By John Richardson

POLYMER BUYERS outside northeast (NEA) and southeast Asia (SEA) have a big opportunity to save millions of dollars on procurement costs during the rest of this year through purchasing more from the two regions.

The opportunity has arisen because I believe that NEA and SEA polymer prices will remain very cheap relative to most of the world until at least the end of 2021.

NEA comprises China, Japan, Taiwan and South Korea. Our definition of the SEA region is Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

NEA and SEA producers can also make a lot of money by constantly monitoring and acting on strong arbitrage opportunities in other regions.

As supply disruptions in the US look likely to continue, Europe and South & Central America seem particularly good opportunities for both buyers and producers.

Before we discuss why I see NEA and SEA remaining cheap relative to most of the rest of the world until at least the end of the year, let us consider in more detail the size of the prize, starting with the resin buyers.

Demand has been very strong for converters and brand owners since the pandemic began because of booming consumption of takeaway and supermarket food, hygiene products and durable goods. And any brand owner selling online (in other words, all of them) has enjoyed very strong sales.

But supply has been a major headache due to the global problem of lack of feedstock from refineries for making polymers. Winter storms shut down most US polymer capacity for several weeks during February and supply is only just getting back to normal.

This year’s US hurricane season is expected to be above average in severity. Potential power outages caused by hot summer weather may further disrupt US polymer production. The US is a major supplier of polyethylene (PE) to Europe and PE and other polymers to South & Central America.

The surge in container freight costs to historic highs and insufficient container space have caused further major problems.

Some regions such as Europe have ended up incredibly tight because of the difficulty in finding container space to import polymers. Regions such as NEA and SEA, where supply is long, have struggled to export their way to more balanced markets.

Strong demand, limited supply and the container freight crisis have combined to drive pricing in regions such as Europe to historic highs. Managing extreme price volatility has been another big difficulty for polymer procurement managers.

NEA and SEA producers are confronting weak demand and increased supply in polymers such as polypropylene (PP) – along with the difficulty of finding containers to ship elsewhere.

But if the producers find the container space, the opportunity as obvious as the nose on Cyrano de Bergerac’s face: other regions can act as a relief valve for Asian producers while also generating strong profits.

The big challenge will remain finding containers at the right price, the right volume and in the right delivery timeframes. But trade data so far this year show that this can be done.

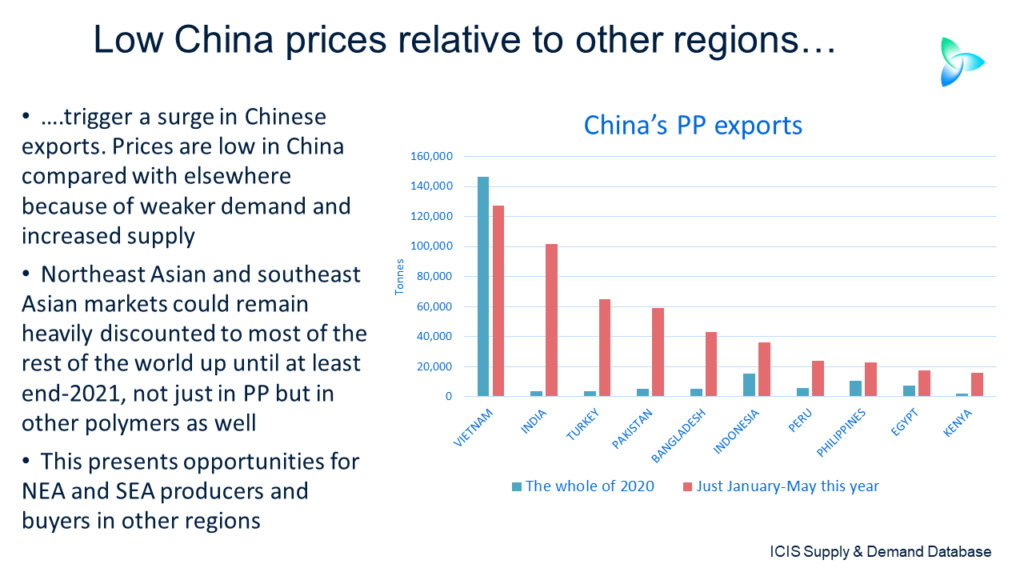

For example, consider the slide at the beginning of this blog post which shows the top ten destinations for China’s PP exports in January-May 2021 versus all of 2020.

As you can, Vietnam remained the top destinations. But as overall exports in January-May 2021 jumped by an astonishing 419% versus August-December 2020:

- Exports to India, which is part of our South Asian region, jumped to 101,571 in January-May from just 3,414 tonnes during the whole of last year.

