Scenario 1 for next year assumes that China successfully transitions from its zero-COVID policies. Consumer confidence comes roaring back. Demand grows by 4% year-on-year to a market of 17.6m tonnes.

Scenario 2 assumes that high infection rates and lack of healthcare resources keep consumer confidence depressed but that the global economy recovers, supporting China’s exports. Growth is minus 2%, leaving demand at 6.6m tonnes.

The worst-case outcome is Scenario 3 where the impact of zero-COVID continues, and the global economy gets weaker. Consumption falls by 4% to 16.1m tonnes.

Asian Chemical Connections

China’s long-term GDP growth risks and polymers demand

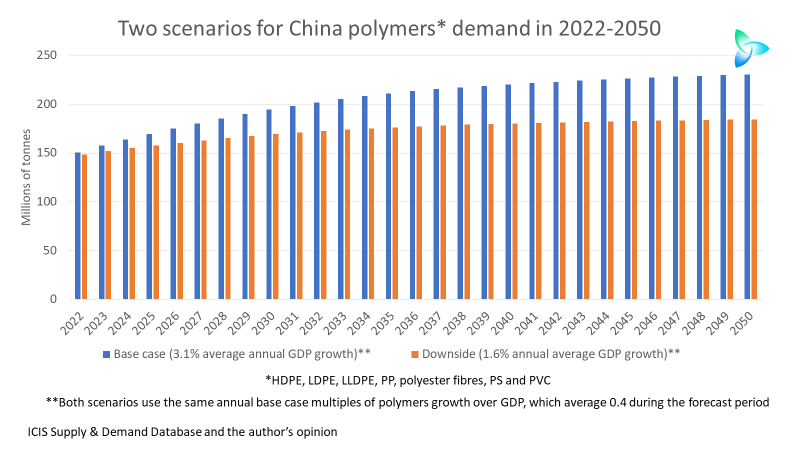

Cumulative downside demand in the above chart would total 5bn – 91m tonnes lower than our base case.

China chemicals growth and the 20th Communist Party Congress

China’s share of global demand growth in the seven big resins jumped to an astonishing 67% in 2002-2021. Northeast Asia ex-China’s share of demand fell to minus 1% with Europe and North America worth just 4% and 2% of growth respectively. The chemicals world had become dangerously lopsided.

Naphtha markets underline why “Micawberism” is not the answer

The January-September 2022 multiple of BFOE crude prices per barrel over CFR Japan naphtha prices per tonne averaged just 7.9. The lowest multiple so far this year was 6.9 in August. The January-September 2022 average was the lowest annual average since our naphtha price assessments began in March 1990.

China’s dominance of global polymer demand delivered huge global growth. But what now?

China accounted for 33% of global growth in the seven major synthetic resins between 1990 and 2001. But this jumped to 63% in 2002-2021. In distant second place during both these periods was the Asia and Pacific region at 15% and 17% respectively.

China’s HDPE prices recover but spreads tell the real story as prospects dim for next year

CHINA HDPE injection grade prices over naphtha feedstock costs are the lowest this year since our price assessments began in 1990

European PE and PP: Energy cost and demand crisis gathers momentum as pricing falls closer to China levels

The chart shows European

dependence on Russian gas compared with country-by-country percentages of the region’s total PE capacity, Germany is the standout risk country as it has a nearly 50% reliance on Russia for its gas supplies with a total of more than 70% of Europe’s PE capacities across the three grades. In the case of the Netherlands, it is the location for just under 40% of capacities with its dependence on Russian gas at around 20%.

China LDPE demand in 2022 could fall by 8%, which would be worst year since 1990

Annualised January-June China LDPE data only indicated a 4% decline in full-year demand. What a difference a month has made. The January-July numbers point to an 8% fall in demand this year. This would be the worst annual fall in growth since 1990.

China PE demand may fall by 5% this year with net imports 3.2m tonnes lower

ANY short-term recovery in China’s PE and PP markets will likely be driven by supply and not demand. Local supply could become tighter on refinery rate cuts. Refineries have reduced production because of weak gasoline and diesel demand.

China’s latest LLDPE spread and demand data offer worrying clarity about the broader economy

THE LATEST DATA on linear low-density polyethylene (LLDPE) China CFR (cost & freight) pricing spreads over CFR Japan naphtha costs underlines the evidence from the other grades of polyolefins, that China is a long way from a full economic recovery.