By John Richardson

WE ARE LIVING in a much more complex polyolefins world where every decision you make over the remainder of this year will require levels of analysis that was previously unnecessary.

You will need to drill down at a country level in Europe to calculate the resilience of polyethylene (PE) and polypropylene (PP) demand to weaker GDP growth. The IMF, in its April World Economic Outlook, has revised down its forecast for EU growth in 2022 to 2.9%, 1.1 percentage points lower than its forecast in January.

Europe’s cost-of-living crisis, along with further supply chain problems caused by the Ukraine-Russia crisis and China Zero-COVID lockdowns, seems likely to depress demand for PE and PP in durable goods applications. But determining levels of single-use demand is way, way more complicated.

You can make a case, as I have done, that if we move to the endemic phase of coronavirus, single-use demand will decline from its 2020-2021 peaks in Europe and the rest of the developed world.

But consider this further complication, however trivial this sounds versus what really matters, which is nothing short of a humanitarian disaster: The extra single-use demand generated by the millions of people displaced by the Ukraine-Russia conflict.

As I said, the humanitarian aspect is what really matters. But businesses must continue to function in this crisis and the opacity of demand is making running polyolefins businesses very difficult indeed.

You will instead need to send more sales and marketing people out there to pick up every anecdote and micro statistic on demand in each country in Europe and in each end-use application.

The same difficulties very much apply to assessing levels of European PE and PP production – and therefore import requirements – as Europe reduces oil, naphtha and natural gas supplies from Russia.

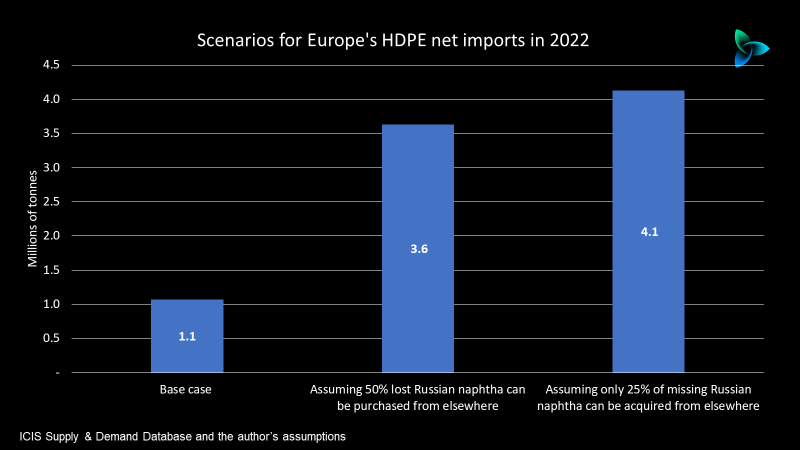

Either 1.1m tonnes of net HDPE imports or 4.1m in 2022

This 3m tonnes difference in HDPE net imports would make a big, big difference in the global context given that:

- Chinese demand growth seems likely to be weak in 2022 because of the pandemic-related lockdowns and the inflationary effects of the Ukraine-Russia crisis. The consumption slowdown looks set to occur as China raises its capacity by 22%.

- The impact of the food crisis on the developing world ex-China. The developing world ex-China comprises most of the Asia and Pacific region including southeast Asia and south Asia, Africa, the Middle East and South & Central America. The region’s consumption of all petrochemicals and polymers may decline as hundreds of millions more people are exposed to extreme poverty. The ICIS Supply & Demand Database estimates that the developing world ex-China will account for around one-third of this year’s global HDPE demand.

Our base case for European net HDPE imports (consumption minus production) is slightly less than 1.1m tonnes in 2022. This is close to last year’s actual net imports of just over 1.1m tonnes, according to the trade data.

Europe is said to source around 50% of its naphtha from Russia. Purchases of Russian naphtha have sharply fallen since the Ukraine-Russian conflict began. Our ICIS Pricing team say just about all purchases will stop from 15 May.

Our base estimate for European ethylene production in 2022 is around 21m tonnes, representing an operating rate of 86%.

But not all ethylene is of course made from naphtha. I’ve been told that some 20% of European ethylene feedstocks are liquefied petroleum gas (LPG), refinery fractions heavier than naphtha and ethane.

