ANY short-term recovery in China’s PE and PP markets will likely be driven by supply and not demand. Local supply could become tighter on refinery rate cuts. Refineries have reduced production because of weak gasoline and diesel demand.

Asian Chemical Connections

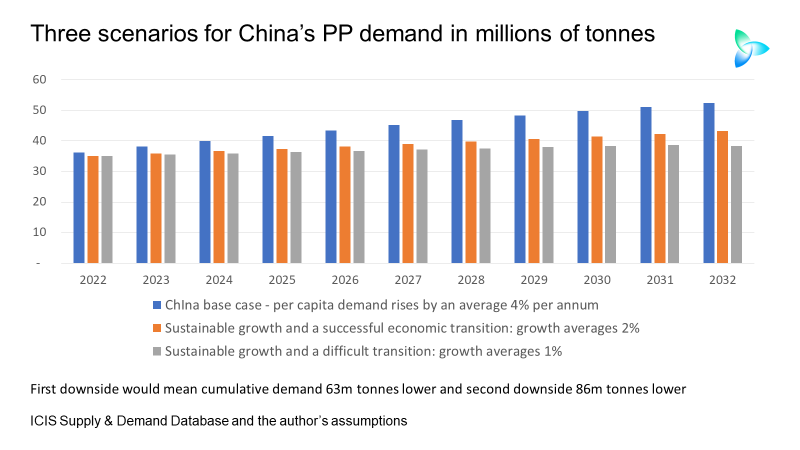

Why China’s PP demand may only grow by 1% per year in 2022-2032

By John Richardson MOST people now accept that China’s real estate sector, worth some 29% of the country’s GDP, is deflating with significant long-term implications for petrochemicals growth. But because China’s GDP growth is very likely to still grow and because China’ existing demand is already so big the common view is that there is […]

China 2021 polyethylene demand could be 1.9m tonnes lower than last year

By John Richardson WE NOW HAVE enough data to make some firm conclusions about what the Chinese polyethylene (PE) market will have looked like in 2021. We can also make some early estimates about the shape of the market in 2022. The slide below details what the ICIS apparent demand data for January-October 2021 (our […]

Global polypropylene could also move from inflation to deflation in Q1 next year

By John Richardson WE ALL NEED TO ASK ourselves whether the global patterns in polyethylene (PE) and polypropylene (PP) pricing and margins that we have seen over the last year represent a long-term divergence in global markets or something temporary. As discussed on Monday, when I examined linear low-density PE (LLDPE) market (and the same […]

Global polyethylene could move from inflation to deflation by as early as Q1 2022

By John Richardson THE BALTIC DRY INDEX, one of the excellent barometers of overall economic activity, was late last week at its lowest level since June on a slowing Chinese economy, easing congestion at Chinese ports and a fall in Chinese coal imports (more on this in a moment). “The index was around 1,000 a […]

As China coal shortages end, polyolefins margins reach historic lows on oversupply

By John Richardson AGAIN, DON’T say I didn’t tell you. In my 11 October blog post, having talked to people who know what they are talking about, I flagged up the possibility that China’s energy shortages could be fixed a lot quicker than many people were suggesting. Those in the know about China told me […]

Dip in Chinese PP exports only temporary with Q1 2022 resurgence looking likely

By John Richardson TRADE DATA when combined with price assessments, supply and demand estimates and market intelligence is the modern-day equivalent of alchemy with a rather important difference: we can genuinely convert numbers and conversations with the market into gold, unlike the bogus science of alchemy. A great example is the chart below, the first […]

Global polyethylene supply could lengthen, becoming a buyers’ market, sooner than many people think

By John Richardson RARELY, IF EVER, have events felt so bafflingly complex in the global polyethylene (PE) business. Take as an example the chart below listing the factors that have reshaped demand since the beginning of the pandemic. Let’s go through these factors one by one, box by box. It is reasonable to assume, starting […]

China could either see net imports of 63m tonnes in 2021-2031 or net exports of 18m tonnes!

By John Richardson CONFUSED BY the above chart? Once again I certainly hope so, provided confusion is not followed by blind paralysing panic. The chart, showing three scenarios for China’s net polypropylene (PP) imports in 2021-2031, follows last week’s chart of 2021-2031 high-density polyethylene net imports. Confusion is valuable because we need to go back […]

After the COP26 disappointment, the “blame game” will get us nowhere

The implications of last week’s disappointing COP26 meeting in Glasgow are so complex and so numerous that is going to take more than one blog post to provide adequate coverage. In this first post, I look at the failure of COP26 to agree on a global carbon tax, in my view essential, and discuss the […]