THE HEADLINE IN the above slide has always been the case. But why it was forgotten could be because many of us spent most, if not all, of our professional careers in the benign period between the end of the Cold War in 1991 and the pivot in the US approach to China, which happened some four years ago.

Asian Chemical Connections

Global inflation may matter more than China’s latest supply chain disruptions

IF THE REPORTED new problems at Yantian container port –- the third largest in the world –- had happened before 24 February, the only concern would have been further disruptions to the global container business.

Back then, I would have only worried this would have caused yet another delay to in the fall in of east-west freight rates to much more manageable levels.

Under the Old Normal, high freight rates had created a divided polyolefins world – very strong pricing and margins in Europe and the US versus comparatively very weak pricing and margins in Asia.

High container freight rates had limited the ability of Middle East and Asian producers to relieve oversupply in the dominant China market through exporting to the West. The oversupply was the result of a China demand slowdown caused by Common Prosperity and big capacity increases in China and South Korea.

But does it now even matter that much that Yantian is said by CNBC to be effectively shut down because of the coronavirus-related lockdown affecting Shenzhen –- the city of 17m people where the port is located?

Not if we are already amid a collapse in demand for Chinese exports more significant than any reductions in container-freight shipments, the result of high inflation.

Or maybe China will, as it has done in the past, subsidise its exporters to keep the China price cheap enough to sustain its export trade. There are reports of this already happening.

China polyolefins: several years of history pass in just one week

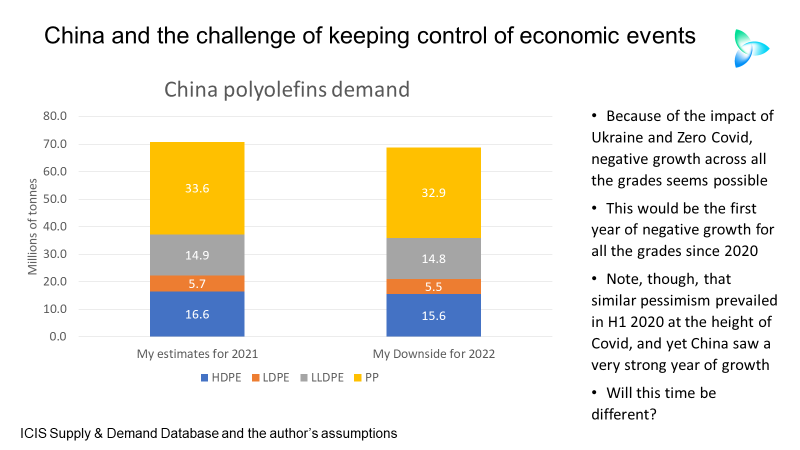

LAST WEEK I challenged whether the longstanding “put option” for petrochemicals companies and investors would still apply to China 2022.

The put option rests on the well-proven notion that the worst things get in the short term, the better the immediate outlook because Beijing always rides to the rescue with big economic stimulus.

The challenge I posed to the put option was that China might only tinker around the edges of its Common Prosperity economic reforms.

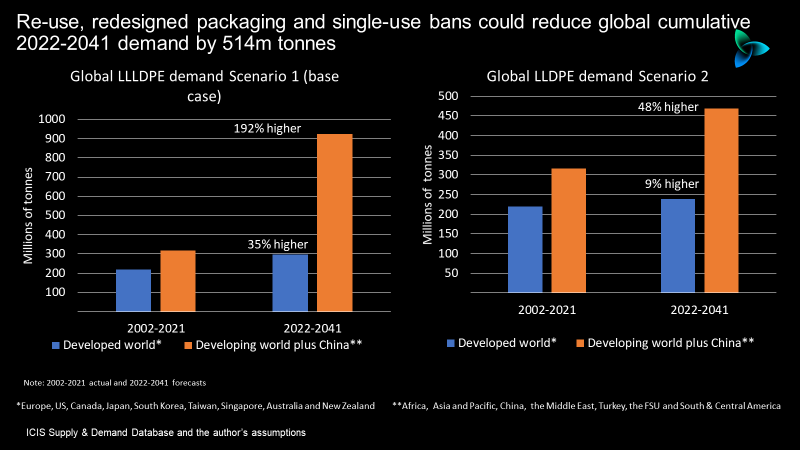

Tackling the plastic waste crisis must remain a priority because of growing legislative pressure

By John Richardson WE NOW HAVE an agreement amongst 175 countries, reached in Nairobi in Kenya last week, to develop a legally binding treaty to deal with plastic waste. This was something I called for last year. At the time I said we needed global limits on plastic waste that would be as important for […]

Ukraine: Oil prices, lost petrochemicals demand, changing trade flows and the impact of the four megatrends

By John Richardson IF WE ARE involved in a new protracted Cold War, this will change just about everything for the petrochemicals industry. Or, of course, we could go back to the Old Normal. Corporate planners must therefore press on with drawing up short, medium and long-term scenarios and then apply these scenarios to tactics […]

Risk of crude at $135/bbl may have increased on SWIFT sanctions decision

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson WHETHER OIL PRICES will rise to a high of $135/bbl – the worst-case warning highlighted in […]

Ukraine-Russia: Assessing petrochemical demand losses

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson NOW THAT an invasion has started, the critical issue for petrochemicals companies is whether they can […]

Ukraine-Russia, polyethylene and no end to history

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson FRANCIS FUKAYAMA famously wrote about the “end of history” after the Berlin Wall came […]

Petrochemicals transition to Net Zero to result in new margin and cost curve drivers

The petrochemicals or chemicals (depending what you prefer) transition to Net Zero is both connected and different from the energy transition for reasons I’ll detail in a series of blog posts, starting today with a few headline thoughts on how global margin and cost curve positions my change over the next few years – and […]

New scenarios for 2022 US PE exports as volatility and uncertainty increase even further

By John Richardson CONFUSED? If so, you are fully across what’s happening in the global polyethylene (PE) market. Anyone who isn’t confused is likely taking a vacation on Mars with no means of communicating with Planet Earth. The chart below is a case in point. What you can see from the data are actual US […]