EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

Asian Chemical Connections

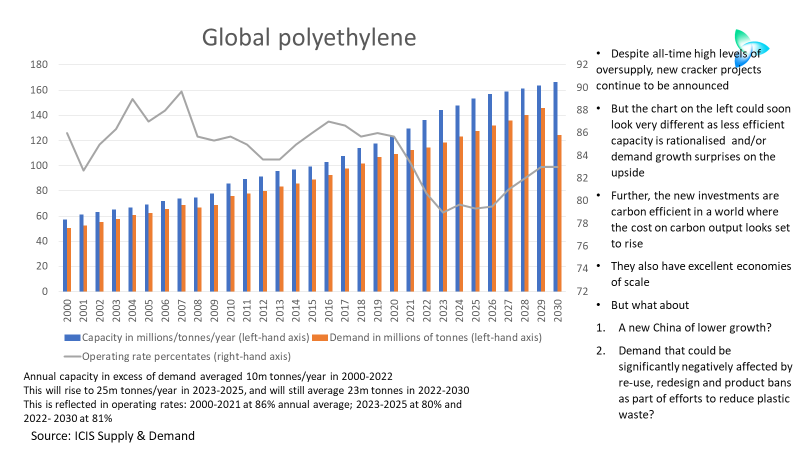

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

China LLDPE: New demand and net import outlook for 2023

China’s LLDPE demand in 2023 could either grow by 3% or contract by as much as 6%, depending on whether or not China successfully exits zero-COVID

China PP exports decline but the reason is hardly cause for cheer

In November 2021, the premium for overseas PP injection grade prices over prices in China reached a historic peak of $408/tonne. But in 1-18 November 2022, the premium was $113/tonne. Premiums have fallen in every month since April this year, resulting in a decline in China exports.

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

China’s PP exports decline, but this is only a temporary reprieve for the other exporters

The January-September data suggested full-year China PP exports to these top ten destinations 75,543 tonnes fewer than the January-August numbers. And the January-September numbers implied total 2021 China exports to all destinations of 1.47m tonnes compared with January-August that indicated 1.58m tonnes.

Overseas HDPE price premiums over China remain at historic highs, but maybe for not much longer

HDPE film grade price premiums for selected countries and regions over China recovered in September and October of this year. In 2020, premiums averaged just $36/tonne compared with $248/tonne in January 2021-October 2022.

China chemicals growth and the 20th Communist Party Congress

China’s share of global demand growth in the seven big resins jumped to an astonishing 67% in 2002-2021. Northeast Asia ex-China’s share of demand fell to minus 1% with Europe and North America worth just 4% and 2% of growth respectively. The chemicals world had become dangerously lopsided.

Naphtha markets underline why “Micawberism” is not the answer

The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

China’s dominance of global polymer demand delivered huge global growth. But what now?

China accounted for 33% of global growth in the seven major synthetic resins between 1990 and 2001. But this jumped to 63% in 2002-2021. In distant second place during both these periods was the Asia and Pacific region at 15% and 17% respectively.