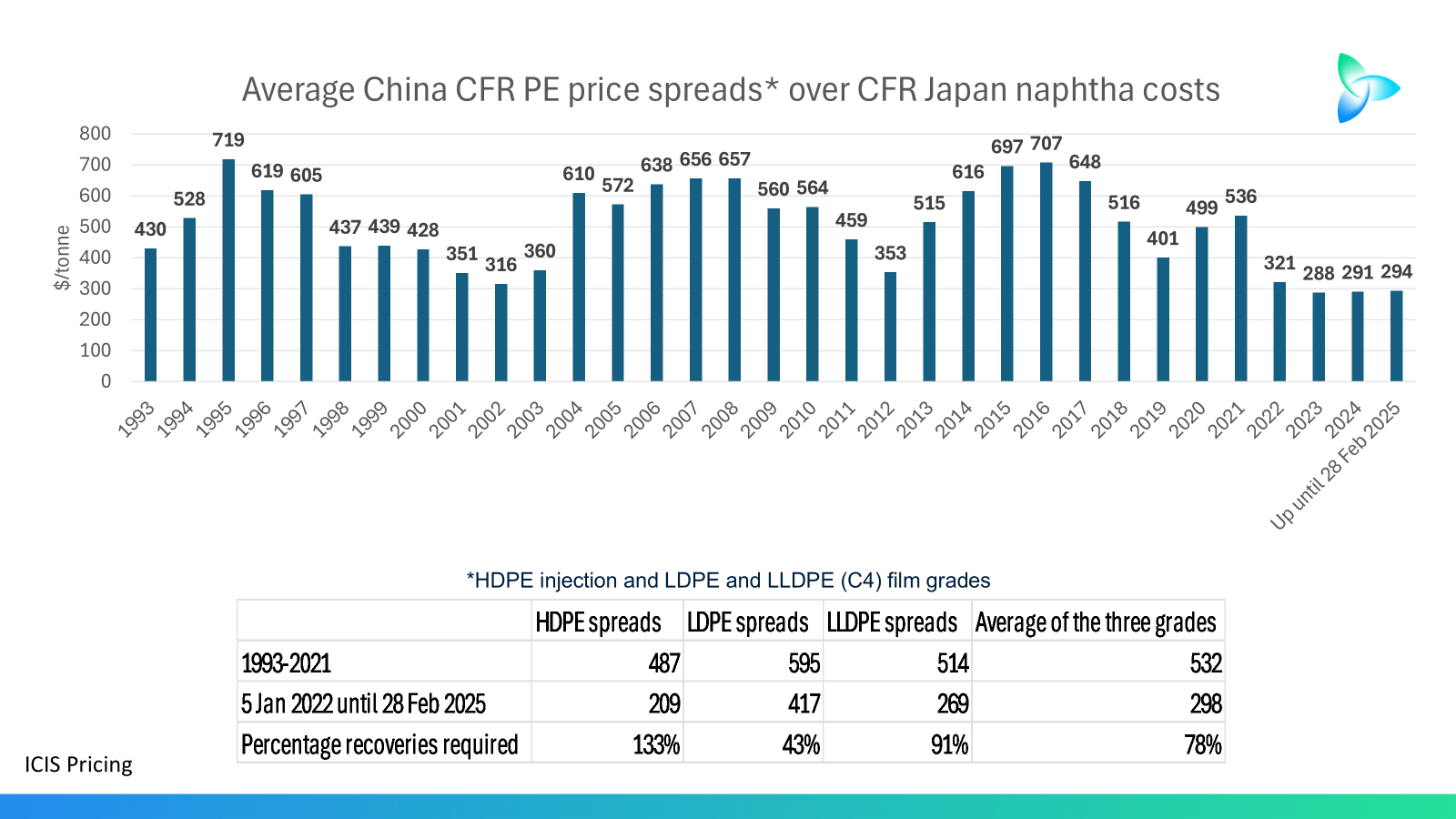

HDPE injection grade spreads would need to rise by 133% from their 2022-2025 level to return to the spreads enjoyed during the Chemicals Supercycle.

LDPE spreads would have to rise by 43%.

LLDPE spreads would need to increase by 91%.

Asian Chemical Connections

Tariffs, Trump, US-China LDPE and the role of AI

The future of US-China PE trade: Trying to figure the impact of the new Trump tariffs and a myriad of other complexities.

The “sound and fury” of new China stimulus and PE and PP spreads

New China stimulus in 2025 seems unlikely to be able to fully address long-term economic challenges

Your new China stimulus noise-cancelling headphones: PE spreads and margins

UNTIL or unless margins and spreads return to normal, there will have been no China recovery

China’s demographic crisis: Implications for polymers demand

The light blue bars show the impact of a Dire Demographics scenario on China’s polymers demand

Stop wasting time waiting for the end of the downcycle

THE TEN REASONS why this isn’t a standard chemical industry downcycle

The US is winning in China in today’s HDPE world but what about tomorrow?

THE US is winning in the key China market because of feedstock advantages in a lower-price environment. But future trade flows will likely be shaped by geopolitics, demographics, debts and sustainability

Global HDPE, the value of facts over commentary and the importance of scenario planning

Global HDPE capacity would have to grow by just 173,000 tonnes a year versus our base case assumption of 2.6m tonnes a year to achieve a 2024-2030 operating rate of 88%.

China events suggest no global petchems recovery until 2026

Capacity growth of just 1.6m tonnes a year versus our base case of 5m tonnes a year would require substantial capacity closures in some regions. Closures are never easy and so take considerable time because of links with upstream refineries, environmental clean-up and redundancy costs – and the reluctance to be the “first plant out” in case markets suddenly recover.

China PP exports could reach 2.6m tonnes in 2024 as markets become ever-more complex

As recently as 2020, China’s PP exports for the whole year were just 424,746 tonnes. Between 2021 and 2023 they ranged between 1.3m to 1.4m tonnes. If the January-May 2024 export momentum were to continue for the rest of this year, full-year 2024 exports would reach 2.6m tonnes, double last year’s level.