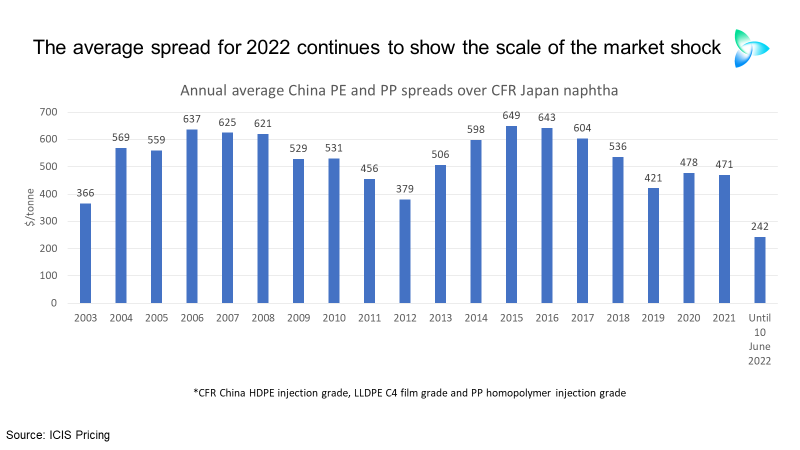

Comparative PE and PP pricing data between Vietnam and southeast asia – and the “spreads” numbers between China PE and PP prices and naphtha costs – suggest the China economy has yet to recover.

Asian Chemical Connections

China naphtha-to-polyolefins spreads data still show recovery yet to happen

RECOVERY? WHAT RECOVERY? Some market players are talking about a rebound in the Chinese economy, and, therefore, polyolefins demand, but the critically important spreads data continue to tell a different story. Nothing has changed from last week.

China 2022 PE demand: latest data point towards a 2% contraction as confusion over outlook builds

January-April 2022 data point towards China’s polyethylene demand for the full year declining by 2% over 2021.

China PP demand in 2022: Latest data suggest flat growth, down from 4%

In January-March 2022, the ICIS China production estimates plus the net import data from the China Customs department suggested that China’s full-year polypropylene (PP) demand growth would have been be 4%. But the January-April data for this year suggest almost zero growth over last year.

China’s ethylene equivalent demand growth in 2022 could be as high as plus 9% or as low as minus 3%

Scenario 1, the ICIS Base Case, for China’s ethylene equivalent demand, sees growth at 9% in 2022 over last year. Scenario 2 involves 4.5% and Scenario 3, minus 3%.

China zero-COVID: 2022 impact on local and global demand for nine major polymers

Instead of demand for the nine polymers growing by 7m tonnes in 2022 under our base cases, my downsides see consumption falling by 6m tonnes.

New scenarios for 2022 Eurozone and UK PE growth as inflation and debt pressures build

The ICIS Supply & Demand Base Case growth for Eurozone and UK PE demand in 2022 over last year is 1%. Downside 1 assumes consumption will contract by 4% and Downside 2 by 7%.

Global chemicals face negative growth on inflation, more logistics problems and a deep China downturn

SUPPLY-CHAIN problems continue to disrupt the global chemicals and polymer industries more than two years since the pandemic began.

Right now, the centre of attention of supply-chain anxiety is China.

China polyethylene: latest scenarios for 2022 demand and net imports

China’s polyethylene (PE) demand in 2022 could fall by 3% over last year. Net imports may be as much as 3.9m tonnes lower

US domestic PE logistics challenges may create bigger opportunity for other producers in Europe

US PE exports could be restricted in 2022 by local logistics challenges as China’s imports decline as its economy suffers a recession. The centre of attention for Asian and Middle exporters may therefore be Europe.