The petrochemicals or chemicals (depending what you prefer) transition to Net Zero is both connected and different from the energy transition for reasons I’ll detail in a series of blog posts, starting today with a few headline thoughts on how global margin and cost curve positions my change over the next few years – and […]

Asian Chemical Connections

Calling all petchem C-suites: Key summary of China risks and opportunities

By John Richardson AS ALL THE CLAMOUR builds about inflation and rising energy costs – and absolutely, of course, these are major challenges which I shalll address in later posts – there’s a danger the petrochemicals industry will lose focus on charts such as the one above, courtesy of the pH Report. I am still […]

With Common Prosperity set to dominate 2022, here is some essential history

By John Richardson THERE IS ONLY one slight problem with the argument that developing world demand is behind the boom in petrochemicals demand over the last 20 years: the data. Sorry to begin the year on a rather sarcastic note, but this is unfortunately a drum I feel I need to keep banging to support […]

New China HDPE import scenarios for 2021-2031 in the context of Common Prosperity

By John Richardson IF YOU THINK that forecasting the direction of China’s petrochemicals demand has become complicated enough because of Common Prosperity, the new complexities around demand pale into insignificance compared with the tangle of fresh variables shaping local capacity growth. The above slide is just my back-of-the-envelope attempt to chart some of […]

China provides major climate hope as latest IEA report underlines that it is all about the developing world

By John Richardson WHEN I worked for a UK local newspaper as a “cub” or junior reporter in the 1980s, there was a major international air crash. “Find out if there was anyone from our city on the flight,” my news editor instructed me. In my naivete, and because of lack of training, I was […]

China’s less commodity intensive future requires major petchem strategic rethink

By John Richardson THE THING about the collapse of China is that, like commercially viable nuclear fusion and peak oil, it is always ten years away from happening. In other words, I don’t think it will happen. But as the journalist and author Richard McGregor said in this Dan Snow history podcast on this year’s […]

China pulls multiple policy levers to fix energy shortages but don’t forget secular fall in demand

By John Richardson Executive Summary CHINA’S POWER shortages could fixed by the end of this month or early November, I was told by a senior polyolefins industry source. Three other contacts concurred. My contacts could be wrong, of course. A coal trader quoted by Reuters said that the energy shortages could continue throughout the fourth […]

China petchem project cancellations on “common prosperity” may not mean higher imports

By John Richardson IT IS BEING suggested that China’s “common prosperity” policy pivot, the biggest event in the global economy since at least 2009, will lead to a slowdown in local petrochemicals capacity additions. Maybe. As we all know, our industry produces a lot of carbon emissions, and a key element of the policy pivot […]

China traditional Q4 petchems demand increase unlikely because of economic rebalancing

By John Richardson A NEW RESEARCH PAPER by economists Kenneth Rogoff and Yuanchen Yang underlines the scale of what is at stake for petrochemicals demand if China doesn’t blink and sticks to its deleveraging of the real estate sector. The authors found that 29% of the Chinese economy is dependent on the property sector when […]

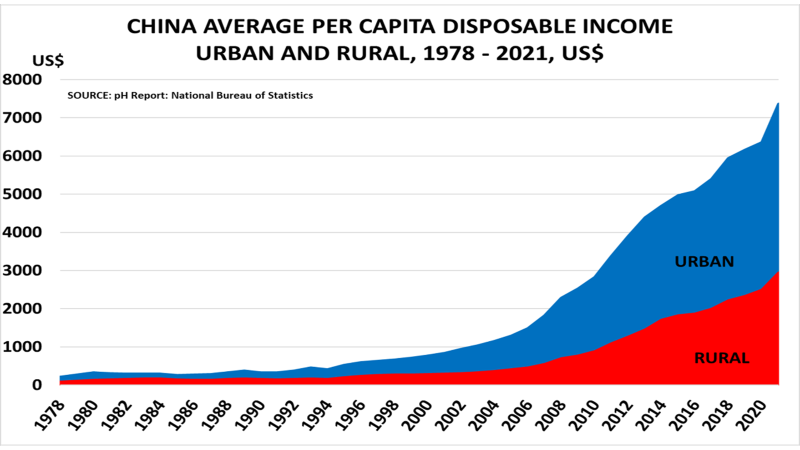

Challenges facing China as it tries to bridge the rural-urban wealth divide

By John Richardson THIS COULD be the biggest event in our industry since at least the Global Financial Crisis, possibly even earlier. Do not make the mistake of underestimating the importance of China’s policy shift to “common prosperity” in your planning process. I’ve already covered some of the short-term potential implications in my posts on […]