- Exports to Turkey rose to 64,698 tonnes from 3,643 tonnes and to Peru to 23,951 tonnes from 5,616 tonnes.

Singapore, South Korea, Thailand and Taiwan are all much bigger exporters than China. When the trade data becomes available, it will be important to see how they have diversified their shipments.

Now let me explain in detail why I believe polymer buyers and producers have a big opportunity, sticking with PP as an example.

Why NEA and SEA demand may remain weak as supply increases

One can argue that PP is the most troubled of all the NEA and SEA polymers because of both the big rise in local capacity and faltering demand growth.

But similar dynamics apply to other polymers such as high-density PE, PET resins and polystyrene. Contact me for the details at john.richardson@icis.com.

The slide immediately above details how China’s PP imports could fall by 28% this year versus 2020.

China’s PP demand growth in January-May 2021 versus August-December 2020 (the only relevant comparison) fell by 5% on slowing Chinese exports of finished goods and one of Beijing’s periodic decisions to more aggressively tackle high levels of debt.

Stronger government efforts to clean up the environment have also suppressed PP demand growth.

If the January-May demand trends were to continue for the full year, China’s 2021 consumption would fall by 1.3m tonnes lower than last year to 31.9m tonnes. This 31.9m tonnes would be 2.6m tonnes smaller than our base for China’s 2021 demand.

This is occurring as a lot of new local capacity comes onstream. China’s PP PP capacity is forecast to rise by 13% in 2021 over last year to 34.8m tonnes/year. Most of the new capacity is due to start-up in H2.

ICIS forecasts that South Korean PP net exports (exports minus imports) will edge up in 2021 to 3.2m tonnes from actual net exports of 3m tonnes last year.

Hanwha-Total Petrochemical is bringing onstream a 316,000 tonnes/year PP plant in South Korea in 2021. Hyundai Chemical is also due to bring new capacity online during the year.

Malaysia is expected to swing from a balanced position in PP in 2020 to net 2021 exports of 117,000 tonnes. This would be the result of the start-up of the delayed Pengerang Refining and Chemicals complex.

Now look at the slide below, detailing two different scenarios for SEA PP demand in 2021.

In my view, the downside scenario is much, much more likely than our base case. This would see demand at 5.3m tonnes – 100,00 tonnes lower than last year and 700,000 tonnes lower than our base case for 2021.

This downside scenario is built on the assumption that the percentage declines in demand growth we saw in the big SEA consumption markets in 2020 – Indonesia, Malaysia, Thailand and the Philippines – follow similar patterns this year.

In Vietnam, too, growth looks set to be lower than our base case because of a recent outbreak of the pandemic.

Continued very weak tourism in what are heavily tourism-dependent economies seems a given this year because of the pandemic.

Market sentiment has recently weakened in SEA because of renewed coronavirus restrictions. End-use demand has fallen as converters also struggle to maintain production due to quarantines.

The other big problem for SEA, as with all developing regions, is the “poverty effect”. Millions of people have been pushed back into extreme poverty because of the pandemic, meaning that they can no longer afford the basic consumer goods made from PP.

Millions more have been denied the chance to climb up the income ladder to middle-income status, allowing them to buy washing machines and motor scooters – two examples of finished goods made partly from PP.

The economic damage or scarring from the pandemic is likely to last for several more years.

Big price differentials and extreme volatility here to stay

Wow! Just look at some of the regional price differentials!

Before I justify my “Wow!” let me make a few important points on container freight. As this article from Business Insider underlines, the shortage of container space isn’t likely to end until next year.

In fact, high costs and shortages are likely to get worse in the build-up to the peak Christmas demand season.

My view is that until or unless the world is adequately vaccinated – and we are a long, long way from this happening – disruptions to the container business will continue. We could be stuck with disruptions for several more years.

Combine the container issues with weak demand and supply fundamentals in NEA and SEA versus stronger demand and supply fundamentals elsewhere and we have ended up with charts such as the one above.

The chart does show a slight dip in PP injection price premiums in Northwest Europe and Brazil versus NEA and SEA during June.

But this was not the result of NEA and SEA getting more expensive. It was was instead due to a slight fall in Northwest Europe and Brazilian prices as NEA and SEA pricing also softened.

As I have said, I believe that further big price differentials between NEA and SEA and other regions will continue in PP for the reasons given above. The same will apply to other polymers. Extreme volatility is also guaranteed.

Conclusion: how to manage the challenges

You need ICIS data and analytics in order to manage these challenges and opportunities.

The analytics half our service is critical. We interpret data and tell you what’s going to happen next. Data has little value without the right interpretations.

Again, please contact me at john.richardson@icis.com for the details, unless you want to leave dollars on the table.