THESE ARE STILL extraordinary times in global polyolefins markets. Although the great equalisation has begun as pricing in most of the rest of the world falls towards Chinese levels, price premiums over China remain historically very high. There are thus still strong opportunities for exporters to make good netbacks in markets other than China.

Asian Chemical Connections

China’s HDPE market is the weakest since at least 1990

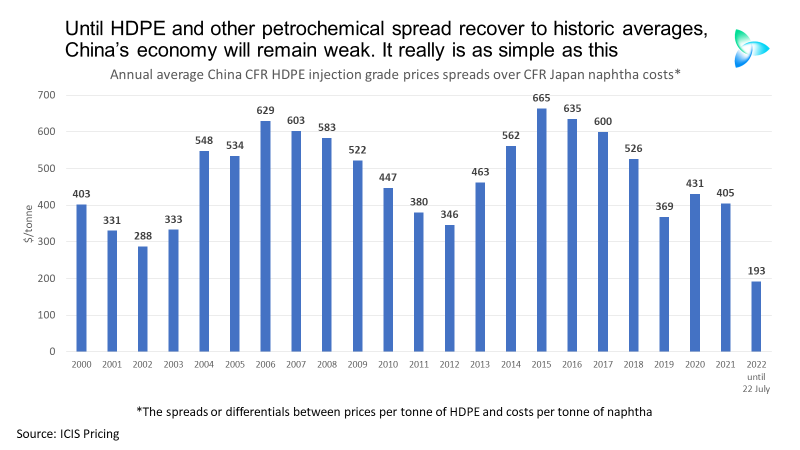

As the chart above shows, the spreads or differentials between China CFR HDPE injection grade prices and CFR Japan naphtha costs are this year the lowest they have been since 1990.

If you think this is a typical chemicals downcycle, think again

THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

The rules of the chemicals game are changing as companies pay the penalty for “growth for growth’s sake”

Because companies in all manufacturing and service sectors haven’t been adequately charged for the natural resources they use, and the damage they cause to the environment, we face the risks of catastrophic climate change and more plastic in the oceans than fish.

China PE demand may fall by 5% this year with net imports 3.2m tonnes lower

ANY short-term recovery in China’s PE and PP markets will likely be driven by supply and not demand. Local supply could become tighter on refinery rate cuts. Refineries have reduced production because of weak gasoline and diesel demand.

China goes global in PP perhaps quicker than had been expected, badly disrupting the global industry

CHINA’S polypropylene (PP) industry is in the short- to medium- term is being pushed into going global perhaps quicker than it had intended. This is because of the collapse of local demand and the resulting all-time weak netbacks in China versus most of the other regions.

China’s PP demand growth: A bubble that may have burst beyond repair

WAS IT JUST an almightily big bubble that cannot now be re-inflated, even if Beijing follows through on its plans to inject $148bn in loans into the country’s troubled real -estate sector? Once confidence has gone, such an intangible thing, there is a risk it cannot be restored.

China petrochemicals spreads data: until or unless it recovers, growth will remain weak

IF THERE IS no return to the historic patterns of spreads between China’s petrochemicals prices and feedstock costs, there will be no economic recovery.

Europe’s gas crisis: the implications for global chemicals

GEOPOLITICS IS, I believe, just one aspect of a crisis facing the chemicals industry that is deeper and more complex than anything we have faced before.

Front mind right now in geopolitics is Ukraine-Russia and the gas-supply crisis facing Europe,

China’s latest LLDPE spread and demand data offer worrying clarity about the broader economy

THE LATEST DATA on linear low-density polyethylene (LLDPE) China CFR (cost & freight) pricing spreads over CFR Japan naphtha costs underlines the evidence from the other grades of polyolefins, that China is a long way from a full economic recovery.