THE GLOBAL CHEMICALS industry is, I believe, facing a demand and supply crisis on a scale and on a level of complexity that nobody has experienced before. This is a huge subjects requiring a series of posts. Let me start by looking at China’s role in this crisis. In later posts.

Asian Chemical Connections

China may this year become the Asia and Middle East third-biggest PP exporter, replacing Singapore. In 2020, China was nowhere in sight

AS RECENTLY AS 2020, China’s polypropylene (PP) exports totalled just 424,746 tonnes, causing what must have been barely a ripple of anxiety among the major Asian and Middle East exporters. But as the slide below shows, in 2021, China moved into the group of top exporters as its exports surged to 1.4m tonnes. This year, exports could be 1.7m tonnes or higher.

Food crisis in 2023 may represent major threat to developing-world polymers demand

High-density polyethylene (HDPE) demand in the developing world in 2023 could contract by 300,000 tonnes, rather than, as in our base case, grow by 800,000 tonnes because of the food crisis.

Assuming all the other regions grew as under our base case, global growth would be 2% in 2023 rather than our base case of 4%.

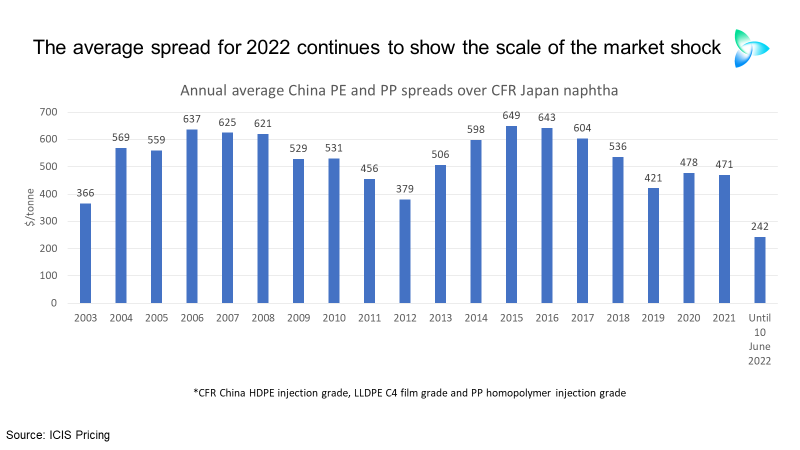

China naphtha-to-polyolefins spreads data still show recovery yet to happen

RECOVERY? WHAT RECOVERY? Some market players are talking about a rebound in the Chinese economy, and, therefore, polyolefins demand, but the critically important spreads data continue to tell a different story. Nothing has changed from last week.

China’s post-lockdown economic rebound has yet to happen, according to the ICIS spreads data

At some point, polyolefins exporters to China and the local producers will regain pricing power. This will become apparent from a widening of spreads as economic activity returns to normal. It really is as simple as this. So, you need our data and analysis.

European polypropylene: Supply chain demand destruction and the need for a new business model

EFFICIENT SUPPLY CHAINS were something that we used to take for granted. They hummed away in the background, making petrochemicals just one of many globalised industries where products and services flowed almost seamlessly across borders. We didn’t have to think about supply chains because they worked so well.

PE and PP production decisions become super-critical amid Ukraine-Russia, zero-COVID complications

Every tonne you don’t produce, when you correctly assess that the demand isn’t there in a particular market, will be important in preserving cashflow. Cashflow could once again be king, as it was just during the 2008-2009 Global Financial Crisis; and every tonne that you do produce, when you accurately assess that demand is there will, of course, support your revenues.

Major China PE and PP rate cuts fail to halt slide in spreads to historic lows

Reductions in production seem to have been forced by the logistics and demand challenges caused by Zero-COVID.

New global LLDPE demand scenarios in the context of Ukraine-Russia

How on earth does one respond to the daily news flow? The answer must be headline scenarios – best, – medium and worst-case scenarios

Ukraine, the global food crisis and implications for polyethylene

THE GLOBAL FOOD crisis is first and foremost a potential humanitarian disaster that must be avoided. But “must” doesn’t mean “will”, of course. Nobody should underestimate the scale of the challenges in front of us.