The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

Asian Chemical Connections

China’s dominance of global polymer demand delivered huge global growth. But what now?

China accounted for 33% of global growth in the seven major synthetic resins between 1990 and 2001. But this jumped to 63% in 2002-2021. In distant second place during both these periods was the Asia and Pacific region at 15% and 17% respectively.

China could become the world’s third-biggest PP net exporter in 2022-2040

China’s cumulative net imports of polypropylene (PP) might be as big as 91m tonnes in 2022-2040 – the ICIS base case. Or China’s total net exports during the same period may reach 90m tonnes.

This is the first significant chemicals downcycle for many years

Every tonne of polymer you decide not to produce because there isn’t a viable market will save vital revenues – especially as feedstock costs will remain very volatile. Every tonne of polymer you do produce because the market works will earn you crucial money at a time of declining overall sales.

China’s styrene demand in 2022 could be negative for the first time since 1990

China’s net styrene imports in 2022 could also fall to just 290,000 tonnes from 1.5m tonnes in 2021 and 2.8m tonnes in 2020.

If you think this is a typical chemicals downcycle, think again

THERE IS A FEELING out there that the chemicals and polymers industry is undergoing a typical downcycle that will last a few years, followed by yet another spectacular fly-up in margins. But I believe a great deal more is happening beyond the usual cycles of over-building followed by under-building.

The rules of the chemicals game are changing as companies pay the penalty for “growth for growth’s sake”

Because companies in all manufacturing and service sectors haven’t been adequately charged for the natural resources they use, and the damage they cause to the environment, we face the risks of catastrophic climate change and more plastic in the oceans than fish.

Global chemicals: What I believe our industry must do in response to a deep and complex crisis

I WORRY that we face a crisis deeper and more complex than any of us have seen before because of the confluence of geopolitics, demographics, the changing nature of the Chinese economy as Common Prosperity reforms accelerate, China’s rising chemicals and polymers self-sufficiency, the high levels of global inflation with all its causes, and, last but certainly not least, climate change.

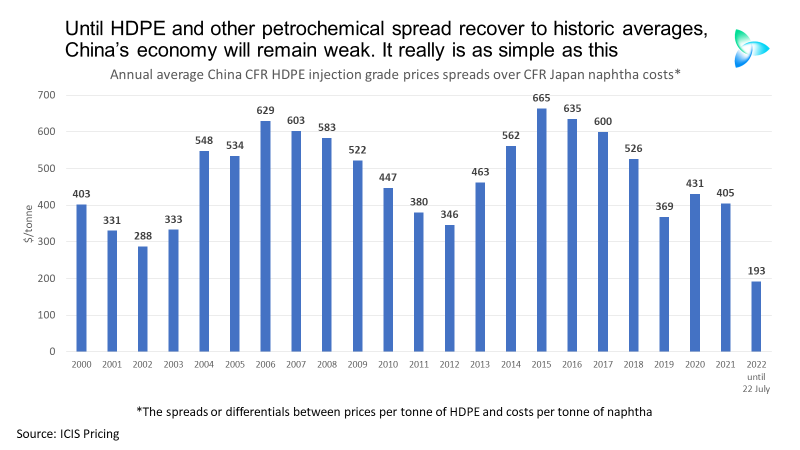

China petrochemicals spreads data: until or unless it recovers, growth will remain weak

IF THERE IS no return to the historic patterns of spreads between China’s petrochemicals prices and feedstock costs, there will be no economic recovery.

Europe’s gas crisis: the implications for global chemicals

GEOPOLITICS IS, I believe, just one aspect of a crisis facing the chemicals industry that is deeper and more complex than anything we have faced before.

Front mind right now in geopolitics is Ukraine-Russia and the gas-supply crisis facing Europe,