Blood bags, syringes, disposable hospital sheets, gowns and medicine packaging. Modern-day medicine, which has greatly extended the quantity and quality of our lives, would be impossible without the plastics industry.

Asian Chemical Connections

As China volume growth is no longer guaranteed, focus on growing value

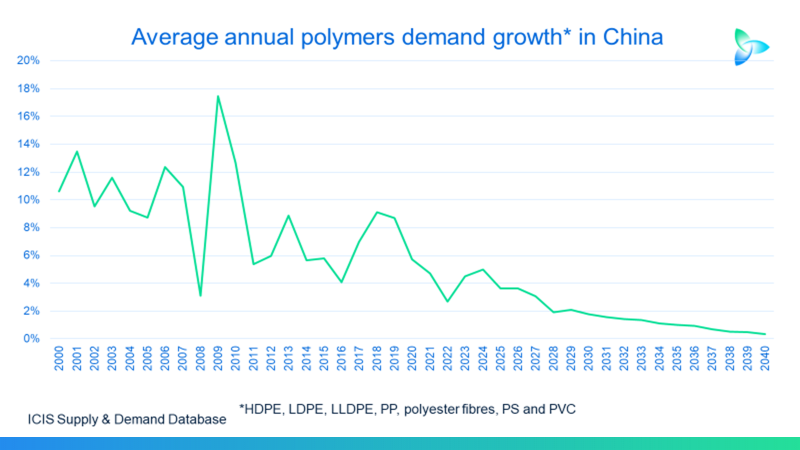

THE THREE EVENTS described are historic, meaning that the tremendous volume growth that the petrochemicals business has seen since 1992 could be largely over.

The focus therefore needs to switch to growing value

China’s demographic crisis and the impact on global PP

If we are to see a repeat of 87% in 2024-2030 (the green line in the chart) and assuming my forecast of 2% demand growth is correct, the increase in global capacity would need to average just 154,000 tonnes/year during each year between 2024 and 2030. This is versus our base case of 4.5m tonnes/year of annual increases.

Why China may struggle to maintain 4-5% GDP growth: Implications for polymers

If GDP growth were a percentage point lower than ICIS forecasts during each of the years between 2023 and 2040, and assuming the same 0.7% polymer multiple over GDP, annual consumption of the nine synthetic resins would be around 10m tonnes a year lower than our base case.

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

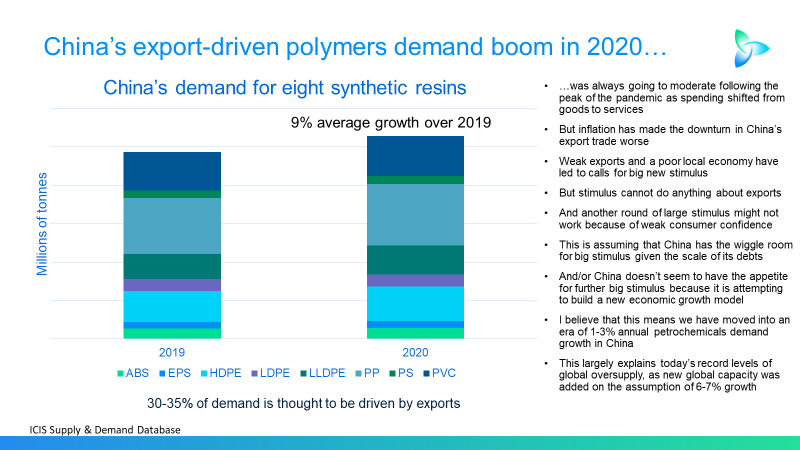

China and “pushing on a piece of string: The moderate impact of future economic stimulus

THE PHRASE “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

Demographics, sustainability and 1bn tonne less global polymers demand

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

Why China could become self-sufficient in HDPE

CHINA’S NET IMPORTS of HDPE could be either 126m tonnes in 2023-2040, 38m tonnes or as low as 7m tonnes

The old China and HDPE, the new China and the future of demand

In my downside scenario for China’s HDPE demand in 2023-2040 is correct, the country’s total consumption during this period would be 134m tonnes lower than the ICIS Base Case.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.