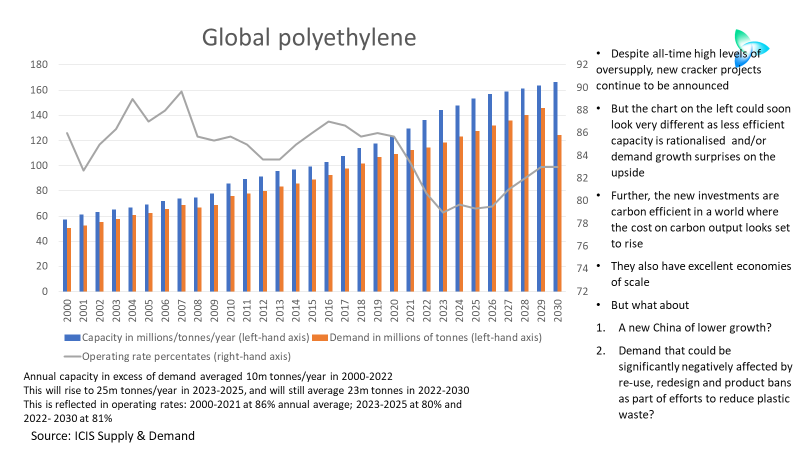

Global PE capacity in excess of demand is forecast to average 24m tonnes/year in 2022-2025, and to reach 26m tonnes this year

Operating rates are expected to average 81% in 2022-2025. This would compare with a 10m tonnes annual average capacityexceeding demand in 2000-2021 and an operating rate of 85%.

Asian Chemical Connections

Your complete and updated outlook for global polyethylene in 2023

The strength of China’s post zero-COVID recovery in 2023 will be crucial, as will local operating rates as self-sufficiency further increases.

Another important factor: European gas supply next winter and the effect on local PE production.

Assessing confidence and the China PE demand recovery: More scenarios are needed

Scenario 2, my preferred scenario, would see China 2023 PE demand at approximately 38.5m tonnes – an average of 2% higher across the three grades than in 2022.

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

Coming to terms with the new China is essential for sensible forecasting

Even our base case sees global PE capacity in excess of de</mand at 22m tonnes in 2023 compared with a 10m tonnes/year annual average in 2000-2022. We forecast this year’s global operating rate at 79% versus the average annual 2000-2022 operating rate of 86%. Downside One would see 28m tonnes of excess capacity and a global operating rate of 77%; Downside Two would be 30m tonnes and 76% respectively.

China HDPE 2023 demand and net import forecasts

Scenario 1 for next year assumes that China successfully transitions from its zero-COVID policies. Consumer confidence comes roaring back. Demand grows by 4% year-on-year to a market of 17.6m tonnes.

Scenario 2 assumes that high infection rates and lack of healthcare resources keep consumer confidence depressed but that the global economy recovers, supporting China’s exports. Growth is minus 2%, leaving demand at 6.6m tonnes.

The worst-case outcome is Scenario 3 where the impact of zero-COVID continues, and the global economy gets weaker. Consumption falls by 4% to 16.1m tonnes.

China PP exports decline but the reason is hardly cause for cheer

In November 2021, the premium for overseas PP injection grade prices over prices in China reached a historic peak of $408/tonne. But in 1-18 November 2022, the premium was $113/tonne. Premiums have fallen in every month since April this year, resulting in a decline in China exports.

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

Naphtha markets underline why “Micawberism” is not the answer

The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

China PP spreads data continue to show no recovery, weakest market since at least 2003

UNTIL WE SEE a recovery in China PP-naphtha spreads during around a 12-month period to close to long-term annual averages, there will have been no complete rebound in the market. The spread so far this year at just $264/tonne is 41% lower than the previous lowest year of $447/tonne in 2012.