A petrochemicals world dominated by Supermajors, especially those running COTC plants, or one where greater regional cooperation (more on this in later posts) and increased protectionism allow older, smaller and less carbon efficient plants to survive.

Asian Chemical Connections

The “National Champions” in the New Petrochemicals Landscape

SHORT-TERM tactics should involve maximising returns within regions along with a greater focus on exports anywhere in the world

Why the rest of the developing world cannot follow in China’s growth footsteps

The developing world outside China cannot repeat China’s economic growth model because of climate change, ageing populations in the West and sustainability

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

Details of how Saudi Aramco COTC and other advantaged feedstock projects could redraw the petrochemicals map

There is a big new wave of lower-carbon and very advantaged cracker projects on the way, including Saudi Aramco’s crude-oil-to-chemicals investments.

Winners and losers as demographics, debt, sustainability, geopolitics and crude-to-chemicals rewrite the rules of success

I BELIEVE WE are heading for the biggest period of change in the global petrochemicals industry since the 1990s.

This was when globalisation took off with the formation of the World Trade Organisation (WTO), when China’s economic boom began, when the global population was more youthful and before climate change became a major threat to growth.

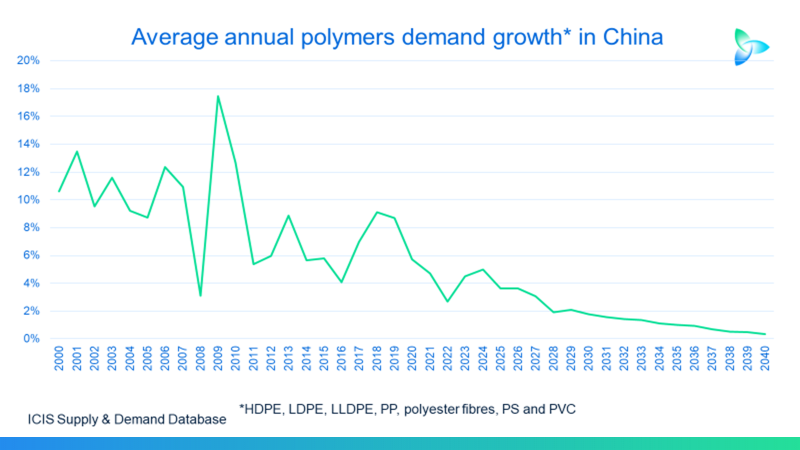

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

The old China and HDPE, the new China and the future of demand

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

China PP demand could grow by 3% in 2023, down from the 2000-2020 average of 10%

THE EARLY DATA suggest that China’s polypropylene (PP) demand could grow by 3% in 2023. This would be in line with the base case forecast I provided in February.