China’s HDPE in demand in 2023 could fall by as much as 4% over 2022. Next year’s net imports may slip to as low as 3.8m tonnes from around 5.7m tonnes in 2022.

Asian Chemical Connections

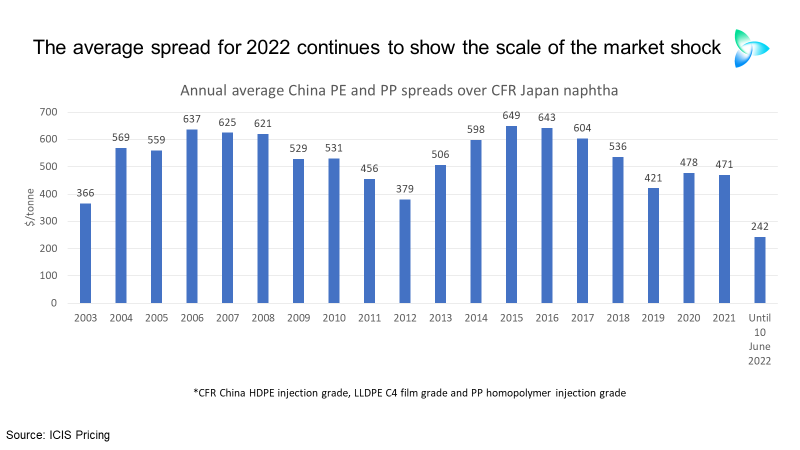

China naphtha-to-polyolefins spreads data still show recovery yet to happen

RECOVERY? WHAT RECOVERY? Some market players are talking about a rebound in the Chinese economy, and, therefore, polyolefins demand, but the critically important spreads data continue to tell a different story. Nothing has changed from last week.

Europe HDPE: why net imports could be 3m tonnes higher this year

EUROPE’S NET HDPE imports could be as high as 4.1m tonnes in 2022 versus last year’s 1.1m tonnes.

New global LLDPE demand scenarios in the context of Ukraine-Russia

How on earth does one respond to the daily news flow? The answer must be headline scenarios – best, – medium and worst-case scenarios

Ukraine-Russia: how the crisis could reshape petrochemicals demand

I hope what follows helps as a first pass at describing the new environment in which our industry is operating as a result of the Ukraine-Russia conflict.

China’s HDPE market in 2022 will be a litmus test of how well Beijing can manage unprecedented challenges

By John Richardson CHINA’S INCREASING self-sufficiency in high-density polyethylene (HDPE), combined with the potential for slower economic growth, is a developing story which is obviously being overshadowed by Ukraine. But China’s decisions on operating rates – as much political as economic –- and on whether its sticks hard and fast to Common Prosperity reforms in […]

Ukraine: Oil prices, lost petrochemicals demand, changing trade flows and the impact of the four megatrends

By John Richardson IF WE ARE involved in a new protracted Cold War, this will change just about everything for the petrochemicals industry. Or, of course, we could go back to the Old Normal. Corporate planners must therefore press on with drawing up short, medium and long-term scenarios and then apply these scenarios to tactics […]

Risk of crude at $135/bbl may have increased on SWIFT sanctions decision

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson WHETHER OIL PRICES will rise to a high of $135/bbl – the worst-case warning highlighted in […]

Ukraine-Russia: Assessing petrochemical demand losses

To follow all the breaking news on the crisis and the implications for petrochemicals and energy markets, please click here for the ICIS subscription topic page. If you need a trial of ICIS news, please let me know. By John Richardson NOW THAT an invasion has started, the critical issue for petrochemicals companies is whether they can […]

Global PP market and Omicron: deflationary pressures build

By John Richardson THE OMICRON outbreak is piling further pressure on already extremely stressed supply chains as Europe struggles to cope with the highly infectious variant. As my ICIS colleague, Tom Brown, said in this ICIS Insight article, tapping into market intelligence from our pricing editors: “The supply chain pressures that have dogged the European […]