EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,

Asian Chemical Connections

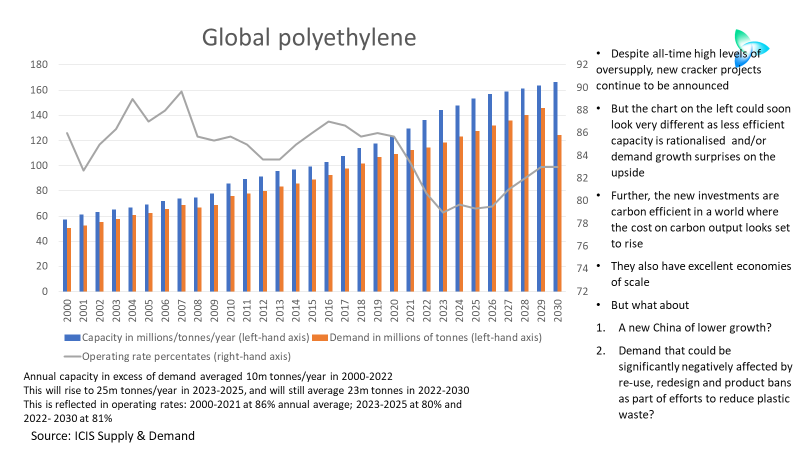

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.

Overseas HDPE price premiums over China remain at historic highs, but maybe for not much longer

HDPE film grade price premiums for selected countries and regions over China recovered in September and October of this year. In 2020, premiums averaged just $36/tonne compared with $248/tonne in January 2021-October 2022.

China chemicals growth and the 20th Communist Party Congress

China’s share of global demand growth in the seven big resins jumped to an astonishing 67% in 2002-2021. Northeast Asia ex-China’s share of demand fell to minus 1% with Europe and North America worth just 4% and 2% of growth respectively. The chemicals world had become dangerously lopsided.

Naphtha markets underline why “Micawberism” is not the answer

The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

This is the first significant chemicals downcycle for many years

Every tonne of polymer you decide not to produce because there isn’t a viable market will save vital revenues – especially as feedstock costs will remain very volatile. Every tonne of polymer you do produce because the market works will earn you crucial money at a time of declining overall sales.

If you think this is a typical chemicals downcycle, think again

THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

Global chemicals: What I believe our industry must do in response to a deep and complex crisis

I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

Chemicals companies face an unprecedented demand and supply crisis

THE GLOBAL CHEMICALS industry is, I believe, facing a demand and supply crisis on a scale and on a level of complexity that nobody has experienced before. This is a huge subjects requiring a series of posts. Let me start by looking at China’s role in this crisis. In later posts.