AN AGEING GLOBAL population doesn’t necessarily mean lower chemicals demand growth

Asian Chemical Connections

Ageing populations, chemicals demand and the broader picture

We need new models for forecasting chemicals demand growth

Trade war or no trade war, these are the market fundamentals that won’t change

THE TRADE WAR, whether it continues or goes away, won’t change the market fundamentals

Why This Year’s NPC Meeting Seems Unlikely to Rescue Chemicals Spreads and Margins

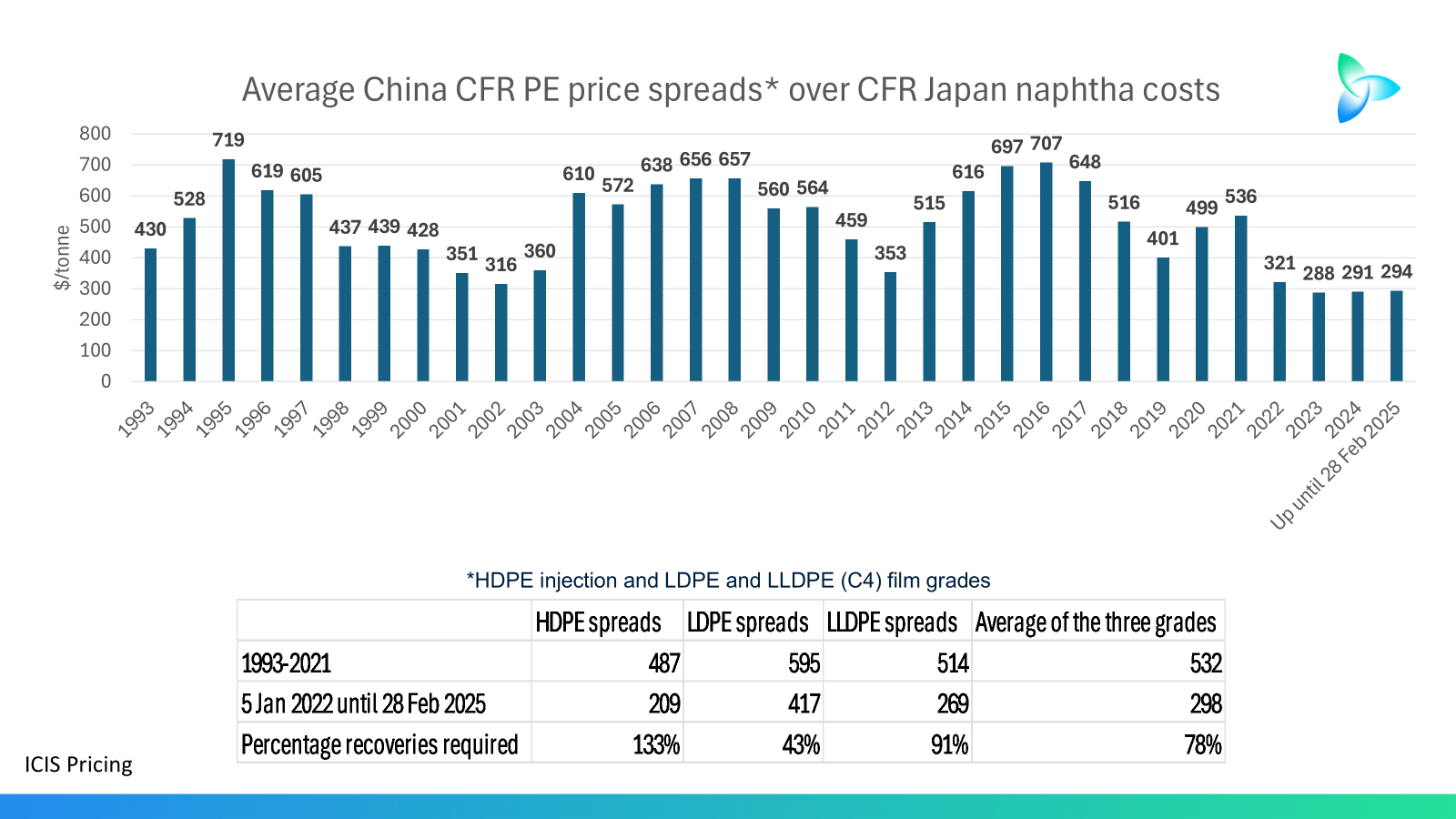

HDPE injection grade spreads would need to rise by 133% from their 2022-2025 level to return to the spreads enjoyed during the Chemicals Supercycle.

LDPE spreads would have to rise by 43%.

LLDPE spreads would need to increase by 91%.

Beyond the China growth miracle: The three things you should do in 2025

IN ALL THE MUDDLE about demand, there are three actions you can take today to give clarity to your business plans

The developing world outside China to the rescue, but not for a long time

A full recovery next year? If you think this is likely, then think again

China versus the rest of the developing world: The great reordering of polymers demand

IN THE FIRST OF a special series of blog posts, I am going to examine Turkey’s chemicals and polymers demand growth prospects. This will be followed by posts on Vietnam, Mexico, India, Brazil and Indonesia.

These will be amongst the countries in the Developing World ex-China region that will eventually replace China as the main drivers of global chemicals demand.

China’s recent economic stimulus barely registers on PE margins

CHINA’S RECENT economic stimulus has failed ot turn around record low PE margins

Alice in Wonderland, the Cheshire cat and the chemicals industry

Chemicals companies need to decide where they are heading now that the Supercycle is over

Stop wasting time waiting for the end of the downcycle

THE TEN REASONS why this isn’t a standard chemical industry downcycle