THE PHRASE “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

Asian Chemical Connections

Demographics, sustainability and 1bn tonne less global polymers demand

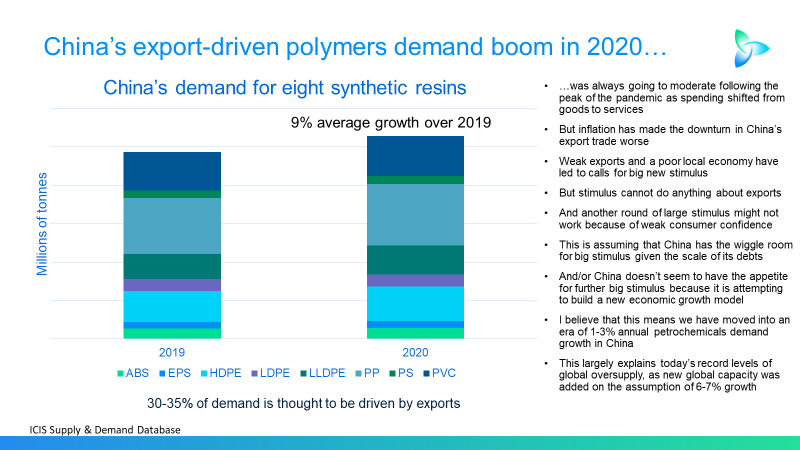

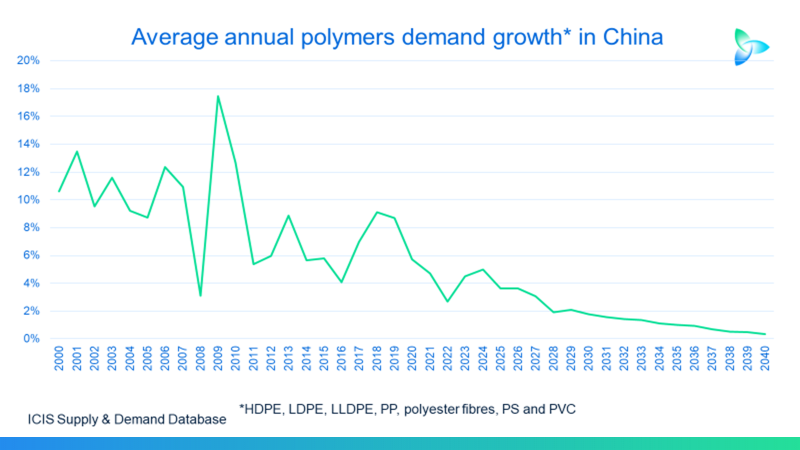

Flat 2023-2050 demand growth in China and the developed world would leave the global market for nine synthetic resins 1bn tonnes smaller than the ICIS base case.

Competing voices and the chemicals challenge of cutting carbon

We don’t have much time. We must act quickly to prevent potentially catastrophic social, political and economic damage from climate change.

Why PP producers need to shift from maximising volumes to adding value through sustainability

Why dig more oil and gas out of the ground to make petrochemicals when the carbon cost is potentially ruinous for our climate? This might be a question increasingly asked by legislators, shareholders and the general public – rightly or wrongly.

Beware of the “head fake” of an improving China and better Q2-Q4 chemicals financial results

YEAR-ON-YEAR chemical company financial results could we improve in Q2-Q4 2023; But this should not be seen as a return to the Old Normal.

India, climate change, demographics and polymers demand growth

Climate change and demographics are economic destiny – their effects cannot be avoided. But the petrochemicals industry has a huge role to play in shaping favourable outcomes

China’s long-term PP demand growth may turn negative, shifting the focus to value from volumes

STRONG upside PP demand growth scenarios for the rest of the world might still not enough to cancel out negative growth in China

Why China’s 1990-2022 PP consumption could have been 300m tonnes lower without the benefit of “one off” historical trends

IF China had been a typical developing economy, as the above chart illustrates, its cumulative 1990-2022 could have been 300m tonnes smaller. As history moves forward,this suggests that China’s long-term demand growth could turn negative

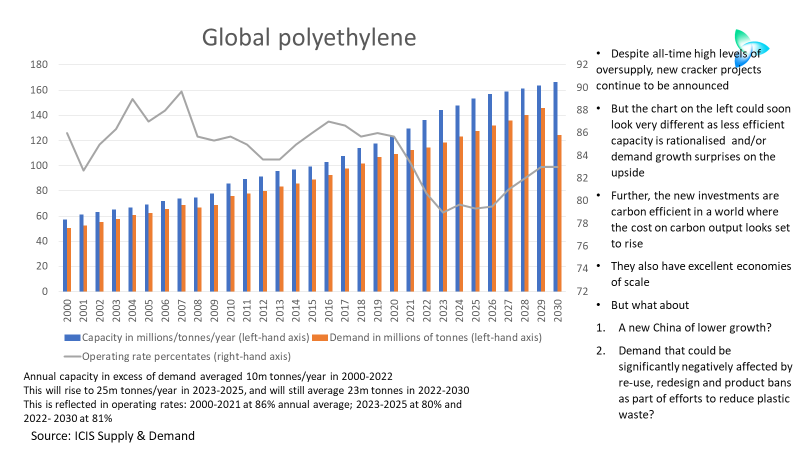

Cracker project announcements continue despite all-time high oversupply

Companies behind the crackers due on-stream over the next four years emphasise the low-carbon output. The planned new plant also have excellent economies of scale

Why European chemicals can emerge from this crisis as a winner

IT REALLY ISN’T doom and gloom if you take the longer-term view. Instead, for the chemical companies with the right strategies, the opportunities to build new sustainable business models are huge. The winners will make an awful lot of money while also doing the right things for humanity and our natural environment.