THESE REALLY ARE extraordinary times as the following two charts tell us. Let us start with a chart on China.

As you can see from the high-density polyethylene (HDPE), linear-low density PE (LLDPE) and polypropylene (PP) trend lines, China price spreads per tonne over tonnes of naphtha feedstocks saw steep declines in March this year.

Spreads had started to weaken in August 2021 on China’s Common Prosperity economic reforms, but in March they, quite literally, fell off a cliff.

Spreads are a crude measure of how much money producers are making.

During March, spreads fell to their lowest levels since our price assessments began in November 2002, on the acceleration of China’s zero-COVID policies and the Ukraine-Russia conflict.

Low-density (LDPE) spreads performed much better. But data is nothing without ICIS market intelligence. LDPE spreads have remained relatively strong because of very tight supply as LDPE/ethylene vinyl acetate (EVA) swing plants swung to more EVA production. The swing to more EVA production began last year because of strong demand, especially in the solar-panel end-use market.

High prices for LDPE relative to the more widely available LLDPE (LLDPE competes in many of the same end-use markets as LDPE), has led to LDPE demand destruction. In Q1 this year, China’s LDPE demand was down by 4% versus the same period in 2021.

There was a slight recovery in HDPE, LLDPE and PP spreads in April, but they remained close to record lows. Spreads declined again during the first two weeks of May.

The spread story, when linked, as I said, with the right market intelligence, tells us what’s happened to the China’s economy.

Until the zero-COVID restrictions are relaxed, and this doesn’t look likely to happen anytime soon, it is hard to see how spreads will substantially increase. But we will only know what’s actually happening by analysing spread patterns, using historic ICIS price data.

More major production cuts might, I suppose, strengthen spreads. But China idled some 25% of its PP capacity in March and yet the PP March spread still fell to a record low.

And with the Chinese yuan down this year against the US dollar, some of China’s producers might resort to raising exports as opposed to making further rate cuts – provided container space can found

Global PP markets would be the most disrupted by any big increase in exports given China’s potential swing from being the world’s biggest net importer to a net export position.

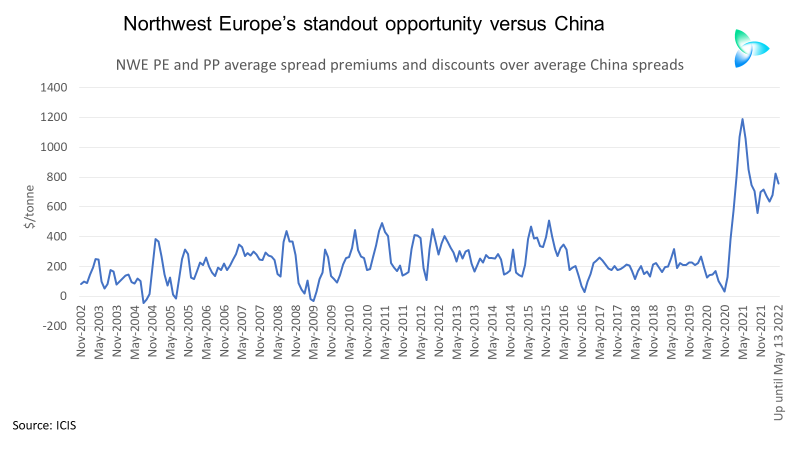

Now let us look at northwest Europe (NWE). This is almost a mirror image of what’s happened in China.

NWE spreads began to widen to historic highs from February 2021 onwards on tight supply and strong demand. Supply was tightened by the February 2021 Texas winter storm as the US is a major PE exporter to Europe. European demand was strong because of the pandemic.

European supply has been further limited by high container freight costs and shortages of containers space on the Asia-Europe routes, making it difficult for Middle East and Asia producers to relieve the oversupply in northeast Asia by moving more volumes to Europe.

There was a brief producer scare in March this year when European spreads fell on the rapid rise on naphtha costs resulting from the Ukraine-Russia crisis. But in April, spreads improved as producers passed higher costs onto customers.

European spreads, though, dipped again during the first two week of May. Perhaps this means that inflation is finally affecting demand for single-use PE and PP.

There are also reports of further supply-chain problems in the European autos and household goods end-use sectors, which each account for some 10% of global PP consumption. The new supply-chain problems are caused by China’s zero-COVID policies.

Here is a third chart that shows the rise in average NWE PE and PP spreads versus those in China.

The multi-million-dollar value of ICIS price data

Regular readers of the blog will know that I first highlighted the big polyolefins market divergence in April 2021. Back then, I said that:

- Asia and Middle East producers needed to sell more to Europe because of much better netbacks than in China.

- Buyers should secure more resin supplies from Asia.

- Until spreads started to normalise – which we would be able to recognise from the ICIS data – producers and buyers needed to focus on these two parallel opportunities.

- But this would require dealing with very challenging container-freight markets. ICIS trade-flow data suggest this can be done.

I also presented a scenario where European demand remained strong with supply tight as China moved in the opposite direction. This scenario has happened.

Using our historic pricing data combined with our market intelligence can make or save you, quite literally, millions of dollars.

If you have yet to act, it is not too late. For more information on how to make use of our pricing data and market intelligence to avoid leaving further millions of dollars on the negotiating table, contact me at john.richardson@icis.com.