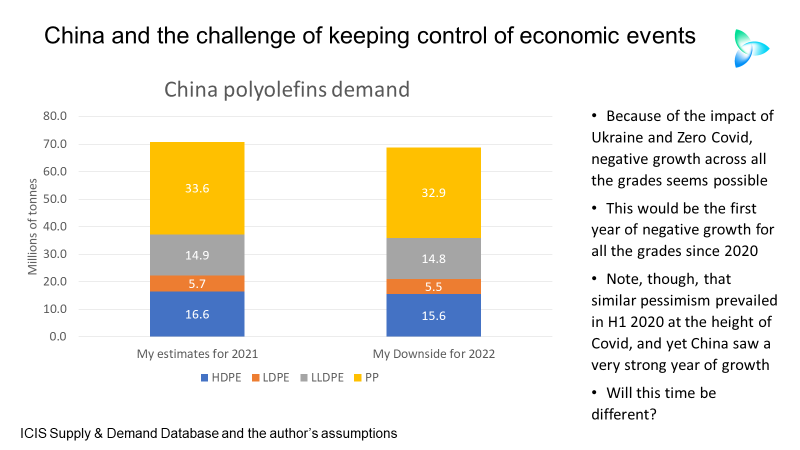

LAST WEEK I challenged whether the longstanding “put option” for petrochemicals companies and investors would still apply to China 2022.

The put option rests on the well-proven notion that the worst things get in the short term, the better the immediate outlook because Beijing always rides to the rescue with big economic stimulus.

The challenge I posed to the put option was that China might only tinker around the edges of its Common Prosperity economic reforms.