If population and incomes drove growth, global PE demand could have been just 52m tonne in 2024 versus the ICIS forecast of 126m tonnes. The China market could have been just 10m tonnes versus 43m tonnes; the Developing World ex-China 13m tonnes versus 44m tonnes and the Developed World 29m tonnes versus 38m tonnes.

Asian Chemical Connections

How Europe can avoid “sleepwalking” towards offshoring of petrochemicals

Neither Supermajors nor Deglobalisation are inevitable. Outcomes will instead be set by many individual choices that are coordinated in the rights ways. In other words, it is within the gift of Europe to wake up from Jim Ratcliffe’s “sleepwalk”.

Global demographics shape polyethylene demand yesterday, today and tomorrow

DEMOGRAPHICS SHAPE petrochemicals demand. As we consider the future, evaluate the different challenges of the G20’s Rich but Old, Poor & Old and Poor & Young G2O groups of countries.

China’s demographic crisis and the impact on global PP

If we are to see a repeat of 87% in 2024-2030 (the green line in the chart) and assuming my forecast of 2% demand growth is correct, the increase in global capacity would need to average just 154,000 tonnes/year during each year between 2024 and 2030. This is versus our base case of 4.5m tonnes/year of annual increases.

Global HDPE capacity may have to be 13m tonnes/year lower in 2024-2030 to return to healthy operating rates

Global HDPE capacity in 2024-2030 would need to be a total of 13m tonnes/year lower than our base case to return to the 2000-2019 operating rate of 88%.

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

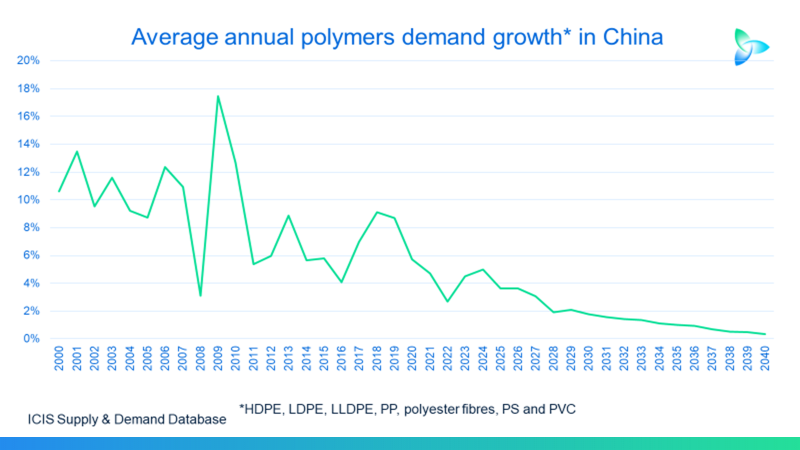

China, demographics, debt and polymers demand

China’s polymers consumption in 2022 107m tonnes from a population of 1.4bn. The developing world ex-China’s consumption was at 84m tonnes from a population of 5.3bn. And the developed world consumed 82m from 1.1bn people.

The old China and HDPE, the new China and the future of demand

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

China PP demand could grow by 3% in 2023, down from the 2000-2020 average of 10%

THE EARLY DATA suggest that China’s polypropylene (PP) demand could grow by 3% in 2023. This would be in line with the base case forecast I provided in February.