The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

Asian Chemical Connections

China’s dominance of global polymer demand delivered huge global growth. But what now?

China accounted for 33% of global growth in the seven major synthetic resins between 1990 and 2001. But this jumped to 63% in 2002-2021. In distant second place during both these periods was the Asia and Pacific region at 15% and 17% respectively.

If you think this is a typical chemicals downcycle, think again

THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

The rules of the chemicals game are changing as companies pay the penalty for “growth for growth’s sake”

Because companies in all manufacturing and service sectors haven’t been adequately charged for the natural resources they use, and the damage they cause to the environment, we face the risks of catastrophic climate change and more plastic in the oceans than fish.

Global chemicals: What I believe our industry must do in response to a deep and complex crisis

I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

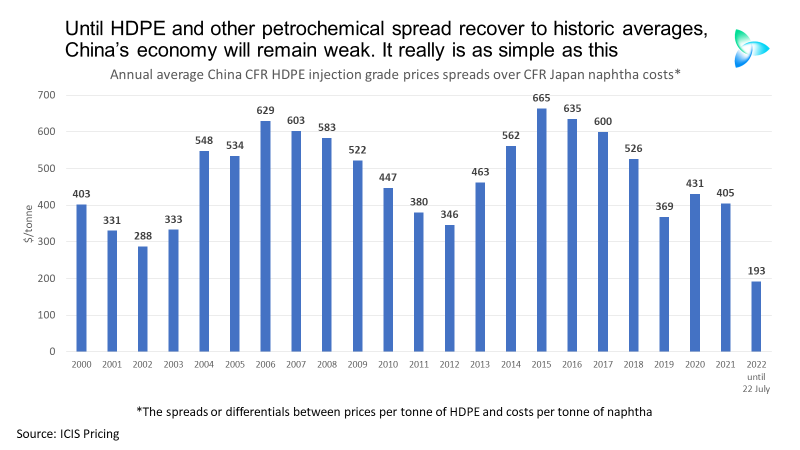

China petrochemicals spreads data: until or unless it recovers, growth will remain weak

IF THERE IS no return to the historic patterns of spreads between China’s petrochemicals prices and feedstock costs, there will be no economic recovery.

Chemicals companies face an unprecedented demand and supply crisis

THE GLOBAL CHEMICALS industry is, I believe, facing a demand and supply crisis on a scale and on a level of complexity that nobody has experienced before. This is a huge subjects requiring a series of posts. Let me start by looking at China’s role in this crisis. In later posts.

China zero-COVID: 2022 impact on local and global demand for nine major polymers

Instead of demand for the nine polymers growing by 7m tonnes in 2022 under our base cases, my downsides see consumption falling by 6m tonnes.

The EU in 2030: How Ukraine-Russia could reshape its chemicals industry and economy

”. Manufacturing cost pressures and the climate change and plastic -waste clean-up imperatives have created a new chemicals business model. No longer is financial success driven by sales-volume growth in chemicals.

Ukraine-Russia: how the crisis could reshape petrochemicals demand

I hope what follows helps as a first pass at describing the new environment in which our industry is operating as a result of the Ukraine-Russia conflict.