By John Richardson

I WORRY THAT too many people still don’t get it. This 17 August Financial Times article, on foreign investors dumping Chinese stocks and bonds, talks about the frustration of investors over lack of solid policy action by China to turn its economy around.

But I don’t believe that, at least in the short-to medium-term, Beijing can significantly rejuvenate growth. Maybe in the long term, however, if it can build an effective new economic growth model. As I wrote in my 20 July blog post:

The phrase “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

This is assuming that China has the wiggle room for big stimulus given the scale of its debts. Furthermore, we cannot be sure if it has the appetite or not for further big stimulus because it is attempting to build a new economic growth model.

Further challenges include record-high youth unemployment and the declines in China’s exports of finished goods. Exports were always going to decline from their peak during the pandemic as spending shifted from goods into services. What has made the decline unexpectedly worse is multi-decade high levels of inflation, which is are another consequence of the pandemic.

But chemicals companies could and should have built scenarios to future-proof their businesses against the impact of the unsustainable rise in China’s debts, centred on real estate, and its ageing population.

Paul Hodges and I first flagged up these risks in 2011. And in late 2021, it was clear from the ICIS data on chemicals spreads and margins, combined with data on China’s real-estate sector, that we had reached a critical turning point.

This is when the downturn began with, in my view, no amount of stimulus by China capable of ending the global chemicals downturn.

Global HDPE capacity in excess of demand expected to triple

The patterns shown in the chart below are the same across all chemicals and polymers because of overestimates of China’s demand growth.

Average annual high-density polyethylene (HDPE) capacity exceeding demand was 4m tonnes in 2000-2019 with the average operating rate at 88%. I have chosen this cut-off point as this was before the distortions to global demand caused by the pandemic.

Annual average global capacity exceeding demand is forecast by ICIS to be 12m tonnes in 2020-2030 with the operating rate at 79%.

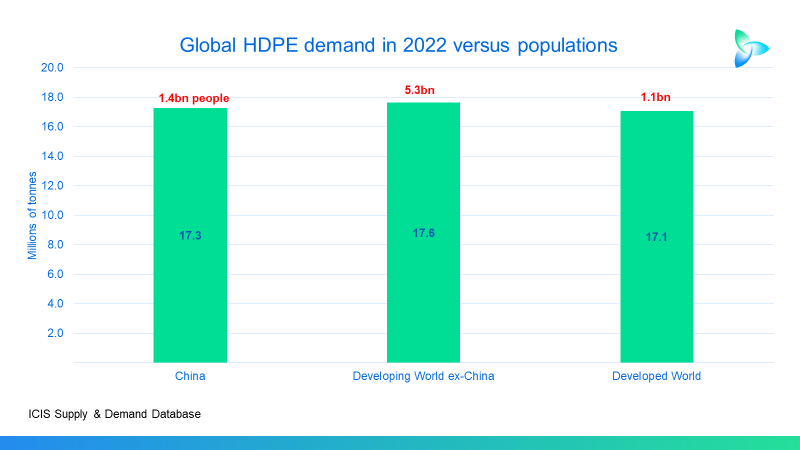

The table below breaks the HDPE world (I believe this should apply to all chemicals and polymers) into three mega-regions, which each have different growth prospects.

The Developed World, comprising Canada, the US, Australia, Europe, Japan, New Zealand, Singapore, South Korea and Taiwan, faces the greatest downward pressure on consumption resulting from sustainability.

For the Developing World ex-China – made up of Africa, Developing Asia & Pacific, the Former Soviet Union, the Middle East including Turkey and South and Central America – the escape from poverty of hundreds of millions of people offers potential.

Balanced against this must be analysis of the risks from climate change. A large proportion of the Developing World ex-China is equatorial and therefore at high risk from increased flooding and droughts.

I’ve already covered the challenges facing China.

As you can see from the numbers on the chart, our base case sees better Developed World HDPE demand in 2020-2030 versus 2000-2019. Work with ICIS to build alternative scenarios of growth less than 1.5% per year in this region because of sustainability.

As for the Developing World ex-China, we see growth slipping to an annual average of 4% in 2020-2030 from 6% in 2000-2019.

This seems to be partly the effect on consumption of the pandemic. Perhaps there is an upside to this scenario resulting from the escape from poverty before the effects of climate change start to kick in after 2030.

The forecast decline in China’s growth to just 3.3% in 2020-2030 from 11% in 2000-2019 is eye-popping. Here’s the thing as the red wording below the table tells us: As recently as three years ago, consensus views on China’s future polymers growth in general were at 6-8% per year.

The effects of an extra 35m tonnes of global HDPE demand

As I did with polypropylene (PP) earlier this month, let me now imagine different outcomes for HDPE to the one predicted under our base case.

