Will China, the world’s most important HDPE demand centre, and an increasingly important supply centre, drag Europe down to its levels? Or will the China market increase closer to today’s levels in Europe?

Asian Chemical Connections

Chemicals companies face an unprecedented demand and supply crisis

THE GLOBAL CHEMICALS industry is, I believe, facing a demand and supply crisis on a scale and on a level of complexity that nobody has experienced before. This is a huge subjects requiring a series of posts. Let me start by looking at China’s role in this crisis. In later posts.

China’s latest LLDPE spread and demand data offer worrying clarity about the broader economy

THE LATEST DATA on linear low-density polyethylene (LLDPE) China CFR (cost & freight) pricing spreads over CFR Japan naphtha costs underlines the evidence from the other grades of polyolefins, that China is a long way from a full economic recovery.

China’s options for economic revival in 2022 narrow as HDPE demand outlook worsens

My previous best-case outcome for China’s HDPE demand growth in 2022 was 6%. My worst-case scenario was a 3% decline. Now, though, I worry that the best-case outcome for 2022 HDPE demand could be flat or zero growth. My worst-case outcome is a 4% decline.

China may this year become the Asia and Middle East third-biggest PP exporter, replacing Singapore. In 2020, China was nowhere in sight

AS RECENTLY AS 2020, China’s polypropylene (PP) exports totalled just 424,746 tonnes, causing what must have been barely a ripple of anxiety among the major Asian and Middle East exporters. But as the slide below shows, in 2021, China moved into the group of top exporters as its exports surged to 1.4m tonnes. This year, exports could be 1.7m tonnes or higher.

Polyolefins pricing data suggest China still hasn’t recovered

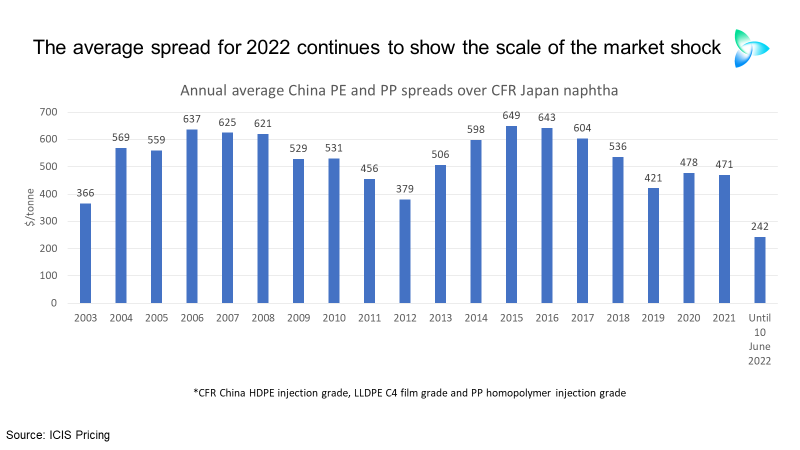

Comparative PE and PP pricing data between Vietnam and southeast asia – and the “spreads” numbers between China PE and PP prices and naphtha costs – suggest the China economy has yet to recover.

China naphtha-to-polyolefins spreads data still show recovery yet to happen

RECOVERY? WHAT RECOVERY? Some market players are talking about a rebound in the Chinese economy, and, therefore, polyolefins demand, but the critically important spreads data continue to tell a different story. Nothing has changed from last week.

China 2022 PE demand: latest data point towards a 2% contraction as confusion over outlook builds

January-April 2022 data point towards China’s polyethylene demand for the full year declining by 2% over 2021.

China’s post-lockdown economic rebound has yet to happen, according to the ICIS spreads data

At some point, polyolefins exporters to China and the local producers will regain pricing power. This will become apparent from a widening of spreads as economic activity returns to normal. It really is as simple as this. So, you need our data and analysis.

China’s ethylene equivalent demand growth in 2022 could be as high as plus 9% or as low as minus 3%

Scenario 1, the ICIS Base Case, for China’s ethylene equivalent demand, sees growth at 9% in 2022 over last year. Scenario 2 involves 4.5% and Scenario 3, minus 3%.