By John Richardson

WAS IT JUST an almightily big bubble that cannot now be re-inflated, even if Beijing follows through on its plans to inject $148bn in loans into the country’s troubled real estate sector?

Once confidence has gone, such an intangible thing, there is a risk it cannot be restored. The old “put option” was that the government would always effectively intervene to stabilise real estate, the main source of investment and savings in China because of weak pensions provision. What happens if faith in the put option fades away?

The scale of the problem was highlighted in the July pH Report: Bloomberg’s current view of Chinese banks’ exposure to property loans. Its $9.3tn number. This is almost certainly an under-estimate, given that all the major players – developers, borrowers, local governments etc – have an interest in minimising the risks. But even $9.3tn represents almost two-thirds of China’s GDP last year”.

Confidence in real estate and the broader economy seem to have also been undermined by the zero-COVID policies. A stop/start recovery appears inevitable until or unless China develops an effective mRNA vaccine and administers the vaccine to the point where lockdowns and mass testing are no longer necessary.

Back to real estate. As I highlighted in January, there appears to be a close link between the rise of China’s demand for petrochemicals and polymers since 2009 and the country’s big increase in Total Social Financing, the People’s Bank of China’s broad measure of credit availability. A big portion of the surge in lending has gone into real estate.

And as I’ve been arguing for many years, China punches above its weight in terms of per capita petrochemicals demand versus its per capita income. . In 2021, its nominal per capita income was $14,096 and was $21,364 in terms of purchasing power parity, according to data quoted by Wikipedia

This compared with the US where nominal 2021 per capita GDP even just in nominal terms was $69,288, according to IMF data quoted by Wikipedia. And yet in polypropylene (PP), as the chart below illustrates, China’s per capita consumption overtook the US in 2019.

Absolutely, of course, China’s vast export machine has played a big role in the rise of PP demand in per capita terms and in millions of tonnes. But so, I believe, has the big jump in credit availability, real estate wealth and all the economic activity and conspicuous consumption connected to rising property prices.

And while we are on the theme of exports, the type of export-led recovery that China enjoyed in H2 2020 doesn’t seem likely to be repeated given inflation in the West and the negative impact on demand for durable goods.

It also seems likely that during the peak pandemic period in the West, big government stimulus brought forward demand for new computers, washing machines, game consoles and office furniture to equip homes. These were occasional purchases meaning that, even without today’s record-high inflation, demand for durable goods was always going to dip.

But, as with high-density polyethylene (HDPE), you don’t have to take my word for what’s happening with PP. Instead, all you need to do is look at the spreads – the differentials between ICIS PP prices and naphtha feedstock costs – and what the latest ICIS data are telling us about China’s PP demand in 2022.

Spreads confirm the slowdown continues

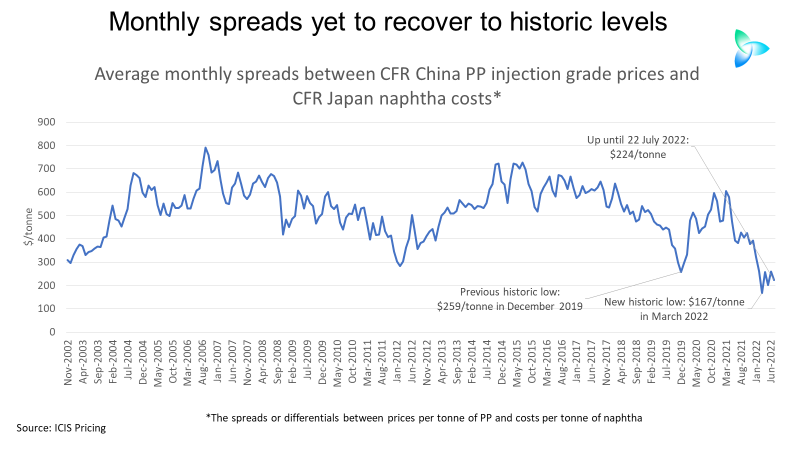

The above chart shows monthly spreads since our PP injection grade and naphtha price assessments began in November 2002 up until 22 July 2022.

The previous record-low spread occurred in December 2019 during the big oversupply shock when global PE and PP markets, particularly those in China and southeast Asia, reacted negatively to large additions of new supply.