Here I look just at 2024-2030 because this is the immediate future, and this year is already done.

Let’s assume that the Developed World does grow at our improved average of 1.5% despite the sustainability pressures. But let’s up the Developing World ex-China growth rate to 6% from our assumption of 4%.

Here’s the critical difference, however: Let’s raise the China growth rate to 8% – the upper end of what the consensus used to assume – from our forecast of 3.3%.

This would add 35m tonnes global demand in 2024-2030 versus our base case with 75% of this extra demand (26m tonnes) driven by China. The Developing World ex-China would be responsible for 9m tonnes – 25%. The Developed World would obviously be unchanged from our base case.

This would result in an average global operating rate of 84% in 2024-2030 versus our forecast of just 77%. While 84% would still be lower than the very healthy 88% in 2000-2019, 84% would represent a very mild downturn compared with what we face today.

Getting back to 88% under our base case – 9m tonnes/year less capacity

So, under our base case, what would it take to get back to the very healthy operating rate of 88%? Here’s my very crude attempt to predict what this would require. As always, this should not be confused with the much more thorough scenario work ICIS can provide for your company.

I estimate that total global HDPE capacity between 2024 and 2030 would need to be 9m tonnes/year lower than our base case. This would of course mean postponements or cancellations of some products and/or shutdowns of existing plants.

But maybe even future growth of 3.3% per year in China is too high an estimate. What follows explains why this might be the case.

The chart below shows China’s remarkable HDPE per capita consumption growth versus the rest of the world since 1992. What applies to HDPE applies to nine of the major synthetic resins.

The three events detailed in the above chart are history. Deng Xiaoping’s Southern Tour led to economic liberalisation that boosted export-focused manufacturing, with this manufacturing sector receiving further support from China joining the World Trade Organisation in 2001.

This removed the tariffs and quotas that had restricted China’s exports to the West, allowing China to take maximum advantage of what was then a youthful population.

Then came the launch of the world’s biggest-ever economic stimulus package that resulted in the real estate sector accounting for some 30% of China’s GDP, the highest in economic history.

The chart below details why these three events are now history.

China faces the world’s biggest-ever demographic crisis which is evident from the fall in household formation since 2013.

Pressure to save more to cover pensions and healthcare is rising as the population ages.

The old government “put option” on real estate– the guarantee that property prices would never fall – no longer applies now that house prices have fallen. This has dampened speculative investment in property.

China’s local governments that provide 70% of total government spending are struggling to pump-prime the economy through infrastructure spending. This is because they issue bonds to pay for spending that are backed by rising land prices. Land prices have fallen.

And consider the above chart on births per woman. China’s births per woman have been below the population replacement rate of 2.1 since 2001.

Now let us return to the earlier chart showing per capita HDPE demand and translate some of these numbers into millions of tonnes of demand compared with populations. The changes since 1992 are staggering.

In 1992, China’s population of 1.2bn generated just 0.8m tonnes of HDPE demand versus 2.5m tonnes from a Developing World ex-China population of 3.2bn and 10m tonnes from a Developed World population of 1bn.

Let’s move onto 2022.

China’s 1.4bn people drove 17.3m tonnes of demand. In the Developed World ex-China, 5.3bn people generated 17.6m tonnes of consumption. Developed World demand was 17.1m tonnes from 1.1bn people.

Why HDPE capacity might have to be 13m tonnes/year lower

The above data suggest that China’s HDPE demand may have grown too quickly for the three historic reasons. Now that China’s population is ageing, and the real estate bubble is over, we could see much lower annual growth even than our forecast of 3.3% per year.

The chart below again assumes Developed World demand growth at 1.5%. But I’ve lowered China growth to 1.5% per year, including a possible 3% decline in growth this year over 2022 based on the January-June net import and local production numbers. I’ve again raised Developed World ex-China growth to 6% from our base case 4%.

Global HDPE capacity in 2024-2030 would need to be a total of 13m tonnes/year lower than our base case to return to the 2000-2019 operating rate of 88%.

A major industry shakeout

I believe this is no normal downcycle. Some hard decisions lie ahead for HDPE and other producers.

As restructuring accelerates, I believe we will see the smaller less feedstock-advantaged chemicals players in general under pressure to switch their business models to “less is more”. Niche, higher-value end-use markets where “green premiums” can be won by being more sustainable is the way to go.

This will leave companies with access to cheap feedstocks in positions to dominate the commodity end of the chemicals business. But the problem is that they, too, want to go into higher-value green end-use markets.

It won’t be pretty, I am afraid. But at least if we accept the scale of the challenges we can move forward. Denial is a distracting thing.