THE PHRASE “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

Asian Chemical Connections

The old China and HDPE, the new China and the future of demand

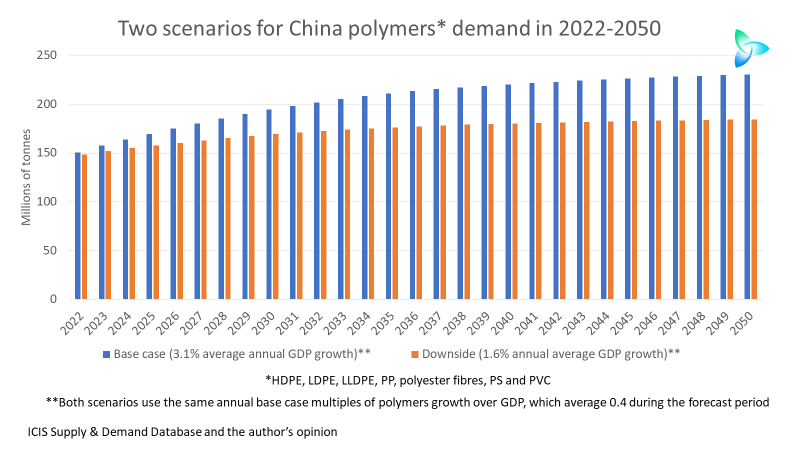

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.

Competing voices and the chemicals challenge of cutting carbon

We don’t have much time. We must act quickly to prevent potentially catastrophic social, political and economic damage from climate change.

India, climate change, demographics and polymers demand growth

Climate change and demographics are economic destiny – their effects cannot be avoided. But the petrochemicals industry has a huge role to play in shaping favourable outcomes

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

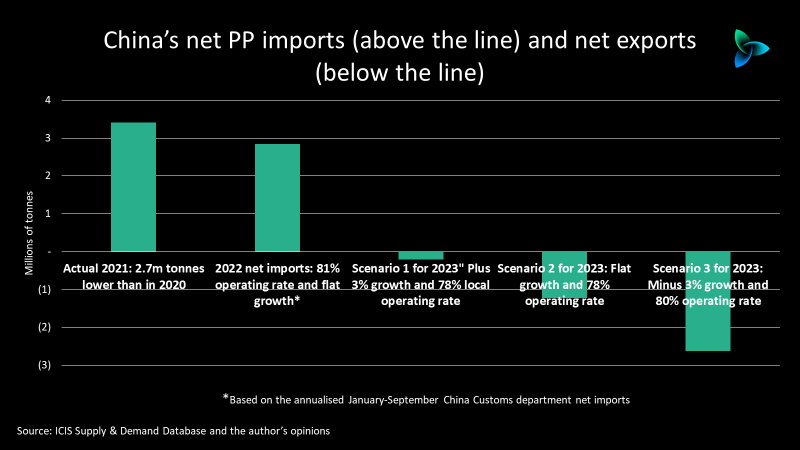

China PP demand and net import outlook for 2023

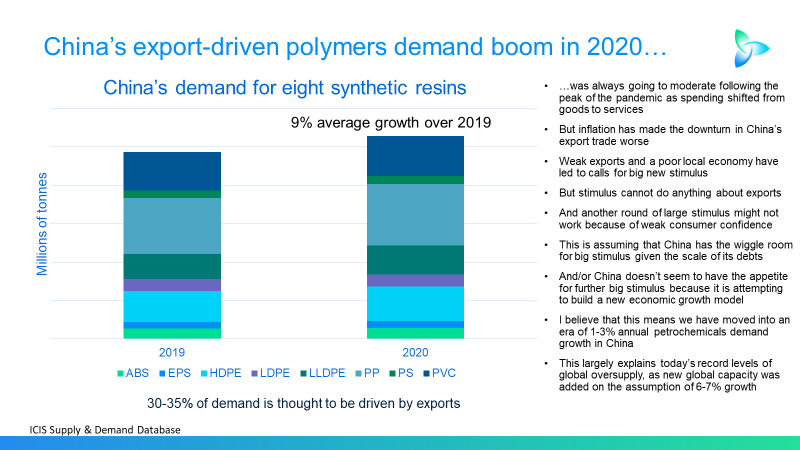

China[s PP demand growth in 2023 could be as low as minus 3% as it swings into a 2.6m tonnes net export position from this year’s likely net imports of around 3.4m tonnes.

China’s long-term GDP growth risks and polymers demand

Cumulative downside demand in the above chart would total 5bn – 91m tonnes lower than our base case.

China’s dominance of global polymer demand delivered huge global growth. But what now?

China accounted for 33% of global growth in the seven major synthetic resins between 1990 and 2001. But this jumped to 63% in 2002-2021. In distant second place during both these periods was the Asia and Pacific region at 15% and 17% respectively.

This is the first significant chemicals downcycle for many years

Every tonne of polymer you decide not to produce because there isn’t a viable market will save vital revenues – especially as feedstock costs will remain very volatile. Every tonne of polymer you do produce because the market works will earn you crucial money at a time of declining overall sales.

China’s styrene demand in 2022 could be negative for the first time since 1990

China’s net styrene imports in 2022 could also fall to just 290,000 tonnes from 1.5m tonnes in 2021 and 2.8m tonnes in 2020.