Scenario 2, my preferred scenario, would see China 2023 PE demand at approximately 38.5m tonnes – an average of 2% higher across the three grades than in 2022.

Asian Chemical Connections

China HDPE 2023 demand and net import forecasts

Scenario 1 for next year assumes that China successfully transitions from its zero-COVID policies. Consumer confidence comes roaring back. Demand grows by 4% year-on-year to a market of 17.6m tonnes.

Scenario 2 assumes that high infection rates and lack of healthcare resources keep consumer confidence depressed but that the global economy recovers, supporting China’s exports. Growth is minus 2%, leaving demand at 6.6m tonnes.

The worst-case outcome is Scenario 3 where the impact of zero-COVID continues, and the global economy gets weaker. Consumption falls by 4% to 16.1m tonnes.

China economy, PP demand, may see no benefit from zero-COVID exit until 2024

A SELECTIVE READING of the news is giving polyolefins market participants confidence. They see the relaxation of zero-COVID restrictions in some Chinese cities as a sign that the worst is over. But a recovery in PP and PE demand seems unlikely until 2024.

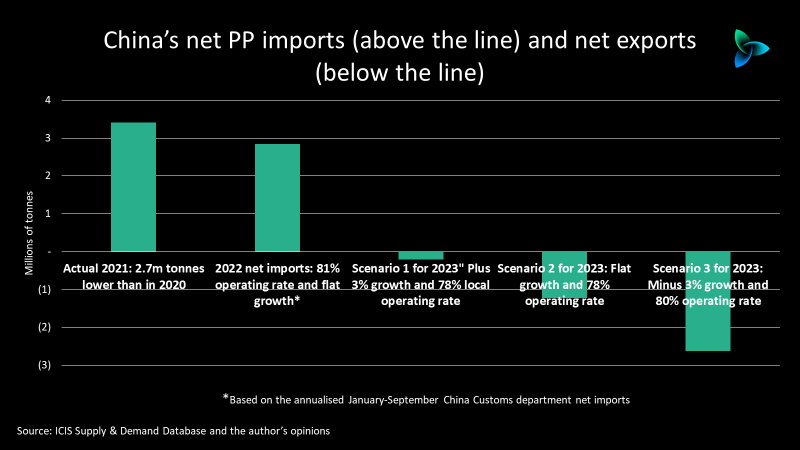

China PP demand and net import outlook for 2023

China[s PP demand growth in 2023 could be as low as minus 3% as it swings into a 2.6m tonnes net export position from this year’s likely net imports of around 3.4m tonnes.

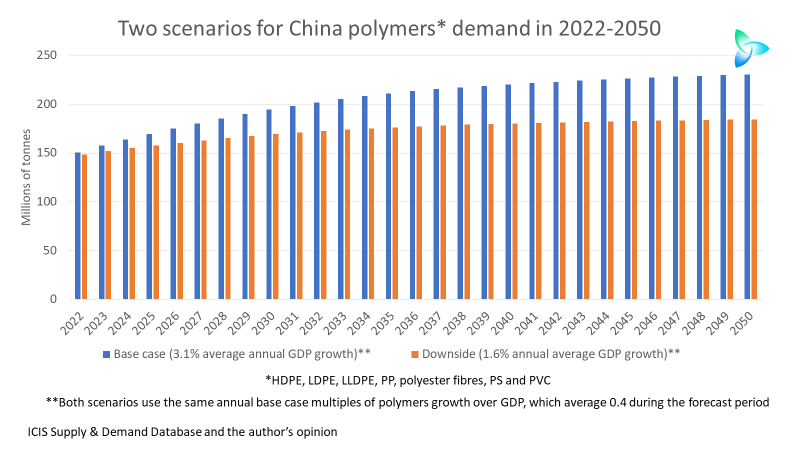

China’s long-term GDP growth risks and polymers demand

Cumulative downside demand in the above chart would total 5bn – 91m tonnes lower than our base case.

China chemicals growth and the 20th Communist Party Congress

China’s share of global demand growth in the seven big resins jumped to an astonishing 67% in 2002-2021. Northeast Asia ex-China’s share of demand fell to minus 1% with Europe and North America worth just 4% and 2% of growth respectively. The chemicals world had become dangerously lopsided.

Naphtha markets underline why “Micawberism” is not the answer

The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

China’s dominance of global polymer demand delivered huge global growth. But what now?

China accounted for 33% of global growth in the seven major synthetic resins between 1990 and 2001. But this jumped to 63% in 2002-2021. In distant second place during both these periods was the Asia and Pacific region at 15% and 17% respectively.

China could become the world’s third-biggest PP net exporter in 2022-2040

China’s cumulative net imports of polypropylene (PP) might be as big as 91m tonnes in 2022-2040 – the ICIS base case. Or China’s total net exports during the same period may reach 90m tonnes.

Success in the new HDPE world: Tactics must be accompanied by a whole new strategy

By John Richardson TACTICALLY, as the first chart below tells us, using just high-density polyethylene (HDPE) as an example (the same applies to other grades of PE and polypropylene), it is obvious what the major exporters in the Middle East and elsewhere must do as China’s self-sufficiency increases. The exporters need to focus on import […]