochemicals imports point in this direction. Last year was a “China in, China out” story – big increases in petrochemicals imports that were re-exported as finished goods that satisfied our new pandemic lifestyles.

- The domestic economy has yet to fully recover from a decline during the full-year 2020. Retail sales were down by 4.8% last year over 2019, according to an unofficial estimate.

In my view it stands to reason that there will have been a moderate slowdown in export growth versus late 2020 because of the global container-freight and semiconductor shortages.

The semiconductor shortage has worsened over the last two weeks as consumer electronics production Is now being affected along with autos production.

Whether the slowdown in Chinese export growth continues for the rest of this year very much remains to be seen, of course.

We are equally in the dark about whether China’s local economy will fully make up the ground it lost in 2020.

As I’ve discussed before, a scenario-based approach is the only solution for your business because of today’s exceptional global complexity and ambiguity.

The scenarios will be very difficult to build and keep up to date because of the scale of the complexity and ambiguity. But it is work that must done.

Early data point to a collapse in PP and SM imports

China’s net imports PP imports (imports minus exports) fell by 25% to 714,323 tonnes in January-February 2021 versus November-December 2020.

This was party because PP exports hit a record-high in January-February because of the big jump in local capacity and better overseas netbacks.

But it is also important note that China’s PP imports also fell sharply; they were down by 28% to 1m tonnes.

Local production rose by 2% to 4.8m tonnes, resulting in a 2% decline in apparent demand to 5.5m tonnes.

If this trend were to continue for the rest of this year, 2021 demand would reach 32m tonnes – 10% lower than 32.9m tonnes in 2020.

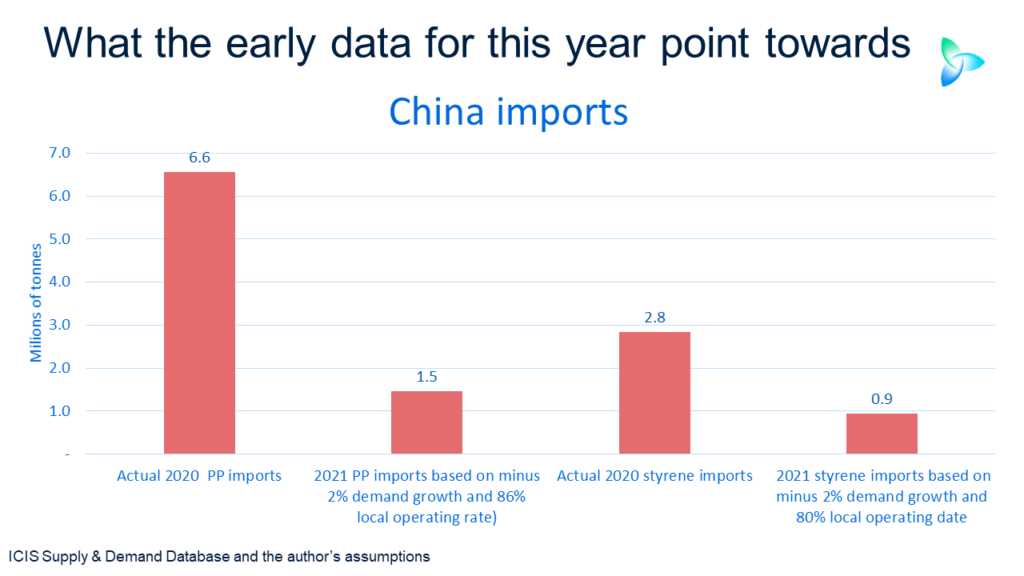

Local capacity is forecast to rise by 12% to 32.1m tonnes/year. Assuming the same local operating rate as we estimate for last year – 86% – and the 2% decline in consumption, 2021 imports would total 1.5m tonnes, 78% lower than last year’s 6.6m tonnes.

SM net imports cratered by 39% to 377,932 tonnes as local production increased by 1% to 1.6m tonnes. This left apparent demand 10% lower at 2m tonnes.

If this trend were again to continue for the rest of 2021, this year’s demand would total 12m tonnes – 2% lower than 12.3 tonnes in 2020.

Local capacity is due to rise by 26% in 2021 to around 14m tonnes/year. We estimate last year’s operating rate at 80%.

If we assume this operating rate reoccurs in 2021 and include a 2% decline in demand, 2021 imports would total 933,230 tonnes. This would be 67% lower than 2.8m tonnes in 2021.

It may be nowhere as bad this. We could instead see another boom year for Chinese imports.

But, as I said earlier, hoping for the best without adequate scenario planning is hardly the right strategy in today’s environment.

And because of China’s big push towards complete PP and SM self-sufficiency, a collapse in imports on this scale is only a question of time.