NINE OUT OF CHINA’S top 10 high density polyethylene (HDPE) import partners saw their sales to China fall by an estimated total of $1.8bn in January-July 2023 versus the same period last year. Meanwhile, the remaining member of the top 10, the US, saw its sales increase by $233m.

Asian Chemical Connections

Global PE capacity may have to be 23m tonnes/year lower in 2023-2030 to end the downturn

GLOBAL PE capacity in 2023-2030 may have to be 23m tonnes/year lower than the ICIS base case to bring markets back into balance

Global HDPE capacity may have to be 13m tonnes/year lower in 2024-2030 to return to healthy operating rates

Global HDPE capacity in 2024-2030 would need to be a total of 13m tonnes/year lower than our base case to return to the 2000-2019 operating rate of 88%.

Exporters of HDPE lose estimated $1.1bn of China sales in H1 2023

Total estimated losses by eight of the major HDPE exporting countries in sales to China was $1.1bn in H1 2023 versus H1 2022.

China H1 2023 PE market review and outlook for the second half

CHINA’S PE demand is heading for 1% growth this year based on the H1 2023. data. Northeast Asian margins would have to recover by 3,423% to get back to normal.

China’s 2024-2034 net HDPE imports: Either 105m tonnes or 19m tonnes

CHINA’S 2024-2034 HDPE net imports could total as much as 105m tonnes or as little a 19m tonnes

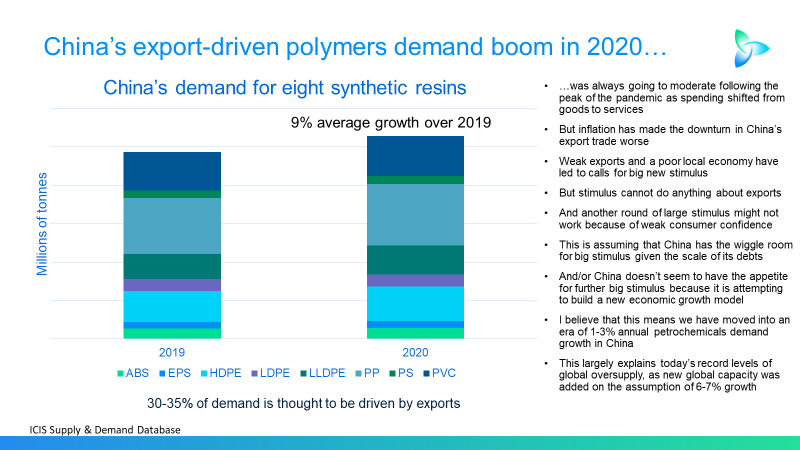

China and “pushing on a piece of string: The moderate impact of future economic stimulus

THE PHRASE “pushing on a piece of string” might best describe the logic behind calls for another round of big economic stimulus in China. Any extra money pumped into the economy could be largely saved rather than spent because of weak consumer confidence resulting from an ageing population and the end of the property bubble.

China’s HDPE imports from the US surge more than triple as South Korea and Saudi Arabia and the UAE lose ground

As China’s overall high density PE (HDPE) imports fell to 2m tonnes in January-May 2023 from 2.5m tonnes during the same period last year, the US’s share of China’s import market jumped to 13% from 3%. Year-on-year imports from the US rose by 335% to 268,892 tonnes.

China imports 220% more LLDPE from the US as naphtha-based players lose market share

CHINA’S imports from the US surge by 220% in January-May 2023 as local production falls by 11% and as imports decline from Singapore, South Korea and Thailand.

The big challenges facing the world’s HDPE exporters

Saudi Arabia and South Korea must find alternative HDPE markets to China, as China’s demand weakens and it becomes more self-sufficient