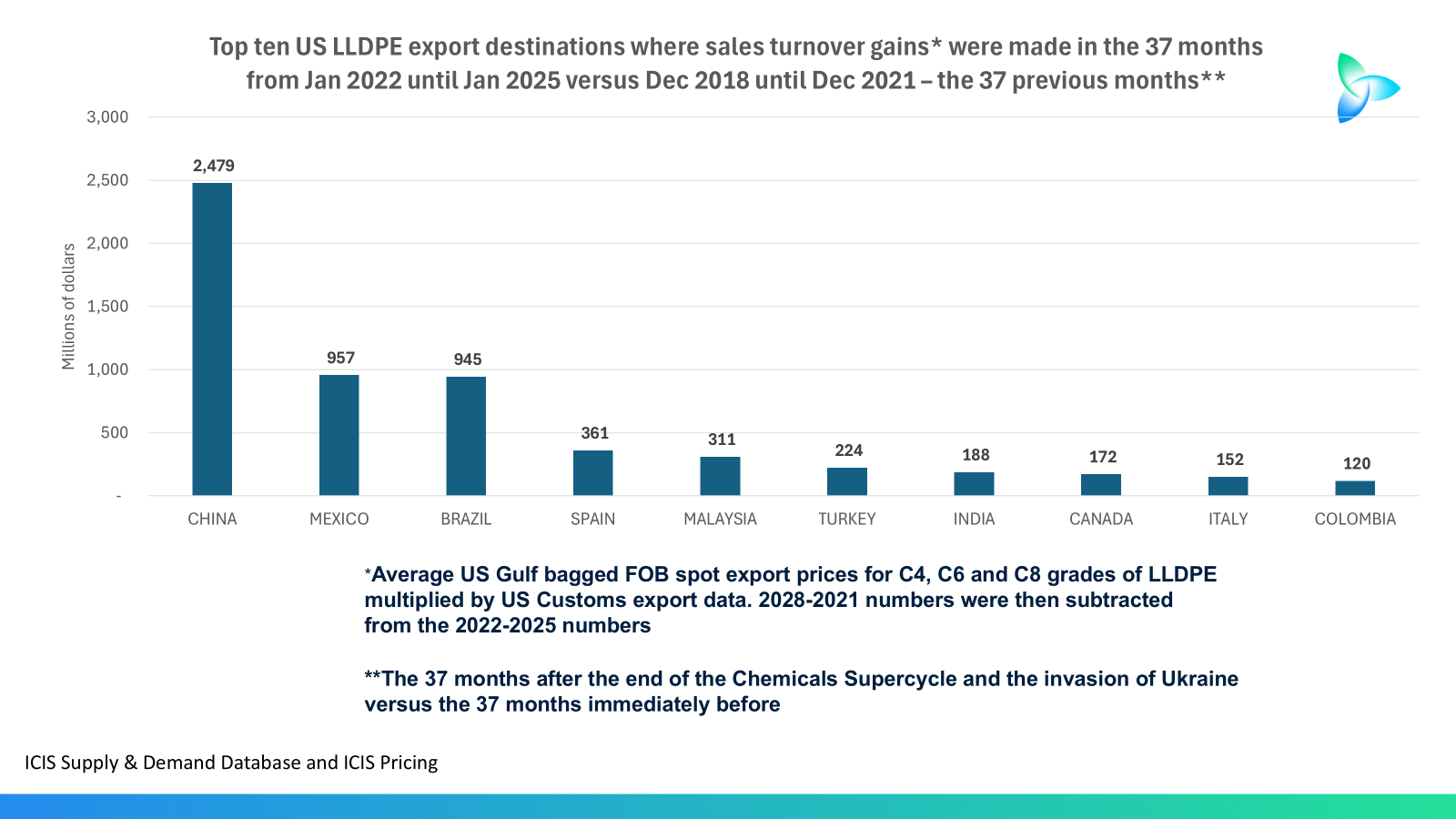

US LLDPE exporters made big gains in January 2022 until January 2025 thanks to their cost advantages and China’s lower import tariffs.

Asian Chemical Connections

China stimulus: Short-term benefits versus long-term challenges

STIMULUS measures announced at this year’s NPC meeting have yet to move the needle.

