We don’t have much time. We must act quickly to prevent potentially catastrophic social, political and economic damage from climate change.

Asian Chemical Connections

Why PP producers need to shift from maximising volumes to adding value through sustainability

Why dig more oil and gas out of the ground to make petrochemicals when the carbon cost is potentially ruinous for our climate? This might be a question increasingly asked by legislators, shareholders and the general public – rightly or wrongly.

A flood of PP no matter how what the 2023-2025 demand growth

EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

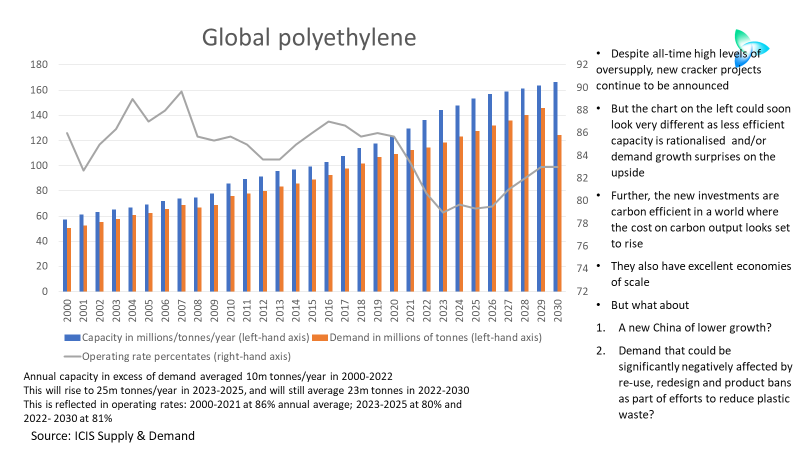

Your complete and updated outlook for global polyethylene in 2023

The strength of China’s post zero-COVID recovery in 2023 will be crucial, as will local operating rates as self-sufficiency further increases.

Another important factor: European gas supply next winter and the effect on local PE production.

Assessing confidence and the China PE demand recovery: More scenarios are needed

Scenario 2, my preferred scenario, would see China 2023 PE demand at approximately 38.5m tonnes – an average of 2% higher across the three grades than in 2022.

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

China PP exports decline but the reason is hardly cause for cheer

In November 2021, the premium for overseas PP injection grade prices over prices in China reached a historic peak of $408/tonne. But in 1-18 November 2022, the premium was $113/tonne. Premiums have fallen in every month since April this year, resulting in a decline in China exports.

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

China’s real estate rescue and zero-COVID tinkering will make little difference

China’s real estate rescue only involves shoring-up lenders. The property bubble will not and cannot be reflated. Most of the zero-COVID rules remain in place, and will likely stay in place well into 2023

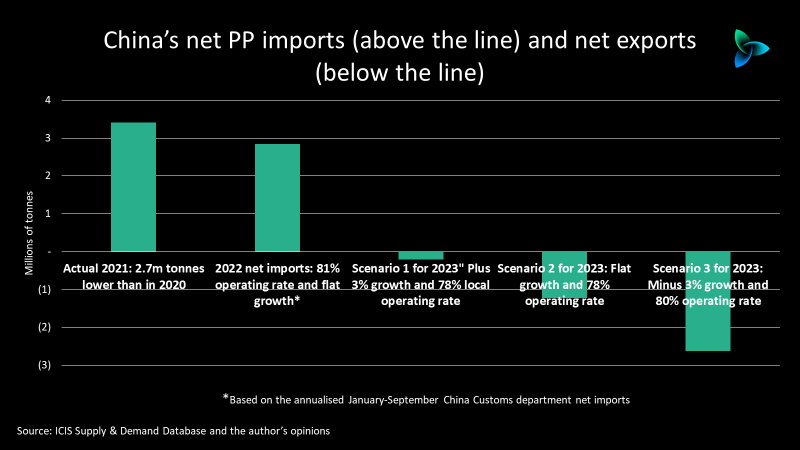

China PP demand and net import outlook for 2023

China[s PP demand growth in 2023 could be as low as minus 3% as it swings into a 2.6m tonnes net export position from this year’s likely net imports of around 3.4m tonnes.