Neither Supermajors nor Deglobalisation are inevitable. Outcomes will instead be set by many individual choices that are coordinated in the rights ways. In other words, it is within the gift of Europe to wake up from Jim Ratcliffe’s “sleepwalk”.

Asian Chemical Connections

A fundamental shift in thinking on petrochemical plant closures

Environmental, social and political factors – along with integration into upstream petrochemicals – have held back plant closures. Now, things seems very different.

Your complete and updated outlook for global polyethylene in 2023

The strength of China’s post zero-COVID recovery in 2023 will be crucial, as will local operating rates as self-sufficiency further increases.

Another important factor: European gas supply next winter and the effect on local PE production.

Europe, re-globalisation of PE prices and the challenges for 2023

AGAIN, PLEASE DON’T SAY I didn’t warn you. The chart below is an example of how PE prices have started to re-globalise. as I said they would when they began to de-globalise from March 2021 onwards.

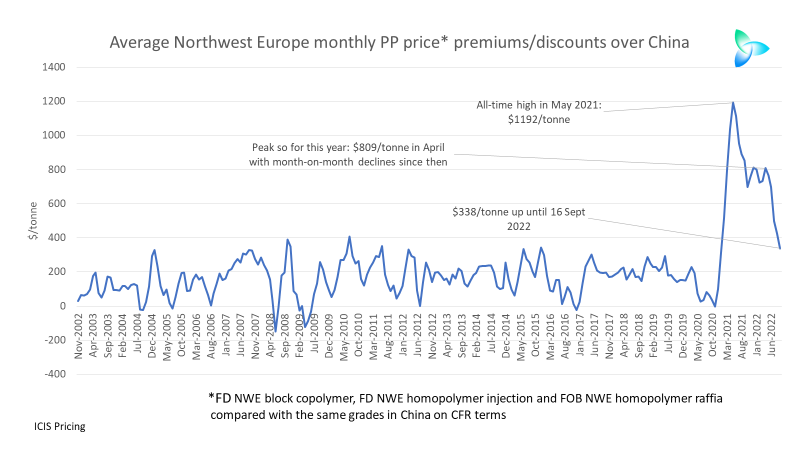

What applies to the declining polyethylene (PE) price differentials between Europe and China applies to all the other countries and regions versus China. The pattern has been the same in polypropylene (PP) over recent months.

European PE and PP producers face re-globalisation risks

Northwest Europe PP price premiums over China averaged $161/tonne between November 2002 and December 2020. Between January 2021 and 16 September 2022, price premiums averaged $749/tonne. What would be the consequences for European PP pricing and profitability if price premiums returned much closer to their long-term averages?

European PE and PP: Energy cost and demand crisis gathers momentum as pricing falls closer to China levels

The chart shows European

dependence on Russian gas compared with country-by-country percentages of the region’s total PE capacity, Germany is the standout risk country as it has a nearly 50% reliance on Russia for its gas supplies with a total of more than 70% of Europe’s PE capacities across the three grades. In the case of the Netherlands, it is the location for just under 40% of capacities with its dependence on Russian gas at around 20%.

European polyolefins could be dragged down by China

Will China, the world’s most important HDPE demand centre, and an increasingly important supply centre, drag Europe down to its levels? Or will the China market increase closer to today’s levels in Europe?

Europe HDPE: why net imports could be 3m tonnes higher this year

EUROPE’S NET HDPE imports could be as high as 4.1m tonnes in 2022 versus last year’s 1.1m tonnes.

Europe petrochemicals demand weakness may have bigger impact than any production cuts

Lower refinery operating rates on a lack of Russian oil and naphtha -– and reduced electricity supply to refineries and petrochemicals plants -– may be more than offset by weaker European petrochemicals demand.

The EU in 2030: How Ukraine-Russia could reshape its chemicals industry and economy

”. Manufacturing cost pressures and the climate change and plastic -waste clean-up imperatives have created a new chemicals business model. No longer is financial success driven by sales-volume growth in chemicals.