By John Richardson

THERE is a lot of very unhelpful noise out there about China which is making it very difficult for petrochemical producers and buyers to see the real picture.

But the noise is of great benefit to petrochemical and financial traders as, of course, noise accompanied by volatility is how traders make their money. No trader likes calm and flat pricing.

The problem stems from what, in my view, is nothing short of poor data analysis that first led to the perception that China was recovering in H1 of this year. The market-moving narrative has now morphed to a sharp downturn and in H2.

The latest distracting noise has been generated by July purchasing managers’ indices (PMI), such as the Caixin/Markit manufacturing PMI that you can see in the slide below.

But the longer-term pattern of the PMI exactly mirrors what the ICIS petrochemicals local demand data has been telling us since last September.

During the first half of last year, the Chinese economy cratered because of the pandemic – hence, the PMI fell into deep contraction territory at 40.3 in February 2020. Anything below 50 represents a shrinking economy.

But from May 2020 onwards, the PMI rose. We know from the data on exports of manufactured goods that this was the result of booming Chinese exports as China met lockdown needs in developed economies.

Since January, the trend line shows that the PMI has cooled off relative to May-December 2020.

The 20% decline in Chinese manufacturing exports in H1 2021 versus H2 2020 indicates that the decline in the PMI is the result of slowing exports, very likely because of the container and semiconductor shortages.

But despite this week’s panic over the July PMI reading of 50.3, down from 51.3 in June, the July PMI was still an awful lot better than the nadir of 40.3 in February 2020.

The average January-July 2021 PMI reading was also 51.2 versus 49.4 in January-July 2020. So, no need to panic!

But do not get too excited, either. The first seven months of this year were always likely to look better than the first seven months of 2020 because during that period last year, the pandemic was at its worst point so far in China.

Provided China kept the pandemic largely under control in January-July 2021, all year-on-year comparisons were going to look flattering – and China, of course, did keep the pandemic largely under control.

But, as I have already said, the PMI trend line – combined with the export data and the ICIS petrochemicals demand data – confirm that the economy has cooled off following its extraordinary May-December 2020 boom.

Underlining this essential point, the average PMI reading for the last seven months of 2020 was 53.1 compared with 51.2 in January-July 2021.

All the talk about about the Chinese economy recovering in H1 2021 was statistically incoherent because, as I said, the economy cooled off relative to the boom in May-December 2020.

China styrene data further support these points

The H1 2021 ICIS China demand data for polyethylene and polypropylene (PP) show a slowdown in demand growth versus H2 2020.

And as the slide below reminds us, which assumes that the H1 2021 trends continue for the rest of this year, polyolefins demand in 2021 would in some cases be lower than in 2020.

But – and this is the key BUT – this year’s demand would in all cases still be better than in 2019. This tells us that 2020 was a bubble year – an abnormally strong year – because of, as I said, booming manufacturing exports from May 2020 onwards.

Styrene monomer (SM) demand fell by 21% in H1 2021 over H2 2020 to 5.9m tonnes.

The polymers made from SM go into many electronics and white goods applications, where the container and semiconductor shortages are likely to have slowed exports.

But again, please don’t panic. As the slide below shows, even if the SM H1 trends were to continue for the full year, 2021 consumption would still be some 100,000 tonnes higher than in 2020. And it would be 1.4m tonnes more than in 2019.

The doom mongers, and I used to be one of them and I was wrong, will argue that economic growth might get bleaker in H2 2021 because of the logistics issues limiting Chinese exports, the recent floods and a renewed wave of the pandemic in at least 14 provinces.

But, as I’ve detailed, there is nothing new about the logistics issues. They have been around throughout this year and yet H1 2021 trends point to this year’s petrochemicals demand still being stronger than in 2019 – a pre-bubble year. And some cases, this year’s demand is on track to be better than in 2020.

The logistics issues could get worse, and China might lose control of the pandemic. But China has some of the world’s best, if not the best, coronavirus protocols and so my betting is that it will bring the latest outbreaks under control.

Avoid the noise then, avoid the panic as far as Chinese demand is concerned. But in SM, as in PP, local supply is another issue all together, I am afraid.

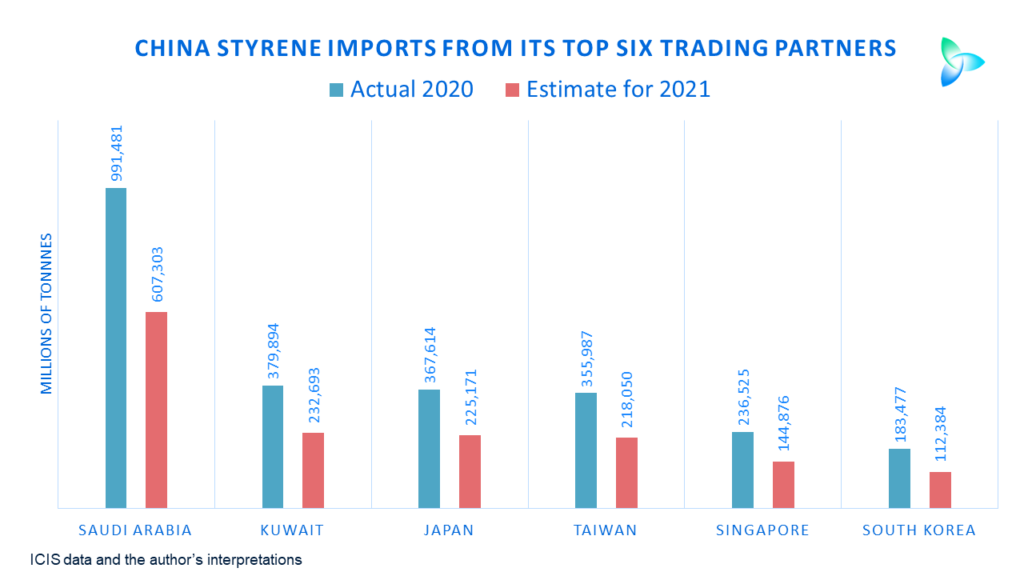

ICIS forecasts that China’s SM capacity will rise by 24% in 2021 versus last year to 13.7m tonnes/year. The H1 2021 import trends imply that this year’s imports will fall to 1.7m tonnes from 2.8m tonnes in 2020.

Assuming China’s top six SM trading partners win the same percentage shares of total Chinese imports in 2021 as they did last year, the fall in imports to 1.7m tonnes would have the following effects on them.

The message in summary from this post is this: keep calm and carry on as regards Chinese demand but not supply. Asian and Middle East producers in PP and SM who heavily rely on China must find alternative markets.

Good luck and stay safe out there.