But then, of course, came the Russian invasion of Ukraine, the run-up in energy costs and the beginning of China’s zero-COVID policies. Spreads in March this year fell to a new record low of $167/tonne and up until July 2022 they were at $224/tonne, still below the previous record low.

Spreads have always been a reliable indicator of supply and demand balances. Therefore, until or unless spreads recover to their historic averages, China’s economy will not have fully recovered as petrochemicals are the raw material building blocks for any economy.

Now, as with HDPE last week, let me put the 2022 average spreads in the long-term historic context.

The annual average spread in 2022, again up until 22 July, was just $242/tonne. Last year’s spread was 86% higher at $452/tonne and the previous record low was $364/tonne in 2003.

It is important to stress, as the chart below confirms, that the weak performance in 2022 is not about the big surge in oil prices and thus naphtha costs.

During previous big run-ups in oil prices, the gaps between the blue line (naphtha costs) and the red line (PP prices) show that PP producers were much better able to pass on higher feedstock costs to converters.

The latest ICIS data on demand underlines that the slowdown continues.

As with the January-May China Customs net import number combined with our estimate of local production when annualised (divided by five and multiplied by 12), the January-June data (divided by six and multiplied by 12) show a 1% decline in full-year 2022 demand. This would compare with 6% consumption growth in 2021 over 2020.

The 1% decline in demand to around $34m tonnes is the basis for Scenario 2, the medium-case outcome. Scenario 1, the best-case outcome, is three percentage points higher at plus 2%. Scenario 3, the worst-case result, is three percentage points lower than the medium case at minus 4%.

In HDPE and the other grades of PE, my month-by-month upside and downside scenarios from the medium cases involve adjustments of plus or minus two percentage points.

But in PP, three percentage point movements seem more logical given the bigger share of PP end-use consumption into durable goods compared with PE. This makes demand more responsive to either a recovery in local retail sales and exports or increased weakness.

China could become a net exporter in 2022

This month’s picture would not be complete without revisiting the outlook for China’s net imports as in 2021 China drove more than 40% of total global net imports among the countries and regions that imported more than they exported. This was by far the biggest percentage.

The story represented in the chart below is partly about the different demand outcomes shown in my earlier chart. The context here is also China’s continued push to greater PP self-sufficiency. Its PP capacity is scheduled to increase by a further 12% on a year-on-year basis to around 39m tonnes/year following a 13% increase in 2021.

What will determine this year’s level of net imports will also, of course, be local operating rates. Poor profitability, evidence of which we can see from the spreads, led to our January-June estimate of operating rates of just 80% compared with our assumption at the start of the year of full-year capacity utilisation of 84%.

So, in the best-case outcome, assuming full-year operating rates are 80% and demand growth sees the best-case outcome of 2%, this would leave this year’s net imports at 3.5m tonnes, 100,000 tonnes more than 2021. But net imports would still be 2.6m tonnes lower than in 2020.

Scenario 2 is again based on the actual ICIS data for January-June when annualised. This involves a 1% decline in growth and an 80% operating rate, leaving this year’s net imports a million tonnes lower than last year at 2.4m tonnes.

The worst-case outcome, Scenario 3, would involve China deciding to run its plants harder in H2 than H1, resulting in an annual average operating rate of 84% as demand growth falls by 4%. This would result in China swinging into a net export position of some 270,000 tonnes.

China might decide to raise operating rates, despite poor profitability, in order raise exports and thus partly compensate for weak local sales.

The January-June China Customs data suggest China’s 2022 exports could total 1.7m tonnes, up from 1.4m tonnes in 2021 and only 424,746 tonnes in 2020. But even 1.7m tonnes would only represent 5.5% of 2022 local sales, based on Scenario 2 for demand.

But, in a later post, I shall examine the broader detail and context behind China’s PP imports. While exports look likely to remain relatively small in 2022, increased overseas shipments might allow local producers to tighten supply and therefore support the much more important domestic market.

I will also consider the impact of China’s increased export trade on other exporting countries including Saudi Arabia, Abu Dhabi, South Korea, Singapore and Thailand.

Conclusion: Follow the data

A view gathering momentum out there is that China is undergoing at least a medium-term slowdown as it builds a new economic growth model and at is persists with the zero-COVID policies. And it is becoming more broadly accepted that China will continue to move to much greater petrochemicals self-sufficiency.

But there are many people out there who will disagree. They see a potential for a strong H2 economic recovery. All you need to do is follow the ICIS data and you will find out who is proved right.