IF THE REPORTED new problems at Yantian container port –- the third largest in the world –- had happened before 24 February, the only concern would have been further disruptions to the global container business.

Back then, I would have only worried this would have caused yet another delay to in the fall in of east-west freight rates to much more manageable levels.

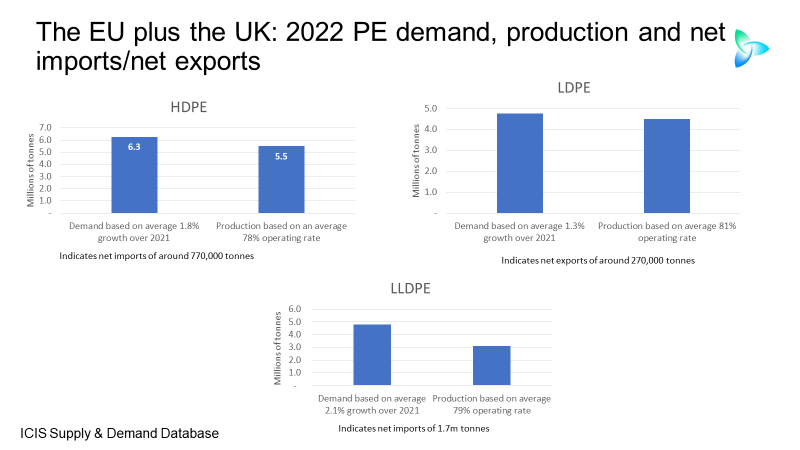

Under the Old Normal, high freight rates had created a divided polyolefins world – very strong pricing and margins in Europe and the US versus comparatively very weak pricing and margins in Asia.

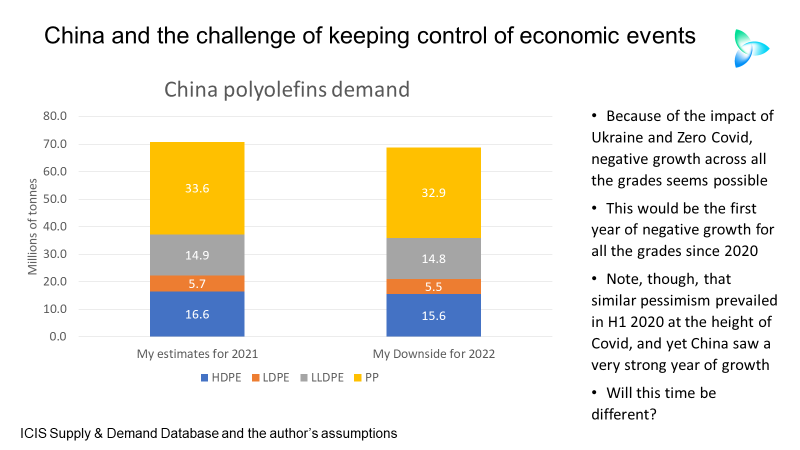

High container freight rates had limited the ability of Middle East and Asian producers to relieve oversupply in the dominant China market through exporting to the West. The oversupply was the result of a China demand slowdown caused by Common Prosperity and big capacity increases in China and South Korea.

But does it now even matter that much that Yantian is said by CNBC to be effectively shut down because of the coronavirus-related lockdown affecting Shenzhen –- the city of 17m people where the port is located?

Not if we are already amid a collapse in demand for Chinese exports more significant than any reductions in container-freight shipments, the result of high inflation.

Or maybe China will, as it has done in the past, subsidise its exporters to keep the China price cheap enough to sustain its export trade. There are reports of this already happening.