By John Richardson

DO YOU WANT the good news or the bad news first? This always a rather silly question because, as I am not telepathic, I cannot hear what you are thinking.

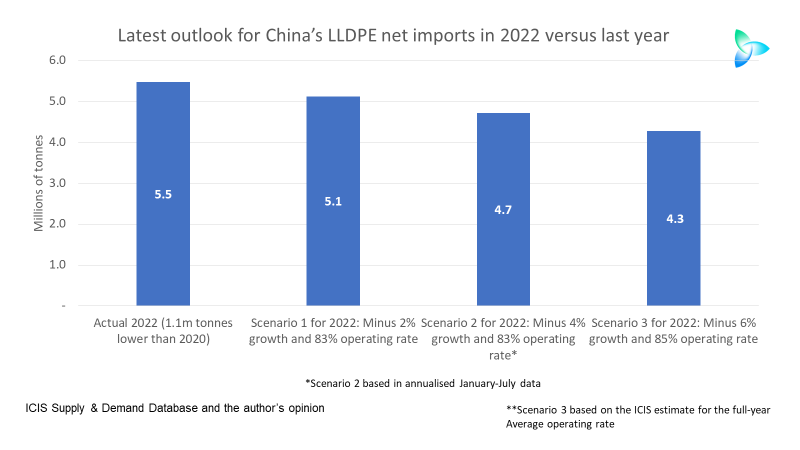

So, let me arbitrarily start with the good news in the chart below. It is that the January-July data suggest full-year 2022 linear-low density polyethylene (LLDPE) demand growth in China will be no worse than what the January-June numbers indicated.

As with January-June, we look to be heading for a 4% decline in consumption (Scenario 2 in the above chart). This would leave the market at around 14.6m tonnes versus last year’s actual consumption of 15.2m tonnes.

As usual, I’ve provided you with two other scenarios. Scenario 1 assumes a strong recovery in demand over the remainder of this year, leaving demand at 14.9m tonnes, only 2% less than last year.

For the sake of all out doom and gloom, Scenario 3 involves economic conditions getting worse. This would see demand fall by 6% to just 14.5m tonnes.

The bad news is that even with a decline of only 2%, this year would still be the second-worst year for growth since 2000. The worst year would be 2012 when demand fell by 3%.

You might argue that a cool-down in growth was inevitable in 2022 given that demand in 2020 grew by an eye-wateringly high 13%. But consider the chart below. Sorry for being maniacal about this, but spreads don’t lie.

The China CFR C4 grade LLDPE price spread over CFR Japan naphtha costs per tonne was $202/tonne in March this year, the lowest monthly spread since our assessments began in January 2000. Spreads had since recovered to $255/tonnes in August 2022 up until the 19th. But….

The annual average CFR China C4 LLDPE price spread over CFR Japan naphtha costs was just $273/tonne in 2022 up until 19 August. This was the lowest since annual spread since 2000. The second lowest annual spread was $303/tonne in 2003.

This tells us that China’s economy is in trouble because all chemicals and polymers are crucial building blocks for manufacturing and service chains (spreads are also weak in many other China chemicals markets).

If we end up with LLDPE demand only declining by 2% this year, spreads during the rest of this year will need to recover to much closer to their long-term historic averages.

A demand decline of 4% would mean spreads staying around where they are today, whereas a 6% fall in consumption would involve spreads weakening.

In the case of the latest outlook for China’s net LLDPE imports, the January-July data (Scenario 2 in the chart below) suggest they will fall to 4.7m tonnes from 5.5m tonnes in 2021. The January-June data indicated this year’s net imports would only slip to 4.8m tonnes.

This helps to explain the Dow operating-rate cut decision

“Dow’s announcement on slashing PE operating rates is a clear sign of weakening global demand and oversupply of the polymer, along with persistent logistics constraints,” wrote my good friend and colleague, Joe Chang, in this 25 August ICIS news article.

“In a 24 August letter to customers, Dow said it is cutting PE operating rates across its asset base, temporarily lowering global nameplate capacity by 15%. It cited continued global logistics constraints, including port and rail congestion in the US Gulf Coast, as well as ‘dynamic conditions in Europe’,” Joe added.

“Dow will consider how best to effectively reduce operating rates in each region and each site on a case-by-case basis while closely monitoring its inventory, supply chain constraints and demand,” said a company spokesperson.

Dow is one of the world’s largest PE producers with global capacity of over 8m tonnes/year, according to the ICIS Supply and Demand Database. It a major LLDPE player.

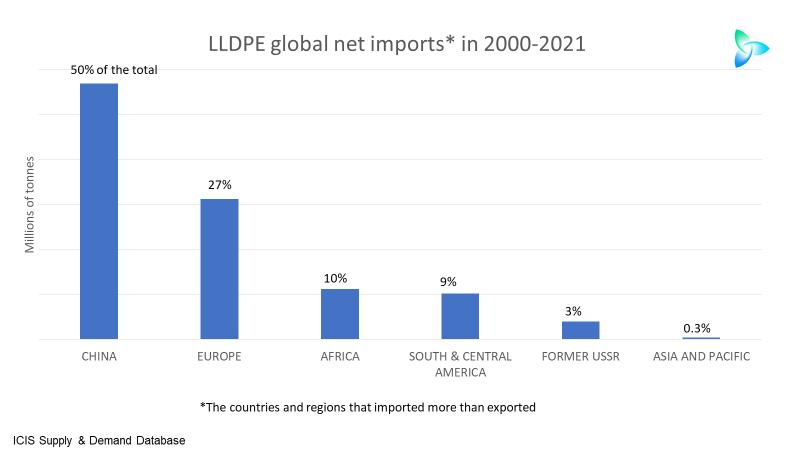

And, of course, China is the world’s biggest source of LLDPE demand and the world’s biggest net importer.

The above type of the chart (the patterns are the same in all other chemicals and polymers) will leave you scratching your head and thinking, “this cannot be right”, unless you understand the economic context.

The chart is absolutely right. In the case of LLDPE, China’s percentage share of global demand rose from 15% in 2000 to 37% in 2021, way overshadowing every other region, including Asia and Pacific which has a much bigger population.

The next chart is equally extraordinary. It shows that China accounted for 50% of the total global LLDPE net imports, amongst the countries and regions that imported more than they exported, in 2000-2021. In distant second place was Europe at 27%.

The much-vaunted “rise of the African middle classes”, one of the favourite themes of so many conference speeches. isn’t supported by the data of its importance in terms of percentage shares of global demand or net imports. As you can see, its share of net imports in 2000-2021 was just 10%.

Not all companies are directly heavily dependent on China for its PE sales. But that’s not the point. Because the scale of China’s demand and net imports dwarves every other region, the indirect effect of a weaker-than-expected China in 2022 is huge for everyone.

I must stress that logistics constraints are also a factor in the Dow decisions. But events in China also seem to be affecting everyone in the industry.

I wouldn’t be surprised to see decisions by other producers to cut operating rates in light of the most challenging market conditions I have seen in the 25 years I’ve analysed the global polyolefins business.