A petrochemicals world dominated by Supermajors, especially those running COTC plants, or one where greater regional cooperation (more on this in later posts) and increased protectionism allow older, smaller and less carbon efficient plants to survive.

Asian Chemical Connections

The “National Champions” in the New Petrochemicals Landscape

SHORT-TERM tactics should involve maximising returns within regions along with a greater focus on exports anywhere in the world

Why the rest of the developing world cannot follow in China’s growth footsteps

The developing world outside China cannot repeat China’s economic growth model because of climate change, ageing populations in the West and sustainability

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

Details of how Saudi Aramco COTC and other advantaged feedstock projects could redraw the petrochemicals map

There is a big new wave of lower-carbon and very advantaged cracker projects on the way, including Saudi Aramco’s crude-oil-to-chemicals investments.

Overstocking may have boosted China PE demand as the US continues to win while others lose

THE US gains $296m in China HDPE sales as Asian and Middle East exporters lose $1.4bn.

Winners and losers as demographics, debt, sustainability, geopolitics and crude-to-chemicals rewrite the rules of success

I BELIEVE WE are heading for the biggest period of change in the global petrochemicals industry since the 1990s.

This was when globalisation took off with the formation of the World Trade Organisation (WTO), when China’s economic boom began, when the global population was more youthful and before climate change became a major threat to growth.

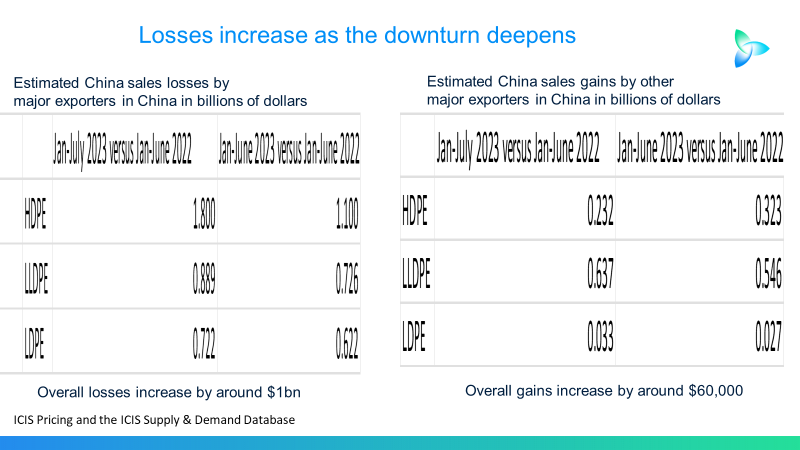

Major PE exporters to China see their sales fall by a further $1 billion

THE BIG PE exporters to China saw their sales to country decline by a further $1bn year-on-year in January-July 2023 versus January-June 2023.

Big HDPE exporters see another $700m of estimated China sales losses in one month

NINE OUT OF CHINA’S top 10 high density polyethylene (HDPE) import partners saw their sales to China fall by an estimated total of $1.8bn in January-July 2023 versus the same period last year. Meanwhile, the remaining member of the top 10, the US, saw its sales increase by $233m.

Global PE capacity may have to be 23m tonnes/year lower in 2023-2030 to end the downturn

GLOBAL PE capacity in 2023-2030 may have to be 23m tonnes/year lower than the ICIS base case to bring markets back into balance