A SCENARIO-BASED approach is essential to understand US PE exports in 2023, based on non-plant economic factors

Asian Chemical Connections

Why China’s HDPE demand could decline in 2023-2040

China’s cumulative HDPE demand under the downside scenario would be 97m tonnes lower than our base case. in the above chart

Global oversupply of petrochemicals to hit 218m tonnes in 2023 – the highest in any other year since 1990

Capacity exceeding demand is forecast to reach 218m tonnes this year from a 1990-2022 annual average of 76m tonnes.

Collective wishful thinking could be behind the global polyethylene crisis

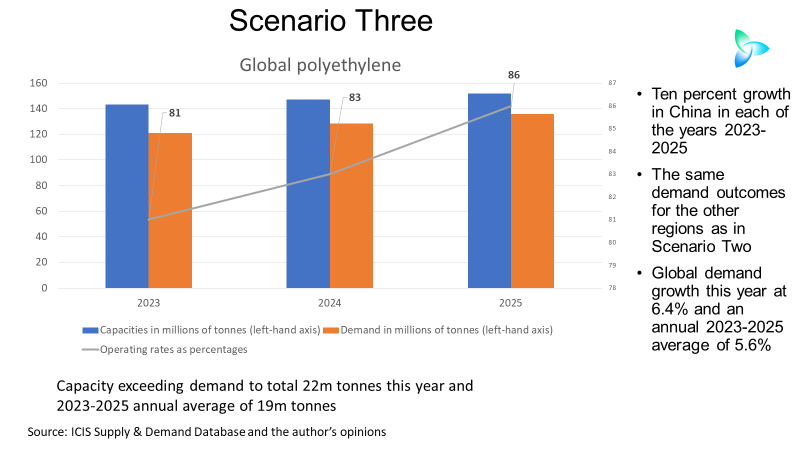

EVEN IF CHINA’S PE demand grows at 10% in 2023, with very strong growth in other regions, this year’s global capacity would still be 22m tonnes more than demand!

Interest rate “lag effect” and the risks for China’s ethylene glycols market

IT ALL CHAOS AND MUDDLE out there: China’s ethylene glycols demand could either grow by 10% in 2023 or contract by 5%.

A flood of PP no matter how what the 2023-2025 demand growth

EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

Global PE new supply and China spreads tell the real story

Global PE capacity in excess of demand is forecast to average 24m tonnes/year in 2022-2025, and to reach 26m tonnes this year

Operating rates are expected to average 81% in 2022-2025. This would compare with a 10m tonnes annual average capacityexceeding demand in 2000-2021 and an operating rate of 85%.

Your complete and updated outlook for global polyethylene in 2023

The strength of China’s post zero-COVID recovery in 2023 will be crucial, as will local operating rates as self-sufficiency further increases.

Another important factor: European gas supply next winter and the effect on local PE production.

Assessing confidence and the China PE demand recovery: More scenarios are needed

Scenario 2, my preferred scenario, would see China 2023 PE demand at approximately 38.5m tonnes – an average of 2% higher across the three grades than in 2022.

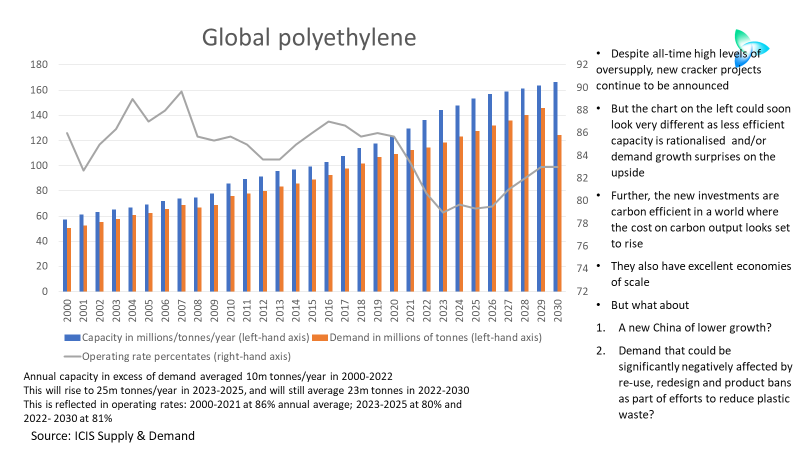

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale