By John Richardson

CHINA’S high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE) markets are very straightforward. As both head for their lowest levels of growth in 2022 for at least two decades, it is all about the country’s economy.

Both the polymers, as with every other chemical and polymer in China, face:

- China’s shift away from “growth for growth’s sake”. As it attempts to build a new economic growth model (we don’t know if this will work), lots of collateral damage should be expected, most notably at the moment in the real-estate market, which, as the ICIS data show, has been a major driver of China’s extraordinarily strong PE demand growth since the property bubble began to inflate in 2009. In August this year, house prices in nearly 70 Chinese cities declined, according to Reuters.

- In the short- to medium-term, China’s zero-COVID polices will add further downward momentum to the economy. China cannot afford to scrap the policies because of the limited effectiveness of its vaccines.

Another factor is rising chemicals self-sufficiency, the roots of which we can trace back to 2014 when the Chinese government decided to much more heavily in domestic capacity. When Beijing says it is going to do something, it usually does it.

As a reminder of an earlier post, the China Customs and ICIS production data show that HDPE demand is in line to fall by 4% this year. The China Customs January-July numbers suggest that HDPE net imports in 2022 will fall to 5.6m tonnes from 6.4m tonnes in 2021 AND 8.9M TONNES IN 2020!

LLDPE demand is this year on track to also fall by 4%. The January-July China Customs data suggest net imports at 4.7m tonnes versus 5.5m tonnes in 2021 and 6.6m tonnes in 2020.

The story of China’s low-density polyethylene (LDPE) market is more complicated. But, of course, as I shall describe now, its demand is also being affected by the new macroeconomic fundamentals.

Booming solar panels demand and ethylene vinyl acetate pricing

The chart below helps explain why we are heading for a third year in a row of contracting LDPE demand in China.

As you can see, the price premiums for the two Asian benchmark grades of EVA (ethylene vinyl acetate) over CFR (cost & freight) China LDPE started to take off from March 2020 onwards and have since remained at very elevated levels.

EVA and LDPE are made in plants that can swing between production of either polymer. Producers have swung to EVA because of the much stronger pricing that has translated into stronger margins relative to LDPE.

The main driver of these historically high premiums is booming demand for solar panels. EVA is used as encapsulants in manufacturing solar panels, with most of the world’s panels made in China.

I am afraid we are heading for the deepest economic downturn that most of us will have seen in our working lifetimes. Events comparable to today are those that led to the stagflation of the 1970s.

We need to add to the stagflation our extreme overreliance on China as an engine of economic growth as this engine splutters and potentially stalls. But while demand for chemicals in general is going to see deep contractions, any chemical or polymer connected with sustainability will do fine (more on this theme in a later post).

So, I wouldn’t be surprised if these record-high EVA price premiums continued, notwithstanding big increases in Chinese EVA capacity.

The effect of the high EVA premiums driving down global LDPE production was to make LDPE expensive relative to LLDPE, which competes in many of the same end-use markets. The cost LLDPE relative to LDPE has also been driven down by large LLDPE capacity additions.

Take a close look at the chart below, which shows CFR China LDPE price premiums over CFR China LLDPE C4 film grade. They have reached record highs since January 2019. But while premiums still remain elevated, they have fallen very sharply since October 2021 (bear with me – more on this decline in premiums later in the post).

So much for what is different about LDPE versus the other two grades of PE. Now, let’s focus on the similarities, starting with the chart below.

The annualised January-June data only indicated a 4% decline in full-year demand. What a difference a month has made. The January-July numbers point to an 8% fall in demand this year. This would be the worst annual fall in growth since 1990.

As usual, the above chart also includes two other scenarios for 2022 LDPE demand – a best-case outcome (Scenario 1) and a worst-case result (Scenario 3). Scenario 2, the 8% fall in demand, is what is suggested by the January-July data.

In January-July 2022 on a year-on-year basis, ICIS estimates that local LDPE production was down by 9%. This is despite recent falls in the EVA price premiums over LDPE and the LDPE price premiums over LLDPE. This year’s fall in LDPE production therefore seems to point to macroeconomic weakness.

Underlying how LDPE is also being affected by the broader economic context was the 10% year-on-year fall in net imports in January-July. The decline happened despite what the chart below tells us.

Despite the negative China LDPE demand growth that we saw in 2020 and 2021, local operating rates were healthy. But this year they look likely to fall off a cliff. Combine this with the fall in net imports – despite what could be record-low operating rates – and I rest my case!

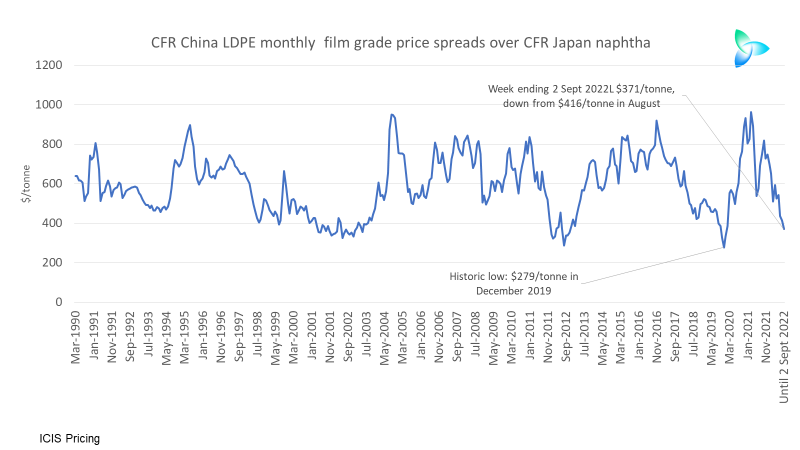

Here is more evidence for the prosecution. CFR China LDPE film grade spreads over CFR Japan naphtha costs have held up very well so far this year compared with the spreads for HDPE and LLDPE. But, as the chart below confirms, LDPE spreads have recently fallen very sharply. Spreads never lie. They remain one of the best measures of demand.

Now let us look at actual China LDPE and LLDPE prices. Both have recently seen sharp declines partly on the back of weaker naphtha costs (also included in this chart), but also because of the declining prospects for the Chinese economy. Note that naphtha is down on weaker oil prices, with oil prices driven lower by what is happening in the Chinese economy.

The fall in LDPE spreads over naphtha is the result of LDPE prices falling more rapidly than the declines in naphtha costs – evidence of a lack of producer power in price negotiations.

And finally, for the sake of completion, see the slide below.

I again provide you with three scenarios for this year’s net imports, with Scenario 2 based on the January-July data annualised (divide by seven and multiply by 12). Net imports at 2.7m tonnes in 2022 would compare with 2.9m tonnes in 2021 and 3.3m tonnes in 2020.

Don’t be misled by claims over an economic recovery

Some commentators still believe that China’s economy will bounce back by the end of this year. I cannot see this happening, and the prospects for 2023 are not looking good.

We are entering an entirely new era in general for the chemicals industry because of short, medium -and long-term events in China and elsewhere. Buckle up for a very difficult ride and get on with building new business models.