NINE OUT OF CHINA’S top 10 high density polyethylene (HDPE) import partners saw their sales to China fall by an estimated total of $1.8bn in January-July 2023 versus the same period last year. Meanwhile, the remaining member of the top 10, the US, saw its sales increase by $233m.

Asian Chemical Connections

Global HDPE capacity may have to be 13m tonnes/year lower in 2024-2030 to return to healthy operating rates

Global HDPE capacity in 2024-2030 would need to be a total of 13m tonnes/year lower than our base case to return to the 2000-2019 operating rate of 88%.

Exporters of HDPE lose estimated $1.1bn of China sales in H1 2023

Total estimated losses by eight of the major HDPE exporting countries in sales to China was $1.1bn in H1 2023 versus H1 2022.

China, demographics, debt and polymers demand

China’s polymers consumption in 2022 107m tonnes from a population of 1.4bn. The developing world ex-China’s consumption was at 84m tonnes from a population of 5.3bn. And the developed world consumed 82m from 1.1bn people.

China’s long-term PP demand growth may turn negative, shifting the focus to value from volumes

STRONG upside PP demand growth scenarios for the rest of the world might still not enough to cancel out negative growth in China

Why China’s 1990-2022 PP consumption could have been 300m tonnes lower without the benefit of “one off” historical trends

IF China had been a typical developing economy, as the above chart illustrates, its cumulative 1990-2022 could have been 300m tonnes smaller. As history moves forward,this suggests that China’s long-term demand growth could turn negative

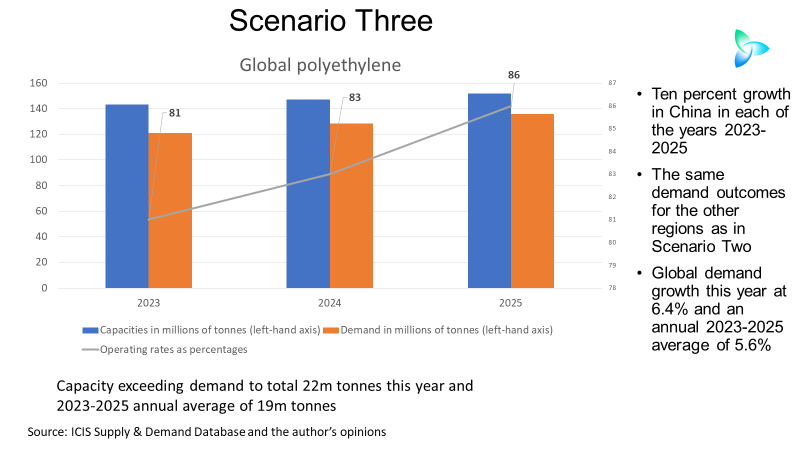

Collective wishful thinking could be behind the global polyethylene crisis

EVEN IF CHINA’S PE demand grows at 10% in 2023, with very strong growth in other regions, this year’s global capacity would still be 22m tonnes more than demand!

Interest rate “lag effect” and the risks for China’s ethylene glycols market

IT ALL CHAOS AND MUDDLE out there: China’s ethylene glycols demand could either grow by 10% in 2023 or contract by 5%.

A flood of PP no matter how what the 2023-2025 demand growth

EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

Your complete and updated outlook for global polyethylene in 2023

The strength of China’s post zero-COVID recovery in 2023 will be crucial, as will local operating rates as self-sufficiency further increases.

Another important factor: European gas supply next winter and the effect on local PE production.