THE PHRASE “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

Asian Chemical Connections

China’s HDPE imports from the US surge more than triple as South Korea and Saudi Arabia and the UAE lose ground

As China’s overall high density PE (HDPE) imports fell to 2m tonnes in January-May 2023 from 2.5m tonnes during the same period last year, the US’s share of China’s import market jumped to 13% from 3%. Year-on-year imports from the US rose by 335% to 268,892 tonnes.

The big challenges facing the world’s HDPE exporters

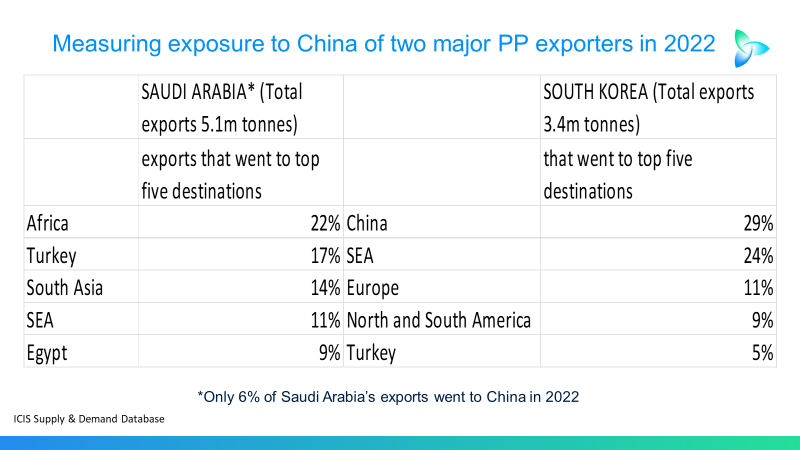

Saudi Arabia and South Korea must find alternative HDPE markets to China, as China’s demand weakens and it becomes more self-sufficient

The China debate seems to be over so let’s move on to other markets

With China’s demand growth at 1-2% and with complete self-sufficiency possible, PP exports must look to break their China dependence.

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

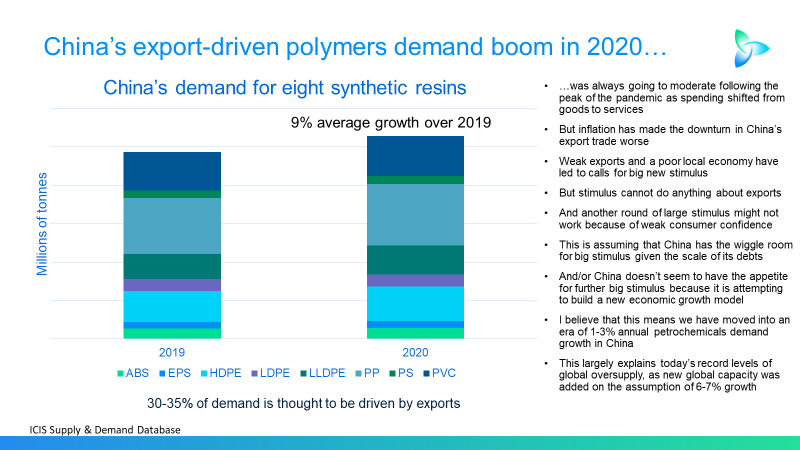

China, demographics, debt and polymers demand

China’s polymers consumption in 2022 107m tonnes from a population of 1.4bn. The developing world ex-China’s consumption was at 84m tonnes from a population of 5.3bn. And the developed world consumed 82m from 1.1bn people.

Why China could become self-sufficient in HDPE

CHINA’S NET IMPORTS of HDPE could be either 126m tonnes in 2023-2040, 38m tonnes or as low as 7m tonnes

China’s LLDPE and LDPE markets see overstocking on unfounded recovery hopes

China’s LLDPE imports in February this year reached their highest level for that month on record – 499,168 tonnes.

This seems likely to have been overstocking on anticipation of the post zero-COVID bounce back that hasn’t happened, as imports in March April fell month-on-month by 6% and 7% respectively. January-April 2023 exports also reached 64,678 tonnes – 96% higher than last year.

China’s PP demand in 2023 heading for a 1% decline on risk of just 2.5% GDP growth

A FALL IN China’s PP imports in April and low operating rates at some China plants suggest 2023 demand growth at minus 1%

The old China and HDPE, the new China and the future of demand

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.