THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

Asian Chemical Connections

Global chemicals: What I believe our industry must do in response to a deep and complex crisis

I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

Europe’s gas crisis: the implications for global chemicals

GEOPOLITICS IS, I believe, just one aspect of a crisis facing the chemicals industry that is deeper and more complex than anything we have faced before.

Front mind right now in geopolitics is Ukraine-Russia and the gas-supply crisis facing Europe,

China zero-COVID: 2022 impact on local and global demand for nine major polymers

Instead of demand for the nine polymers growing by 7m tonnes in 2022 under our base cases, my downsides see consumption falling by 6m tonnes.

Ukraine: Oil prices, lost petrochemicals demand, changing trade flows and the impact of the four megatrends

By John Richardson IF WE ARE involved in a new protracted Cold War, this will change just about everything for the petrochemicals industry. Or, of course, we could go back to the Old Normal. Corporate planners must therefore press on with drawing up short, medium and long-term scenarios and then apply these scenarios to tactics […]

Risk of crude at $135/bbl may have increased on SWIFT sanctions decision

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson WHETHER OIL PRICES will rise to a high of $135/bbl – the worst-case warning highlighted in […]

Ukraine-Russia: Assessing petrochemical demand losses

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson NOW THAT an invasion has started, the critical issue for petrochemicals companies is whether they can […]

Petrochemicals transition to Net Zero to result in new margin and cost curve drivers

The petrochemicals or chemicals (depending what you prefer) transition to Net Zero is both connected and different from the energy transition for reasons I’ll detail in a series of blog posts, starting today with a few headline thoughts on how global margin and cost curve positions my change over the next few years – and […]

Carbon and plastic waste: sorting workable solutions from the confusion and complexity

By John Richardson THE GREAT NEWS, as I discussed last month, is that the more 100 countries, including the US, are thought to favour a treaty being proposed at the next UN Environment Assembly that would set targets for reducing plastic waste in the environment. A date in has now been set for the meeting […]

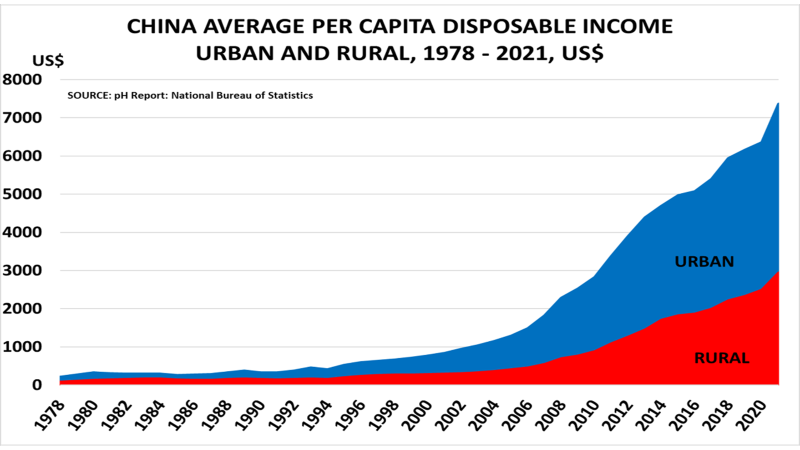

Calling all petchem C-suites: Key summary of China risks and opportunities

By John Richardson AS ALL THE CLAMOUR builds about inflation and rising energy costs – and absolutely, of course, these are major challenges which I shalll address in later posts – there’s a danger the petrochemicals industry will lose focus on charts such as the one above, courtesy of the pH Report. I am still […]