By John Richardson

NEW STEAM cracker projects are still being announced on the assumption that they will still be needed 20 years and more from now – well beyond full depreciation.

One could argue this is reasonable given that it took some 50 years, from the introduction of the Model T to the development of the steam cracker industry, for today’s petrochemicals value chain to get off the ground.

The further sophistication of the value chain to what we recognise today took a great deal longer, from the development of ever-more sophisticated polymer end-use applications to the growth of the gas-based cracker business.

One might also contend that even in the context of the expert view that we must get to Net Zero by 2050 the conventional cracker business still has plenty of life left in it, provided carbon is efficiently managed in a refining or gas processing to steam cracker complex.

New crackers may employ, for instance, electric furnaces fed by renewable energy. The temperatures are terrific in a steam cracker – 850°C, hence the carbon intensity of the process.

There might, therefore, be big carbon wins at crackers. But this could depend on the right economic incentives being provided to make new technologies viable. Dow Chemical and ExxonMobil Chemicals, who want to build a carbon capture and storage hub in Houston, have called for US carbon taxes.

The other issue is the scale of tomorrow’s demand, especially in the developing world.

With, for instance, ethylene equivalent demand in the developing world set to more than double between 2020 and 2040, existing alternative technologies to both steam cracking and reforming come nowhere close to meeting the required volumes.

Unless these technologies can be made economical and scaled-up to meet demand, you can argue that new crackers and reformers will be needed as it is entirely unreasonable, and just plain morally wrong, to expect a rationing of demand.

Poor countries are entitled to all the products and services, made from petrochemicals, that the rich world takes for granted.

But where is the feedstock going to come from?

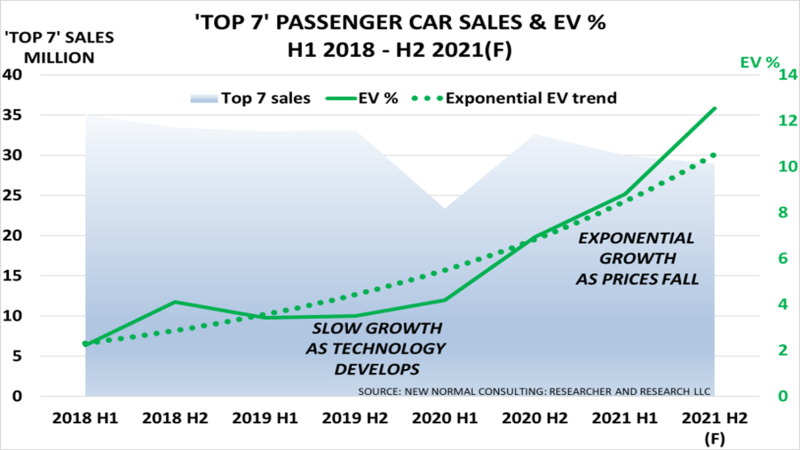

“Estimated electric vehicle (EV) sales in September confirm the potential for sales to further accelerate as market penetration increases [see the chart below],” wrote the November 2021 PH report.

China was 51% of global EV sales, with Europe in second place at 24% and the US third with 10%, But it seemed likely that all three regions would see major volume increases as consumer acceptance increased, the report added.

And while EV prices hadn’t generally increased very much over the past year, internal combustion engine (ICE) prices had risen by around 20%, said the report.

UBS expects EV and ICE prices to equalise by 2024 as EV costs continue to fall. A budget electric vehicle in China is selling for just $4,500.

And as a recent walk with my two carbon-inefficient dogs in Perth, Western Australia, confirmed, I am surrounded by lots of extremely cheap energy – the wind and the sun.

The chart below, from Our World in Data, is rather telling on the tumbling costs of the energy all around us, the supply of which is not confined to just a few countries and regions, as is the case with oil and gas.

“The weighted average cost of electricity in the G20 countries from offshore wind could fall by almost 50% by 2030 from 2019 levels, onshore wind by around 45%, utility-scale solar PV by up to 55% and concentrated solar power by 62%,” wrote Power Engineering International in a December 2020 article, referring to an International Renewable Energy Agency study.

Bringing this more up to date, a December 2021 EcoWatch article, referring to studies by the Institute of New Economic Thinking and the World Economic Forum, said that the cost of renewable energy had been overestimated.

Accounting for the revised estimates, EcoWatch wrote: “From 2010 to 2019, solar electricity prices decreased from $378 per MWh to $68 per MWh. In the same time frame, onshore wind costs decreased by 40%, and offshore wind costs decreased by 29%.”

Back to the fantastic data and analysis website, Our World in Data. As of 2019:

- 940m people (13% of the world) did not have access to electricity

- Per capita electricity consumption varies more than 100-fold across the world.

- Energy access is strongly related to income: poorer households were more likely to lack access.

See the map below from Our World in Data showing percentages of access to electricity by country.

Go figure. If you are a country in Africa, and with the cost of renewables likely to fall even further versus coal and gas, why on earth would you want to use hydrocarbons to provide more electricity? And with coal, there’s the added disadvantage of horrible air pollution.

Let’s take this further. Why would you want to deplete your foreign reserves by importing oil? Today’s high oil prices, which, at more than 3% of global GDP threaten a recession, underline the economic vulnerability of the big energy importers, many of which are developing countries.

When you add the advantages of distributed power, for example, solar panels on the roof of a remote village, why would new vehicles be anything but electric? Africa, like Perth, is hardly short of sun.

The slide below, showing the falling costs of solar panels and lithium-ion batteries, is further interesting evidence.

This covers new demand for oil. Similar dynamics could play out for existing demand as say India takes advantage of its local energy reserves of wind and solar to reduce its high hydrocarbon import costs.

Most energy imports also come from regions of the world where geopolitical stability is hardly a given, creating the constant risk of interruption of supply.

The European Union plans to ban the sale of ICE vehicles in 2035. It has also mandated a 100% cut in CO2 emissions by 2035, which would make it impossible to sell new ICE vehicles in 27 European countries.

Where is the feedstock going to come from for new crackers and reformers? And indeed, where is the feedstock going to come from for all the existing crackers and reformers if oil demand collapses quicker than some people expect?

Conclusion: kissing lots of frogs

This is an immensely complex subject which requires specialist study. This is why we are setting up a Topic Page on ICIS News to report on and debate the energy transition and the implications for petrochemicals. And I will be providing more blogs on this theme.

The Topic Page will include news reports on all the new technologies that emerge to make petrochemicals (will we even call them petrochemicals in future?) from renewable feedstocks.

It will be like kissing lots of frogs in the hope that enough will turn into princes and princesses to meet the scale of tomorrow’s demand with the right economics. As I keep stressing, we must meet the demand, which will be big. There is no other option.

There so many other angles that must be considered. They include inter-polymer competition as the price of some monomers go through the roof on lack of feedstock as oil wells are shut and as refineries close.

Benzene, as I discussed last month, is incredibly vulnerable to feedstock-driven demand-destroying cost increases as refineries close. Might this lead to the downstream polystyrene losing market share to the other commodity polymers?

Another post on benzene and potential demand destruction will therefore be written over the next few months, as will one on entirely new ways of assessing petrochemicals and supply and demand that accommodates the energy transition.

Tough choices lie ahead because of the complexity. But producers must make the right decisions as getting it wrong will cost many billions of dollars – and could even threaten the very existence of some companies.