China’s LLDPE demand is in line to fall by 4% this year with its net imports 800,000 tonnes lower. This would follow a 1.1m tonne decline in net imports in 2021 over 2020.

Asian Chemical Connections

China PE demand may fall by 5% this year with net imports 3.2m tonnes lower

ANY short-term recovery in China’s PE and PP markets will likely be driven by supply and not demand. Local supply could become tighter on refinery rate cuts. Refineries have reduced production because of weak gasoline and diesel demand.

China’s latest LLDPE spread and demand data offer worrying clarity about the broader economy

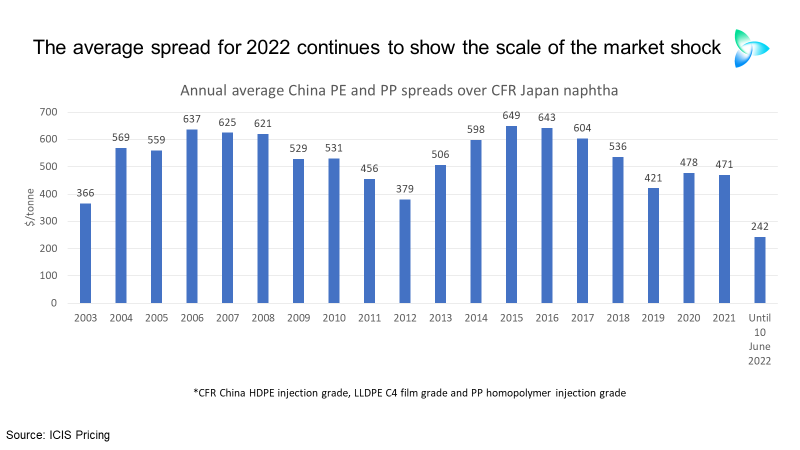

THE LATEST DATA on linear low-density polyethylene (LLDPE) China CFR (cost & freight) pricing spreads over CFR Japan naphtha costs underlines the evidence from the other grades of polyolefins, that China is a long way from a full economic recovery.

China LDPE demand could fall by as much as 8% this year with net imports 500,000 tonnes lower

CHIINA’S LDPE spreads over naphtha feedstock costs have held up very well this. But this doesn’t mean to say that demand is good. Chinese demand could fall by as much as 8% in 2022.

Polyolefins pricing data suggest China still hasn’t recovered

Comparative PE and PP pricing data between Vietnam and southeast asia – and the “spreads” numbers between China PE and PP prices and naphtha costs – suggest the China economy has yet to recover.

Food crisis in 2023 may represent major threat to developing-world polymers demand

High-density polyethylene (HDPE) demand in the developing world in 2023 could contract by 300,000 tonnes, rather than, as in our base case, grow by 800,000 tonnes because of the food crisis.

Assuming all the other regions grew as under our base case, global growth would be 2% in 2023 rather than our base case of 4%.

China naphtha-to-polyolefins spreads data still show recovery yet to happen

RECOVERY? WHAT RECOVERY? Some market players are talking about a rebound in the Chinese economy, and, therefore, polyolefins demand, but the critically important spreads data continue to tell a different story. Nothing has changed from last week.

China 2022 PE demand: latest data point towards a 2% contraction as confusion over outlook builds

January-April 2022 data point towards China’s polyethylene demand for the full year declining by 2% over 2021.

China’s post-lockdown economic rebound has yet to happen, according to the ICIS spreads data

At some point, polyolefins exporters to China and the local producers will regain pricing power. This will become apparent from a widening of spreads as economic activity returns to normal. It really is as simple as this. So, you need our data and analysis.

China’s ethylene equivalent demand growth in 2022 could be as high as plus 9% or as low as minus 3%

Scenario 1, the ICIS Base Case, for China’s ethylene equivalent demand, sees growth at 9% in 2022 over last year. Scenario 2 involves 4.5% and Scenario 3, minus 3%.