By John Richardson

AS ALL THE CLAMOUR builds about inflation and rising energy costs – and absolutely, of course, these are major challenges which I shalll address in later posts – there’s a danger the petrochemicals industry will lose focus on charts such as the one above, courtesy of the pH Report.

I am still not convinced that today’s record-high levels of inflation will persist during the rest of this year, by the way. More on this later.

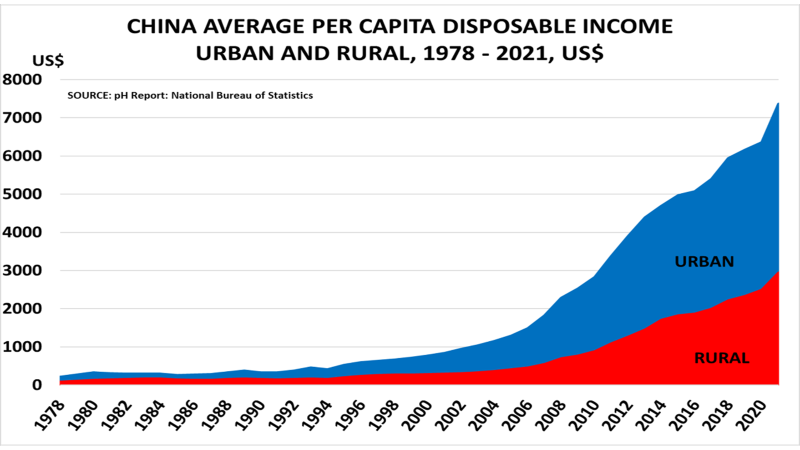

But focusing on the chart above, it tells us that since 2009 and the beginning of China’s huge economic stimulus package, China has become more unequal as the urban and rural divide has widened.

The widening in the disposable income gap is a consequence of the property bubble, the result of the stimulus programme. The bubble has been mainly concentrated in China’s 10 richest coastal urban provinces.

The big gulf measured in HDPE demand

We can see this big divide reflected in the provincial split in petrochemicals demand. This is if one makes the assumptions that there’s a link between per capita income levels in each province and petrochemicals per capita consumptions. There is, of course, a link. Not perfect, but a link.

See the chart below, repeated from an earlier blog post, which gives an example of the approximate split in 2020 high-density polyethylene (HDPE) consumption among China’s 31 mainland provinces and autonomous regions.

We can then go further, as I did in the earlier post, to convert the above chart into tonnes and measure this against population distribution:

- Some 55% of China’s 2020 HDPE demand was consumed by 39% of the population in the 10 richest provinces. Only 45% of demand was accounted for the remaining 61% of the population.

As we all should know by now, one of the three key elements of Common Prosperity involves efforts to narrow the urban/rural income divide. So, of course, this has implications for assumptions on future petrochemicals demand in the world’s most important market.

As a reminder, here are the two other key components of Common Prosperity:

- Deflating the real estate bubble.

- Lowering carbon emissions, cleaning up plastic waste and reducing air, soil and water pollution.

Both the above components also have major implications for China’s petrochemicals demand growth.

Dealing just with attempts to narrow the urban/rural income divide, the unknowns include whether China can raise its tax base by enough to significantly reduce relative rural poverty.

The world doesn’t always end up smelling of roses

Here’s a dilemma: 89% of total government spending is by the provinces with most provincial money raised from land sales, which are of course declining as the property bubble is deflated. For debt reasons, the real estate bubble cannot be reinflated.

This suggests that as Common Prosperity proceeds, government tax collection will decline rather than increase.

Also consider the implications of declining tax collection as China’s pension and healthcare obligations increase due to rapid population ageing (population ageing is a reason for Common Prosperity).

Another issue is that because of mass migration of young people to the coastal provinces for work, China’s rural provinces are ageing faster than its coastal provinces.

This clearly has implications for petrochemicals demand growth assumptions, as older people buy fewer consumer goods than younger people because they are on reduced incomes.

Reversing the ageing of China’s population seems just about impossible. Would encouraging reverse migration of young people back to the rural areas therefore make any net difference? In my view, probably not.

“Here you go again,” I can hear you say, “your glass is always half empty rather than half full.”

No, that’s not the point of the challenges I always present to the “garden is always full of roses” view of the world.

The proverbial Chinese economic garden may indeed continue to bloom with beautiful roses, as it has done for many years. I am not saying it won’t.

But petrochemical producers, traders and buyers need rigorous upside, medium and downside scenarios for what happens next in China. If things don’t turn out as planned under a one-dimensional planning approach, you will be in a lot of trouble.

The above themes are mainly aimed at the C-suites – the long-term corporate planners.

Now let me broaden this out to include the other major uncertainties concerning China and China’s relationship with the rest of the world.

China’s ageing population has helped increase tensions with the US.

Tensions are centred on China’s need for more access to new technologies, to deal with an ageing population and clean up its environment (the two priorities are connected), as the US restricts access.

China, through its Belt & Road Initiative, and through the Regional Comprehensive Economic Partnership (RCEP) free trade deal etc, is attempting to build a separate economic and geopolitical zone to counter the US.

Meanwhile, both Republicans and Democrats support the current approach to China.

Geopolitical tensions are contributing to the Chinese push to greater petrochemicals self-sufficiency – along with deals such as the one with Iran (China plans to invest $400bn in the Iranian economy, including $280bn in Iranian oil, gas and petrochemicals).

The Iran/China deal could lead to greater “virtual petrochemicals self-sufficiency” as China imports more products from Iran at preferential prices.

Petrochemicals trade flows may change. A bipolar world may emerge with China plus its economic and geopolitical partners forming one half of the split. The China plus partners zone could end entirely self-sufficient in petrochemicals, thereby barring imports from the US and its partners.

Now let me provide a summary slide of today’s post for your internal discussions.

Conclusion: ICIS as your partner for strategic planning

We have a wealth of expertise at ICIS in energy, petrochemicals and sustainability to provide you with the scenario-based strategic planning on China and other themes.

This is as much about the internal confidential conversations to arrive at the scenarios as the data and analysis. Through these conversations that take place in workshops, new challenges and opportunities will emerge.

For more information, contact john.richardson@icis.com.