Why This Year’s NPC Meeting Seems Unlikely to Rescue Chemicals Spreads and Margins

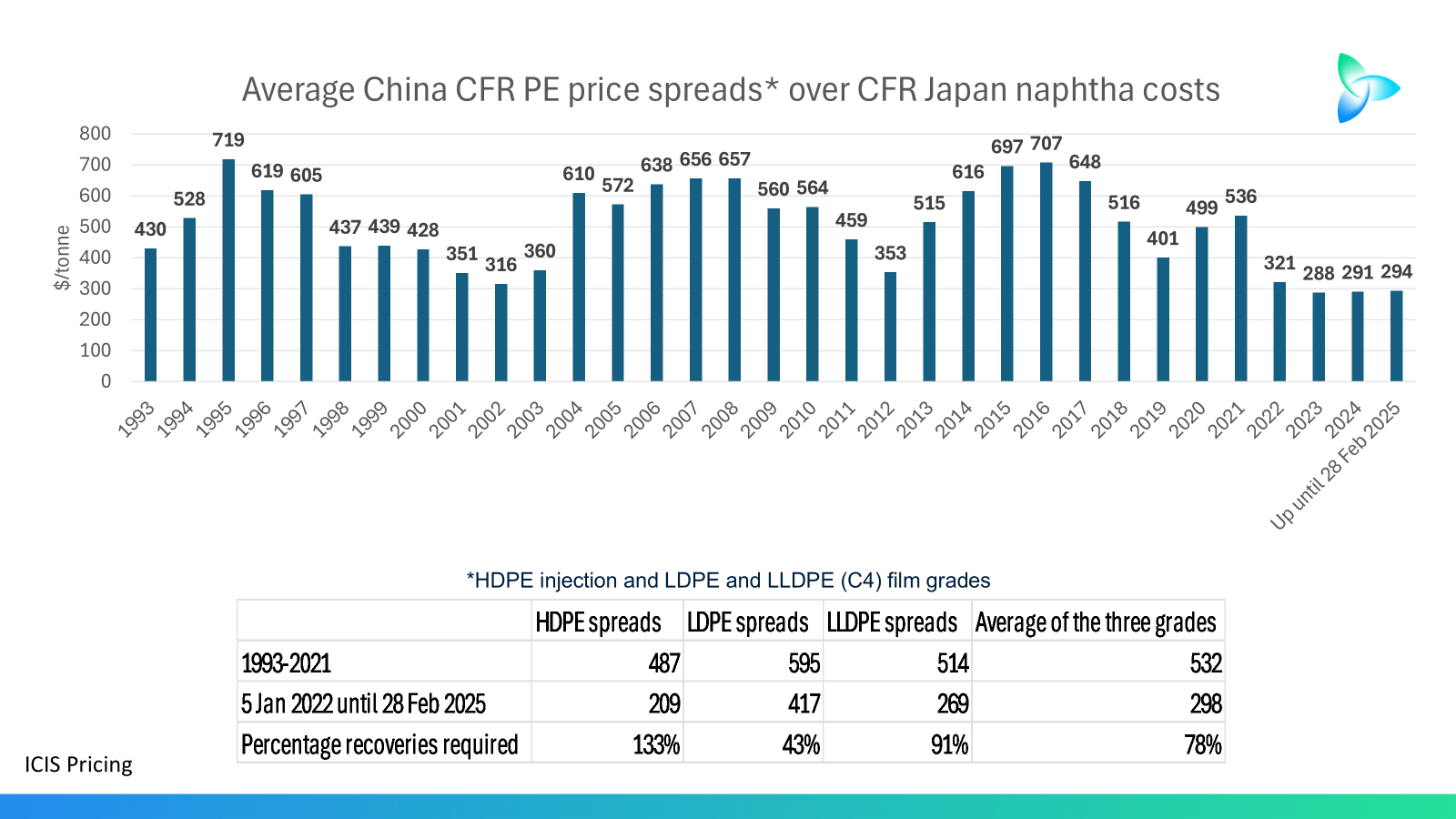

HDPE injection grade spreads would need to rise by 133% from their 2022-2025 level to return to the spreads enjoyed during the Chemicals Supercycle.

LDPE spreads would have to rise by 43%.

LLDPE spreads would need to increase by 91%.

Beyond the China growth miracle: The three things you should do in 2025

IN ALL THE MUDDLE about demand, there are three actions you can take today to give clarity to your business plans

The developing world outside China to the rescue, but not for a long time

A full recovery next year? If you think this is likely, then think again

Stop wasting time waiting for the end of the downcycle

THE TEN REASONS why this isn’t a standard chemical industry downcycle

Don’t put sustainability in a broom cupboard in the basement

How the chemicals world could re-align as sustainability becomes a new route to competitive advantage

China events suggest no global petchems recovery until 2026

Capacity growth of just 1.6m tonnes a year versus our base case of 5m tonnes a year would require substantial capacity closures in some regions. Closures are never easy and so take considerable time because of links with upstream refineries, environmental clean-up and redundancy costs – and the reluctance to be the “first plant out” in case markets suddenly recover.

China PP exports could reach 2.6m tonnes in 2024 as markets become ever-more complex

As recently as 2020, China’s PP exports for the whole year were just 424,746 tonnes. Between 2021 and 2023 they ranged between 1.3m to 1.4m tonnes. If the January-May 2024 export momentum were to continue for the rest of this year, full-year 2024 exports would reach 2.6m tonnes, double last year’s level.

A Personal View of the New Petrochemicals World

What follows is, as always on the blog, a personal view of how I see the petrochemicals world developing. There are no right answers, and the debate is the thing. That’s how we move forward together.