CHINA’S PP net imports could total 5m tonnes in 2040, or the country may instead be in a net export position of 9m tonnes.

Asian Chemical Connections

Global PP crisis: Why capacity may need to be 18m tonnes/year lower in 2024-2030

GLOBAL PP capacity may have to be a total of 18m tonnes/year lower in 2024-2030 to return operating rates to the historically strong levels

The China debate seems to be over so let’s move on to other markets

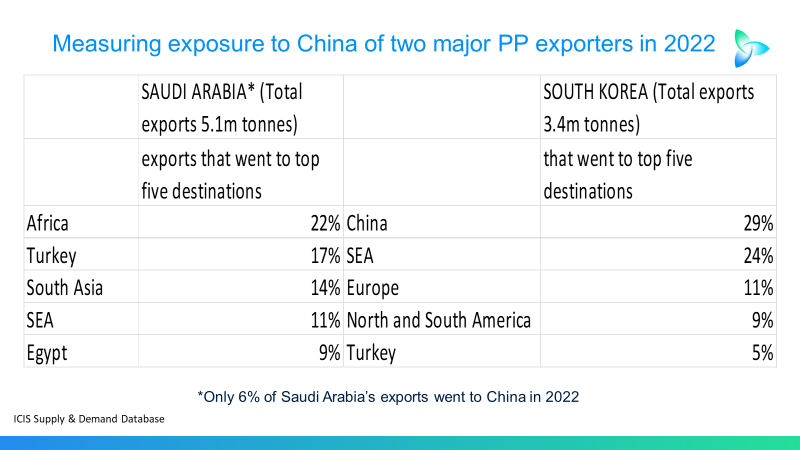

With China’s demand growth at 1-2% and with complete self-sufficiency possible, PP exports must look to break their China dependence.

China, demographics, debt and polymers demand

China’s polymers consumption in 2022 107m tonnes from a population of 1.4bn. The developing world ex-China’s consumption was at 84m tonnes from a population of 5.3bn. And the developed world consumed 82m from 1.1bn people.

Why China could become self-sufficient in HDPE

CHINA’S NET IMPORTS of HDPE could be either 126m tonnes in 2023-2040, 38m tonnes or as low as 7m tonnes

India, climate change, demographics and polymers demand growth

Climate change and demographics are economic destiny – their effects cannot be avoided. But the petrochemicals industry has a huge role to play in shaping favourable outcomes

China PP import and export complexities require much deeper and wider analysis

China’s PP net exports could be more than 2m tonnes in both 2024 and 2025. This would likely make China the fourth biggest exporter in Asia and the Middle East.

How to manage risks and opportunities during maybe the worst-ever PP downcycle

During this downturn, razor-like focus on fluctuating netbacks and supply and demand among all the different countries and regions will allow producers to ensure that they don’t make product for markets where there is no demand, while ensuring that they take maximum advantage of many brief periods of stronger demand and pricing.

Diversification to other markets in 2023 crucial for PP producers because of China risks

China could be net exporter of 900,000 tonnes of PP this year, down from 2022 net imports of 3.2m tonnes This makes the other import markets more important for producers.

A flood of PP no matter how what the 2023-2025 demand growth

EVEN if China’s PP demand growth is 14% this year – double our forecast – and growth in other regions is higher than we expect:

Global capacity in excess of demand would be 18m tonnes in 2023 compared with a 8m tonne/year average in 2000-2022,