What would it take to return global operating rates to the very healthy 1992-2023 average of 88%? Global capacity would have to grow by an average of around 2m tonnes a year versus our base case of 6.2m tonnes a year.

Asian Chemical Connections

Alice in Wonderland, the Cheshire cat and the chemicals industry

Chemicals companies need to decide where they are heading now that the Supercycle is over

Petrochemicals after the Supercycle: Revised scenarios

LET ME AGAIN bang away on the same old drum which I’ve covered with a new skin: The above slide is an updated version of the slide I first published late last year. Note that there is a new scenario added to the original two, A Bi-polar World. Also note that I have this time included percentage weightings of my views on the likelihoods of the scenarios.

Chemicals, sustainability and the new industrial revolution

Blood bags, syringes, disposable hospital sheets, gowns and medicine packaging. Modern-day medicine, which has greatly extended the quantity and quality of our lives, would be impossible without the plastics industry.

Three scenarios for China’s PE demand in 2024-2030 and the effects on global operating rates

UNDER all the scenarios, growth set to decline to the low single digits from 10% in 1992-2023.

China PP price spreads over naphtha hit new low as the long-term shift in markets continues

China block copolymer and raffia-grade price spreads between 2022 and 26 January this year were 144% lower than their long-term average with injection grade spreads 145% lower.

Global ethylene capacity growth would need to be 90% lower than the ICIS base case for healthy 2024-2030 operating rates

The blue line in the above chart involves annual average capacity growing at just 800,000 tonnes/year in each of the years between 2024 and 2030. This is versus our base case assumption of 7m tonnes/year of capacity growth during each of the years.

The “National Champions” in the New Petrochemicals Landscape

SHORT-TERM tactics should involve maximising returns within regions along with a greater focus on exports anywhere in the world

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

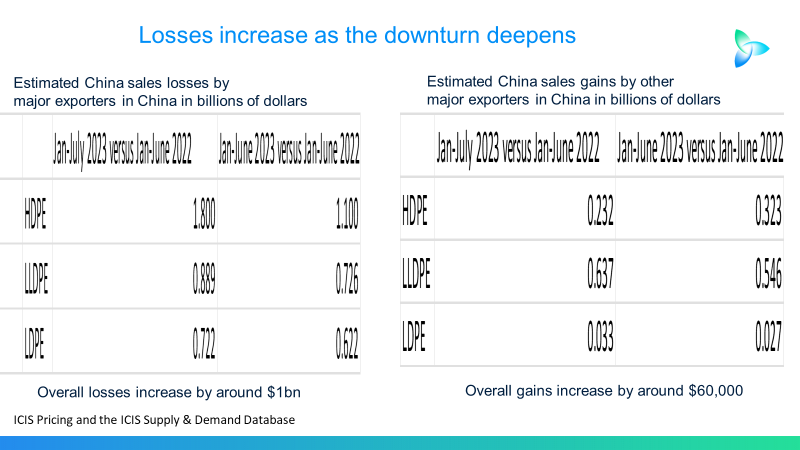

Major PE exporters to China see their sales fall by a further $1 billion

THE BIG PE exporters to China saw their sales to country decline by a further $1bn year-on-year in January-July 2023 versus January-June 2023.