I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

Asian Chemical Connections

China goes global in PP perhaps quicker than had been expected, badly disrupting the global industry

CHINA’S polypropylene (PP) industry is in the short- to medium- term is being pushed into going global perhaps quicker than it had intended. This is because of the collapse of local demand and the resulting all-time weak netbacks in China versus most of the other regions.

European polyolefins could be dragged down by China

Will China, the world’s most important HDPE demand centre, and an increasingly important supply centre, drag Europe down to its levels? Or will the China market increase closer to today’s levels in Europe?

China’s PP demand growth: A bubble that may have burst beyond repair

WAS IT JUST an almightily big bubble that cannot now be re-inflated, even if Beijing follows through on its plans to inject $148bn in loans into the country’s troubled real -estate sector? Once confidence has gone, such an intangible thing, there is a risk it cannot be restored.

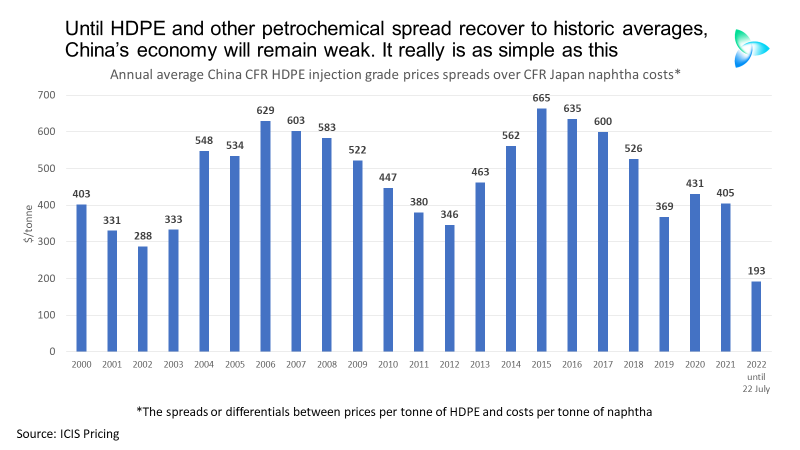

China petrochemicals spreads data: until or unless it recovers, growth will remain weak

IF THERE IS no return to the historic patterns of spreads between China’s petrochemicals prices and feedstock costs, there will be no economic recovery.

Europe’s gas crisis: the implications for global chemicals

GEOPOLITICS IS, I believe, just one aspect of a crisis facing the chemicals industry that is deeper and more complex than anything we have faced before.

Front mind right now in geopolitics is Ukraine-Russia and the gas-supply crisis facing Europe,

Chemicals companies face an unprecedented demand and supply crisis

THE GLOBAL CHEMICALS industry is, I believe, facing a demand and supply crisis on a scale and on a level of complexity that nobody has experienced before. This is a huge subjects requiring a series of posts. Let me start by looking at China’s role in this crisis. In later posts.

China’s latest LLDPE spread and demand data offer worrying clarity about the broader economy

THE LATEST DATA on linear low-density polyethylene (LLDPE) China CFR (cost & freight) pricing spreads over CFR Japan naphtha costs underlines the evidence from the other grades of polyolefins, that China is a long way from a full economic recovery.

China LDPE demand could fall by as much as 8% this year with net imports 500,000 tonnes lower

CHIINA’S LDPE spreads over naphtha feedstock costs have held up very well this. But this doesn’t mean to say that demand is good. Chinese demand could fall by as much as 8% in 2022.

China’s options for economic revival in 2022 narrow as HDPE demand outlook worsens

My previous best-case outcome for China’s HDPE demand growth in 2022 was 6%. My worst-case scenario was a 3% decline. Now, though, I worry that the best-case outcome for 2022 HDPE demand could be flat or zero growth. My worst-case outcome is a 4% decline.