THE TRADE WAR is just the latest of non-plant specific and broader factors that drive the petrochemicals industry

Asian Chemical Connections

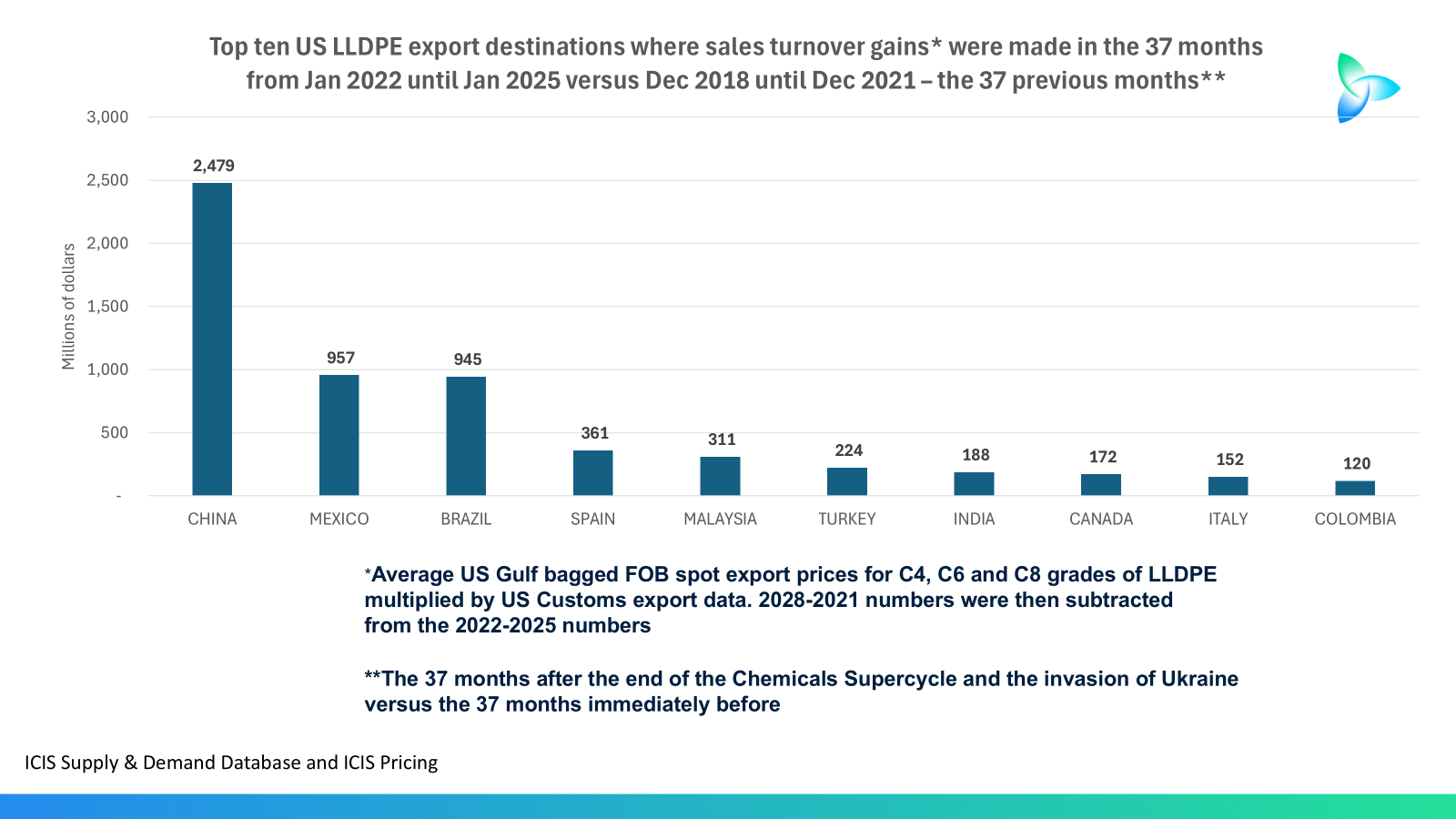

US LLDPE exports, trade tensions and the $6.8bn dollar question

US LLDPE exporters made big gains in January 2022 until January 2025 thanks to their cost advantages and China’s lower import tariffs.

Why Artificial Intelligence Is Not a Dot-Com Bubble Mark II

IF WE END UP in recession we need to spend more and not less on artificial intelligence

Beyond the China growth miracle: The three things you should do in 2025

IN ALL THE MUDDLE about demand, there are three actions you can take today to give clarity to your business plans

AI’s Evolution: Not Inevitable, But Shaped by Critical Decisions

In the first of a new series of blog post, Adventures of AI, I look at why artificial intelligence is truly revolutionary

Two connected words of the year for 2025: “Protectionism” and “China”

LOTS OF FOCUS has been on the Trump effect on the US trading relationship with China. But we need to think more broadly than this. I see a significant risk that next year we will see trade tensions increasing between other countries and China for the reasons described in today’s post

Alice in Wonderland, the Cheshire cat and the chemicals industry

Chemicals companies need to decide where they are heading now that the Supercycle is over

Stop wasting time waiting for the end of the downcycle

THE TEN REASONS why this isn’t a standard chemical industry downcycle

Petrochemicals three years from now: A shrinking global market?

MORE THAN 70% of global polyethylene demand is at risk from ageing populations, climate change and geopolitics.

China events suggest no global petchems recovery until 2026

Capacity growth of just 1.6m tonnes a year versus our base case of 5m tonnes a year would require substantial capacity closures in some regions. Closures are never easy and so take considerable time because of links with upstream refineries, environmental clean-up and redundancy costs – and the reluctance to be the “first plant out” in case markets suddenly recover.