Now let’s assume that the availability of this 20% of other feedstocks will not be affected by the Ukraine-Russia crisis given the world has plenty of LPG, thanks to US shale oil and shale gas production.

Eighty percent of 21m tonnes of total ethylene production from all feedstocks equals around 17m tonnes of production reliant on naphtha.

It takes roughly 3.3 tonnes of naphtha to make a tonne of ethylene. Multiply 17m tonnes by 3.3 and this would leave Europe requiring a total of about 54m tonnes of naphtha. Half of this total (the 50% that comes from Russia) is in the region of 27m tonnes.

Let’s imagine for argument’s sake that Europe can only replace half of the 27m tonnes of lost Russian naphtha through imports from elsewhere. The other two big naphtha exporting regions are the Middle East and the US.

Half of 27m tonne is 13.5m tonnes. Add this to the other 50% of European naphtha that doesn’t come from Russia, and you get to around 41m tonnes of naphtha availability in Europe in 2022.

Divide 41m tonnes by 3.3 and you find that this year’s ethylene production falls to 12.4m tonnes. Using the same approach as above, if you assume European can only replace 25% of Russian naphtha, ethylene production falls to 10.3m tonnes.

Our supply and demand database assumes 24% of this year’s European ethylene production will be allocated to HDPE output. If you take 24% by these alternative levels of total ethylene production, you end up with alternative levels of HDPE output.

We estimate this year’s European HDPE consumption at 6.6m tonnes, representing 2% growth over 2021. Subtract from this consumption my alternative lower levels of HDPE production and you get the chart below showing higher net imports versus our base case.

Yes, absolutely, I know there are more holes in this analysis than the proverbial string vest. These numbers are again not meant to be taken as proper scenario work. They are instead only pointers towards the scenario work we can do for you at ICIS.

I don’t know whether European LPG supply will be unaffected by the Ukraine-Russia crisis. Nor do I know whether 20% is a fair estimate for non-naphtha feedstock supplies used to make ethylene in Europe.

Nor do I know how HDPE demand will be affected by the crisis. My scenarios only assume one level of growth, so different demand outcomes would add another dimension to your analysis.

I have merely guessed that Europe will be able to either replace 50% or 25% of missing Russian naphtha, when what’s instead required is deep analysis of naphtha availability from regions other than Russia.

Complications determining naphtha availability include the blending values of naphtha into gasoline and Asia’s demand for naphtha to make petrochemicals, as Asia is the biggest global importer.

I haven’t considered the effect of any reduced European purchases of Russian oil on European refinery operations and thus naphtha availability, that would be in addition to the decline in direct purchases of naphtha from Russia. Discussions continue over another round of EU sanctions that may target Russian oil.

Back to the subject of demand. JP Morgan warns that a speedy EU ban on Russian oil could push oil prices to $185/bbl. We would then be in a very different environment of inflation-driven demand destruction that could even affect single-use plastics.

The flip side of the coin in such an oil-price environment is squeezed European margins making room for more HDPE exports from lower cost ethane-based producers.

I haven’t considered a scenario where power cuts lead to refinery, cracker and HDPE shutdowns. The EU wants to reduce dependence on imports of Russian gas by two-thirds before the end of this year.

The HDPE net import estimates in the above chart are for Europe as a whole. What would be more useful is to break these estimates down by country. Another missing piece of the jigsaw is the absence of Russian HDPE exports in the European market. How might this affect Europe’s demand for imports?

Conclusion: This type of analysis is so much worth the effort

Now let me put some of European data into the context of what could happen to China’s HDPE net imports in 2022.

Under one outcome for China’s net imports in 2022, I assume demand growth of minus 3% and quite a high local operating rate of 83%. Net imports would fall to 4.6m tonnes from 7.4m tonnes in 2021 – 2.8m tonnes lower.

Europe’s net imports could total as much as 4.1m tonnes in 2022 – 3m tonnes higher than last year. In other words, there may be net gain of around 200,000 tonnes across the two regions.

This second chart underlines the scale of the rewards available for HDPE exporters if they sweat this type of analysis, even more so when you consider the much higher pricing in Europe compared with China that could persist for the rest of this year.

For information on how our analysts and consultants can support you with detailed scenarios, contact me at john.richardson@icis.com.