We don’t have much time. We must act quickly to prevent potentially catastrophic social, political and economic damage from climate change.

Asian Chemical Connections

Why PP producers need to shift from maximising volumes to adding value through sustainability

Why dig more oil and gas out of the ground to make petrochemicals when the carbon cost is potentially ruinous for our climate? This might be a question increasingly asked by legislators, shareholders and the general public – rightly or wrongly.

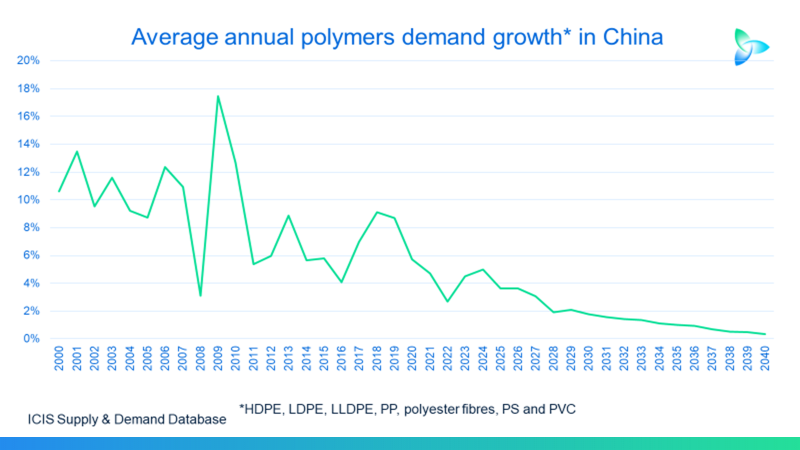

China’s multi-speed economy and the implications for PP demand

AS overall demand growth declines,. PP consumption connected to real estate and infrastructure spending are especially at risk.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

China HDPE demand set for 3% decline this year with, perhaps, overstocking supporting the other grades

CHINA’S POLYETHYLENE (PE) market has performed in a very mixed fashion so far in 2023, as the above chart tells us.

The annualised January-March 2023 data suggest a 3% fall in high-density PE (HDPE) full-year demand over 2022, a 3% in increase in low-density PE (LDPE) demand and a 4% increase in linear-low density PE (LLDPE) consumption.

India, climate change, demographics and polymers demand growth

Climate change and demographics are economic destiny – their effects cannot be avoided. But the petrochemicals industry has a huge role to play in shaping favourable outcomes

China PP import and export complexities require much deeper and wider analysis

China’s PP net exports could be more than 2m tonnes in both 2024 and 2025. This would likely make China the fourth biggest exporter in Asia and the Middle East.

China PP demand could grow by 3% in 2023, down from the 2000-2020 average of 10%

THE EARLY DATA suggest that China’s polypropylene (PP) demand could grow by 3% in 2023. This would be in line with the base case forecast I provided in February.

China PE demand growth in 2023 could be only 1% versus forecasts of 5%

Early data suggest China PE demand growth in 2023 will follow the trend since 2021 of much, much lower growth.

China PE and PP downcycle a long, long way from being over

The average China PE spread between 1 January and 17 March this year was just $290, the lowest since our assessments began.

Between 2000 and 2021, before last year’s collapse, the annual spread averaged $532/tonne. This means that until spreads increase by 83% from their current levels, there will have been no recovery..